Your Comprehensive UK Retirement Lifestyle Guide: Financial Planning, Housing, Health, and Leisure Insights

Retirement is a significant milestone, marking the transition from the world of work to a period of relaxation, exploration, and personal fulfillment. For those planning their retirement in the UK, the opportunities are vast, but so are the considerations. From financial planning to health care, housing, and leisure activities, every aspect of life needs to be carefully thought out. This comprehensive guide will explore everything you need to know to enjoy a fulfilling and secure retirement in the UK.

People planning for or already in retirement will benefit from Retirement Club membership. Business leaders seeking to connect with members will benefit from Corporate Membership.

1. Introduction to Retirement in the UK

The UK offers a diverse and rich environment for retirees, with its blend of bustling cities, tranquil countryside, historical sites, and vibrant cultural scenes. Whether you plan to stay in your current location, downsize, or even relocate to a new area, understanding the options and planning ahead is crucial.

Why Choose the UK for Retirement?

- Familiarity and Comfort: For UK nationals, staying within the country provides continuity in terms of culture, language, and social networks.

- Healthcare System: The National Health Service (NHS) offers comprehensive healthcare, which is a major consideration for retirees.

- Diverse Lifestyle Options: From urban to rural living, the UK offers a wide range of environments to suit different preferences.

- Cultural Richness: The UK is home to a wealth of cultural, historical, and recreational activities.

2. Financial Planning for Retirement

One of the most critical aspects of retirement is ensuring financial security. Proper planning can make the difference between a comfortable retirement and one filled with financial stress.

Understanding Pensions

- State Pension: The UK State Pension provides a basic income for retirees who have paid or been credited with National Insurance contributions. The full new State Pension is currently £203.85 per week (as of 2024), but this depends on your National Insurance record.

- Workplace Pensions: Many employers offer workplace pensions, where both the employee and employer contribute to a pension pot.

- Private Pensions: These are set up by individuals with contributions from personal income. They offer flexibility in how and when you can access your funds.

Budgeting for Retirement

- Estimating Your Retirement Income: Calculate your income from pensions, savings, investments, and any part-time work or business ventures.

- Cost of Living Considerations: Assess your living expenses, including housing, utilities, food, healthcare, and leisure activities.

- Emergency Fund: It’s wise to have an emergency fund to cover unexpected expenses, especially in retirement.

Investment Strategies for Retirees

- Risk Management: As you approach retirement, it’s often recommended to reduce the risk level of your investments. Shift from equities to bonds or other lower-risk assets.

- Income Generating Investments: Consider dividend-paying stocks, annuities, or other income-generating investments that can provide a steady income stream in retirement.

3. Housing and Accommodation Options

Your living situation is a key factor in your retirement lifestyle. Whether you want to stay in your current home, downsize, or move to a retirement community, there are various options to consider.

Staying in Your Own Home

- Ageing in Place: Modifications such as installing stairlifts, walk-in showers, and handrails can make your home more suitable for ageing.

- Equity Release: For homeowners looking to access cash tied up in their property, equity release schemes allow you to take out a loan secured against your home.

Downsizing

- Financial Benefits: Downsizing to a smaller home can reduce maintenance costs, lower utility bills, and free up capital.

- Emotional Considerations: Moving from a long-term family home can be emotionally challenging. It’s important to weigh the pros and cons carefully.

Retirement Villages and Communities

- Purpose-Built Retirement Villages: These offer a community-focused environment with amenities like gyms, swimming pools, social clubs, and healthcare facilities.

- Assisted Living: If you require some level of assistance with daily activities, assisted living facilities provide support while allowing for a degree of independence.

- Care Homes: For those needing full-time care, residential care homes provide a range of services including medical care, meals, and activities.

4. Healthcare in Retirement

Health naturally becomes a more significant concern as we age. The UK offers a robust healthcare system, but planning ahead is still essential.

The National Health Service (NHS)

- Access to Care: All UK residents are entitled to free healthcare through the NHS, which includes hospital care, doctor visits, and emergency services.

- Private Healthcare Options: Some retirees choose private healthcare for faster access to treatments or more specialised care. Private health insurance can be costly, so it’s important to weigh the benefits.

Long-Term Care Considerations

- Care Home Costs: Care homes can be expensive, with costs varying widely depending on location and the level of care required. It’s essential to understand the funding options available, including local authority assistance.

- Home Care Services: For those who prefer to stay at home, various services such as home health aides, meal delivery, and physiotherapy can help maintain independence.

Mental Health and Well-being

- Staying Active: Physical activity is crucial for maintaining both physical and mental health. Many communities offer classes specifically designed for seniors, such as yoga, swimming, and walking groups.

- Social Engagement: Loneliness can be a significant issue in retirement. Staying socially active through clubs, volunteering, or part-time work can greatly enhance quality of life.

- Mental Health Support: Access to mental health services is available through the NHS, and private options also exist for those seeking additional support.

