Cheeringup.info Retirement Magazine: Health, Wellness, and Advertising Opportunities for UK Businesses and Retirees

Cheeringup.info Retirement Magazine is your go-to resource for enhancing life after 55. Packed with expert advice on retirement health, wellness, and lifestyle, it’s designed to inspire and empower the growing UK retiree community. For business leaders, this is a powerful platform to connect with a highly engaged audience. Advertise your business with us for up to 12 months and gain direct exposure to thousands of potential customers. UK retirees, join our magazine today and unlock a lifetime of exclusive content, member-only deals, and a vibrant community to support your retirement journey. Invest in your future with Cheeringup.info – where retirement meets opportunity!

How can you improve your retirement?

Free retirement magazine for retirees and people planning for retirement UK. Retired magazine tips for better retirement life. Magazine on retirement lifestyle enhancement in UK. Living a happier healthier wealthier life in retirement with CheeringupInfo. Retirement living magazine for tips on planning for better retirement in the UK. Helping you to retire when you want to. Retire in the style you want.

The world is changing quickly. Keep up with a free digital retirement magazine subscription to Retirement Magazine aimed at over 55s in UK.

In-depth retirement guides on retirement planning, with in-depth focus and deep-diving on niche areas like tax-efficient strategies, state pension navigation, and investment options.

Engaging simple and at times detailed UK citizen retirement related content. Simple easily understandable language. DIY advice to allow you to manage your retirement planning independently.

User-friendly retirement calculators and retirement planning tools.

Offering interactive webinars and Q&A sessions with UK financial experts who can then provide personalised advice without the complexity or confusion.

Fostering UK retirement community atmosphere by including retirement forums, discussion groups, and user-generated content. Feel at home online with us and stay with us throughout your retirement planning and retirement lifestyle to make your retirement easier and better.

Access our accounts, online tools and social media platforms to discover better retirement and share your retirement story. Use platforms like Facebook, X and LinkedIn to connect with likeminded individuals, sharing success stories and practical retirement living tips.

Access and understand easily simplified complex financial concepts and provide implement clear, actionable steps for retirement planning. Tap into our retirement resources including Retirement Planning 101 area for beginners.

Share your thoughts and strategies! #RetirementPlanning #FinancialFreedom #RetirementClub #MyRetirementStory #CheeringupInfo #RetirementMagazine #OldDigitalNomad #RetirementGoals

Share your thoughts and strategies! #RetirementPlanning #FinancialFreedom #RetirementClub #MyRetirementStory #CheeringupInfo #RetirementMagazine #OldDigitalNomad #RetirementGoalsWatch and view video content and infographics breaking down intricate topics, making them more accessible.

Offering personalised retirement plans and advice without the high costs associated with financial advisors. Use automated tools, AI and retirement resources to access customised recommendations to improve your retirement lifestyle.

Access comparison tools to help members evaluate different pension plans, investments, and savings options.

Access a comprehensive retirement planning resource hub covering all aspects of retirement, from financial planning to lifestyle and health.

Regularly updated retirement related content with current news and trends in retirement planning you keep up to date with relevant and authoritative information to inform your retirement lifestyle improvement decision making.

Market and advertise to retired people over 55 in the UK, or planning for retirement. Targeting Gen X and Baby Boomers online. I’m a UGC creator who can help you target older marketplace.

It’s Never Too Late to Be What You Might Have Been

The quote “It’s never too late to be what you might have been” is a powerful reminder that we are never stuck in our current circumstances. No matter what our age, background, or circumstances, we always have the potential to change our lives and become the people we want to be.

Just not dying is not living

CHEERINGUP.info

Of course, there are challenges that can make it seem like it’s too late to change. We may have made mistakes in the past, or we may feel like we’re too old to start over. But the truth is, these challenges are not insurmountable. With hard work, determination, and a positive attitude, we can overcome anything and achieve our dreams.

Be a better person in retirement in UK

CheeringupInfo

There are many examples of people who have shown that it’s never too late to change their lives. For example, Nelson Mandela was 76 years old when he was elected president of South Africa. He had spent 27 years in prison for his political beliefs, but he never gave up hope that he would one day be free and able to make a difference in the world.