5. Social and Community Activities

Retirement offers the freedom to explore new interests and deepen existing ones. Engaging in social and community activities can be fulfilling and provide a sense of purpose.

Volunteering Opportunities

- Charity Work: Many retirees find volunteering for charities rewarding. Opportunities range from working in charity shops to providing mentoring and support.

- Community Service: Local councils and community groups often seek volunteers to help with various initiatives, such as environmental projects, youth mentoring, and supporting the elderly.

Clubs and Societies

- Special Interest Groups: From gardening and bird watching to bridge clubs and book clubs, there are numerous groups catering to a wide range of interests.

- University of the Third Age (U3A): U3A offers a wide variety of learning opportunities for retirees, from languages and history to science and technology.

- Sports Clubs: Staying active is vital, and many sports clubs offer programs tailored to older adults, including walking football, bowls, and golf.

Hobbies and Personal Development

- Learning New Skills: Retirement is a great time to learn new skills or pick up old hobbies. Local community colleges and online platforms like Coursera offer courses in everything from painting to computer skills.

- Creative Pursuits: Writing, painting, knitting, and photography are just a few of the many creative activities retirees can pursue.

- Travel Groups: Many travel agencies offer group tours specifically designed for seniors, providing an opportunity to explore new places and meet like-minded people.

6. Travel and Leisure

For many retirees, travel is one of the most anticipated aspects of retirement. The UK, with its rich history and diverse landscapes, offers numerous travel opportunities.

Domestic Travel

- Staycations: Exploring the UK’s countryside, historical sites, and cultural landmarks can be as rewarding as international travel. Popular destinations include the Lake District, Cornwall, the Scottish Highlands, and the Cotswolds.

- City Breaks: Cities like London, Edinburgh, Bath, and York offer a wealth of cultural attractions, shopping, and dining experiences.

- National Trust and English Heritage: Memberships to these organisations offer access to a vast array of historical sites, gardens, and estates.

International Travel

- Senior-Friendly Destinations: Europe offers numerous senior-friendly destinations with good accessibility and senior discounts. Popular spots include Spain, Portugal, and Italy.

- Travel Insurance for Seniors: It’s essential to have travel insurance that covers pre-existing medical conditions and other potential risks.

Cruises

- Benefits of Cruising: Cruises are a popular option for retirees due to the all-inclusive nature of the trips, allowing you to see multiple destinations with minimal effort.

- Choosing the Right Cruise: Consider factors such as the size of the ship, the itinerary, and the onboard facilities when choosing a cruise.

7. Inspiration and Personal Growth

Retirement is not just about winding down; it’s also a time for personal growth and pursuing passions.

Lifelong Learning

- Educational Courses: Many universities and local colleges offer courses tailored to retirees. Subjects range from history and literature to technology and business skills.

- Online Learning: Platforms like FutureLearn and OpenLearn offer free or low-cost courses that can be completed from the comfort of your home.

Starting a New Venture

- Small Business Opportunities: Many retirees use their skills and experience to start small businesses, such as consulting, crafting, or online retail.

- Freelancing: For those who prefer a more flexible approach, freelancing offers the chance to work on projects that interest you without the commitment of a full-time job.

Inspiring Retirement Stories

- Case Studies: Reading about how others have successfully navigated retirement can provide inspiration and ideas. Whether it’s starting a new hobby, traveling the world, or volunteering, there are countless ways to make retirement fulfilling.

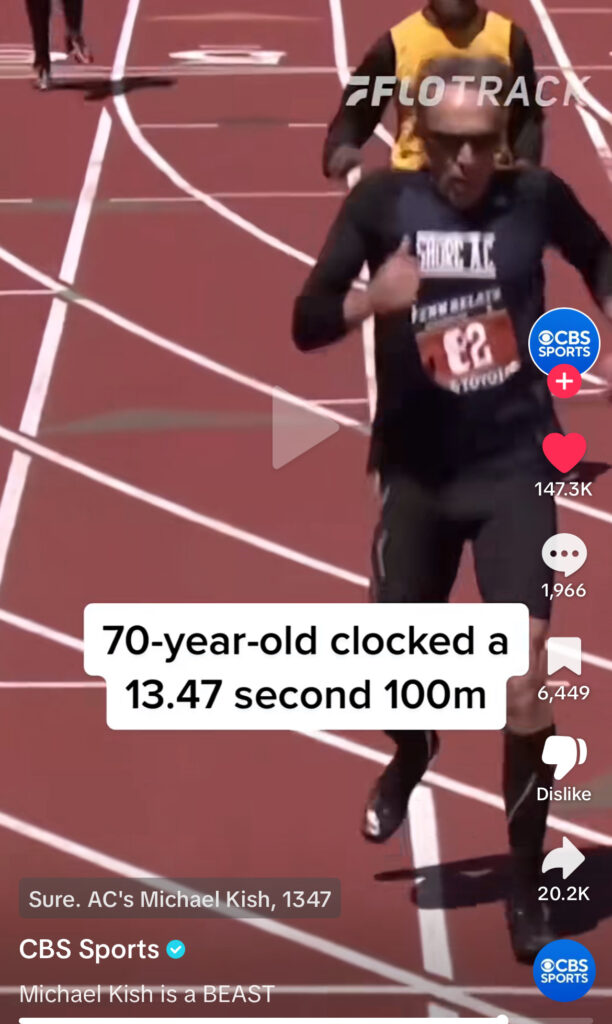

- Role Models: Consider following retirees who have taken unconventional paths, such as moving abroad, pursuing extreme sports, or dedicating themselves to philanthropy.

8. Practical Considerations

Beyond the more exciting aspects of retirement, there are practical considerations to ensure a smooth transition.

Legal Matters

- Wills and Estate Planning: It’s essential to have a legally binding will to ensure that your assets are distributed according to your wishes. Consider consulting a solicitor for estate planning, including setting up trusts, handling inheritance tax, and ensuring your loved ones are cared for.

- Power of Attorney: Establishing a power of attorney allows someone you trust to make decisions on your behalf if you become unable to do so. There are two types in the UK: Health and Welfare, and Property and Financial Affairs.

- Advance Decision (Living Will): This is a legally binding document that outlines your preferences for medical treatment if you become incapacitated. It’s particularly important for ensuring your wishes are respected regarding end-of-life care.

Long-Term Care Planning

- Planning for Care Needs: It’s important to consider how you will manage if you need help with daily activities as you age. This might include moving to a care home, hiring in-home care, or relying on family members.

- Funding Long-Term Care: Long-term care can be expensive. It’s essential to explore your funding options, including savings, pensions, and potential support from local authorities.

Transport and Mobility

- Driving in Retirement: As you age, it’s important to regularly assess your driving ability. The DVLA requires drivers over 70 to renew their licenses every three years. Consider if it might be time to stop driving and explore alternative transport options.

- Public Transport: The UK offers a range of public transport options, often with discounts for seniors. Free bus passes are available in many areas for those over the state pension age.

- Mobility Aids: If you have mobility challenges, consider aids such as scooters, walking frames, or adapted vehicles to maintain your independence.

Technology and Staying Connected

- Digital Literacy: Keeping up with technology can help you stay connected with family and friends, manage your finances, and access entertainment. Many local councils and charities offer digital literacy courses for seniors.

- Social Media: Platforms like Facebook, Instagram, and WhatsApp can help you stay in touch with loved ones and join online communities with similar interests.

- Smart Home Devices: Consider using smart home technology for added convenience and safety, such as voice-activated assistants, smart thermostats, and home security systems.

9. Retirement Trends and the Future

The concept of retirement is evolving. With longer life expectancies and changing economic conditions, today’s retirees face new challenges and opportunities.

Active Ageing

- The New Retirement Age: Many are choosing to work past the traditional retirement age, either out of financial necessity or a desire to stay active and engaged.

- Part-Time Work and Freelancing: Flexible working arrangements allow retirees to continue earning income while maintaining a balanced lifestyle.

Retirement Abroad

- Expat Retirement: Some UK retirees choose to move abroad for better weather, lower costs of living, or a different lifestyle. Popular destinations include Spain, Portugal, and France.

- Considerations for Moving Abroad: It’s important to consider the impact on your pension, healthcare access, and the legalities of living in a foreign country.

Sustainability in Retirement

- Eco-Friendly Living: Many retirees are choosing to live more sustainably, whether through downsizing, using renewable energy, or reducing their carbon footprint.

- Sustainable Investments: Ethical investing has become increasingly popular, with many retirees choosing to invest in companies that prioritize environmental and social responsibility.

10. Conclusion: Crafting Your Ideal Retirement

Retirement in the UK offers a wealth of possibilities. Whether you’re planning to explore new hobbies, travel, volunteer, or simply enjoy the slower pace of life, careful planning will help you make the most of your retirement years.

As you transition into this new phase of life, keep in mind that retirement is not just an end but a beginning. It’s an opportunity to redefine what your life can be—whether that means deepening relationships, learning new skills, giving back to the community, or exploring the world.

Ultimately, the key to a successful retirement lies in aligning your lifestyle choices with your personal values and aspirations. By staying informed, planning ahead, and embracing the possibilities, you can enjoy a fulfilling, vibrant, and meaningful retirement in the UK.

This guide covers the essential aspects of retirement in the UK, but remember that your journey is unique. As you navigate these choices, consider what brings you joy and satisfaction, and don’t be afraid to seek professional advice when needed. Retirement is your time – make it count!

Get help to protect and grow your business faster with CheeringUpInfo

Find out more about the Retirement Club

Subscribe for more retirement lifestyle improvement tips reviews and money saving ideas

Read more retirement lifestyle improvement articles and view videos for free

Over 55s are past it ?

The Ultimate Guide to Retirement Lifestyle in the UK