Another example is J.K. Rowling. She was a single mother living on welfare when she wrote the first Harry Potter book. She was rejected by 12 publishers before one finally agreed to publish her book. The Harry Potter series went on to become a global phenomenon, and Rowling is now one of the richest women in the world.

These are just two examples of people who have shown that it’s never too late to achieve your dreams. If they can do it, so can you.

So, if you’re feeling stuck in your current situation, don’t give up hope. It’s never too late to be what you might have been. Here are a few tips to help you get started:

- Figure out what you want. What are your dreams? What do you want to achieve in life? Once you know what you want, you can start to make a plan to get there.

- Don’t be afraid to start over. If you’ve made mistakes in the past, don’t let them hold you back. Everyone makes mistakes. The important thing is to learn from them and move on.

- Take action. The only way to achieve your dreams is to take action. Don’t just sit around and dream. Start taking steps today to make your dreams a reality.

- Don’t give up. There will be times when you want to give up. But don’t. Keep going. Keep working hard. And eventually, you will achieve your dreams.

Remember, it’s never too late to be what you might have been. So, what are you waiting for? Start today!

Here are some additional tips to help you achieve your dreams:

- Set realistic goals. Don’t try to do too much too soon. Break your goals down into smaller, more manageable steps.

- Find a mentor or support group. Having someone to help you stay motivated and on track can be invaluable.

- Celebrate your successes. When you achieve a goal, take some time to celebrate your success. This will help you stay motivated and keep moving forward.

- Don’t be afraid to ask for help. If you’re struggling, don’t be afraid to ask for help from friends, family, or professionals.

I hope this article has inspired you to believe that it’s never too late to be what you might have been. So, what are you waiting for? Start today!

Are you approaching retirement from the wrong direction!

Is time slipping past you? Is it time to take control of the life you have left? To paraphrase Barry Humphries who once said, when talking about growing old and what it it is like to grow old, that he was unfamiliar with growing old as he didn’t notice it. It was unfamiliar to him. When asked how old he was, he said he was approaching 70 from the wrong direction!

None of us are getting younger. We are all growing older each moment of time. We should be grateful we are growing older as many people no longer have that privilege. The world around us that we see looks back at us and judges us by what they see of us. The way we see the world may not change but the way we are perceived will change as we grow older. We may love the same people, things or activities but they may not love us anymore – too old to be a serious participant in same life we once loved!

Time and your life is ticking away inexorably. We can’t make it stand still, we can’t turn back time and we may not be able to continue the same life in the way we once lived it. That does not mean we cannot live life well as we age but it does mean we have to act now to live well today – and tomorrow will take care of itself.

Share your health tips and routines! #HealthyRetirement #Wellness #RetirementClub #MyRetirementStory #RetirementMagazine #OldDigitalNomad #InvestInYoursel #HealthyAgeing #MindfulLiving

Share your health tips and routines! #HealthyRetirement #Wellness #RetirementClub #MyRetirementStory #RetirementMagazine #OldDigitalNomad #InvestInYoursel #HealthyAgeing #MindfulLivingJust because other people see you as being old doesn’t mean you need to feel or act old. Only you can make yourself feel and act old. Let the young do what they do and we’ll focus on being us.

Are you preparing for your retirement and looking for valuable insights, expert advice, and useful resources? Look no further! CheeringUp.info is your go-to destination for all things retirement-related in the UK. Our comprehensive retirement newsletter is designed to keep you informed and empowered during this important phase of life. Stay up-to-date with the latest retirement trends, financial planning tips, health and wellness advice, and much more. Join our ever-growing community of adults who are passionate about making the most of their retirement years. Follow CheeringUp.info on your preferred social media account to receive regular updates, engaging content, and connect with like-minded individuals on the same journey. Don’t miss out on valuable retirement information—sign up for our newsletter or follow us today!

Are UK pension funds in trouble?

The short answer is yes. The long answer is that UK pension funds are facing a number of challenges, including:

- Declining membership: The number of people in defined benefit (DB) pension schemes has been declining for many years. This is due to a number of factors, including the rise of the gig economy, the increasing number of self-employed people, and the government’s decision to phase out the state earnings-related pension scheme (SERPS).

- Rising costs: The cost of providing a DB pension has been rising in recent years. This is due to a number of factors, including:

- Increased life expectancy: People are living longer, which means that pension providers have to pay out for longer.

- Low interest rates for decades: interest rates can have both positive and negative effect on pension income.

- Unfunded liabilities: Many UK pension funds are currently underfunded. This means that the value of their assets is less than the value of their liabilities. This is a major problem, as it means that pension providers may not be able to meet their obligations to their members.

What is an unfunded pension scheme UK?

An unfunded pension scheme is a pension scheme where the employer does not set aside sufficient assets to meet the full cost of the benefits promised to members. Instead, the employer promises to pay the benefits as they fall due, and relies on the investment performance of the scheme’s assets to make up any shortfall.

How much have UK pension funds lost?

The value of UK pension funds has fallen by a significant amount in recent years. In the 12 months to March 2023, the value of UK pension funds fell by £150 billion. This fall in value is due to a number of factors, including:

- The COVID-19 pandemic: The COVID-19 pandemic has had a significant impact on the global economy, and this has led to a fall in the value of assets held by pension funds.

- The war in Ukraine: The war in Ukraine has also had a negative impact on the global economy, and this has led to a further fall in the value of assets held by pension funds.

Is there a UK pension fund unfunded liabilities time-bomb facing retired pensioners and tax paying workers?

There is a growing concern that the UK pension system is facing a time-bomb. This is due to the fact that the value of UK pension funds is falling, and the number of people in defined benefit pension schemes is declining. This means that there is a risk that pension providers will not be able to meet their obligations to their members, and this could have a significant impact on retired pensioners and tax paying workers.

There are a number of things that can be done to address the challenges facing the UK pension system. These include:

- Encouraging more people to save for retirement: The government could encourage more people to save for retirement by providing tax breaks or other incentives.

- Reforming the state pension: The government could reform the state pension to make it more sustainable. This could involve increasing the state pension age or reducing the level of benefits.

- Improving the governance of pension schemes: The government could improve the governance of pension schemes by introducing new regulations or by providing more support to trustees.

The UK pension system is facing a number of challenges, but there are a number of things that can be done to address these challenges. By taking action now, we can help to ensure that the UK pension system remains sustainable for future generations.

What can people planning for retirement or in retirement in UK do to protect themselves?

There are a number of things that people in the UK can do to protect themselves from the challenges facing the pension system. These include:

- Start saving early: The earlier you start saving for retirement, the more time your money has to grow. Even if you can only save a small amount each month, it will add up over time.

- Contribute to a workplace pension: If your employer offers a workplace pension, take advantage of it. Your employer may make a contribution to your pension, and you may also be able to save tax on your contributions.

- Consider a personal pension: If your employer does not offer a workplace pension, or if you want to save more than your employer will match, you may want to consider a personal pension. There are a number of different personal pension providers available, so shop around to find the best deal.

- Invest your pension wisely: When you invest your pension, it is important to choose investments that are appropriate for your age and risk tolerance. You may want to consider speaking to a financial adviser to get help with this.

- Review your pension regularly: As you get closer to retirement, it is important to review your pension regularly to make sure that it is still on track. You may need to make changes to your investments or contributions as your circumstances change.

By taking these steps, you can help to protect yourself from the challenges facing the UK pension system and ensure that you have a comfortable retirement.

Here are some additional tips to help you protect your pension:

- Make sure you understand the terms and conditions of your pension plan: This includes the types of investments that are available, the fees that are charged, and the benefits that you will receive.

- Keep track of your pension savings: This will help you to make sure that you are on track to reach your retirement goals.

- Be aware of the risks involved in investing: The value of your pension savings can go up and down, so it is important to understand the risks involved before you invest.

- Take professional advice if you need it: A financial adviser can help you to choose the right investments for your needs and to make sure that your pension plan is working for you.

Does the fact that UK interest rates have risen considerably help with the level of UK unfunded pension liabilities?

Yes, rising interest rates can help to reduce unfunded pension liabilities. This is because higher interest rates make it more attractive for pension funds to invest in bonds, which are fixed-income investments that pay a fixed rate of interest. The higher the interest rate, the higher the income that pension funds can earn from their investments. This can help to reduce the gap between the value of a pension fund’s assets and its liabilities.

However, it is important to note that rising interest rates can also have a negative impact on pension funds. This is because higher interest rates can lead to higher inflation, which can erode the value of pension funds’ assets. Additionally, higher interest rates can make it more expensive for pension funds to borrow money, which can make it difficult for them to meet their obligations.

Overall, the impact of rising interest rates on unfunded pension liabilities is mixed. While higher interest rates can help to reduce the gap between assets and liabilities, they can also have a negative impact on pension funds’ assets and make it more expensive for them to borrow money.

Here are some additional points to consider:

- The impact of rising interest rates on pension funds will vary depending on the type of pension scheme. For example, defined benefit pension schemes, which promise to pay a fixed income to members for life, are more sensitive to interest rate changes than defined contribution pension schemes, which allow members to choose how their money is invested.

- The impact of rising interest rates on pension funds will also vary depending on the asset allocation of the pension fund.Pension funds that invest heavily in bonds will benefit from higher interest rates, while pension funds that invest heavily in equities may be more vulnerable to the negative impacts of rising interest rates.

- Pension funds need to take steps to mitigate the risks associated with rising interest rates. This could include investing in assets that are less sensitive to interest rate changes, such as equities or real estate. Pension funds may also need to increase their contributions to their pension schemes in order to reduce the gap between assets and liabilities.

Longevity Tips

The quest for longevity is something that has fascinated humans for centuries. We have always been curious about the secrets of living a long and healthy life. In recent years, researchers have been studying the habits and lifestyles of the longest living people on the planet to understand what it is that makes them live longer than the rest of us. These people are often referred to as “Blue Zones,” and they are areas around the world where people tend to live exceptionally long lives. In this article, we will explore the best practices of the longest living people on the planet and provide 10 longevity lifestyle tips that you can implement in your life to increase your chances of living a long and healthy life.

What Are Blue Zones?

Blue Zones are areas around the world where people tend to live exceptionally long lives. These areas have been identified by National Geographic researcher and author Dan Buettner, who has spent years studying the lifestyles and habits of people in these regions. Buettner has identified five Blue Zones around the world:

- Ikaria, Greece

- Okinawa, Japan

- Ogliastra region, Sardinia

- Nicoya Peninsula, Costa Rica

- Loma Linda, California

In these areas, people tend to live significantly longer than the rest of the world. In fact, they have higher rates of centenarians (people over the age of 100) than any other region in the world. So, what is it that these people are doing that allows them to live such long and healthy lives?

Best Practices of the Longest Living People on the Planet

- Diet

One of the most significant factors contributing to the long lives of people in Blue Zones is their diet. They tend to consume a plant-based diet that is rich in whole foods, fruits, vegetables, whole grains, nuts, and legumes. They eat very little processed food or meat, and they avoid sugar and other refined carbohydrates. They also consume moderate amounts of alcohol, such as red wine, and they drink plenty of water.

- Exercise

Another important factor in the longevity of people in Blue Zones is their level of physical activity. They tend to lead active lives, with regular physical activity being a natural part of their daily routine. They don’t necessarily have structured exercise programs or hit the gym, but they engage in physical activity such as walking, gardening, and other daily tasks that keep them moving.

- Stress Reduction

People in Blue Zones tend to have lower levels of stress than the rest of the world. They have developed ways to manage stress, such as spending time with family and friends, practicing relaxation techniques, and taking time for themselves. They also have a strong sense of purpose and meaning in their lives, which helps them to cope with stress.

- Social Connections

Social connections are an essential aspect of the lives of people in Blue Zones. They tend to have strong social networks, with close relationships with family, friends, and community members. They spend time with each other regularly and support each other in times of need.

- Sleep

Sleep is a critical aspect of longevity, and people in Blue Zones tend to get enough of it. They prioritise sleep and allow their bodies to rest and recharge. They often take naps during the day, and they follow a regular sleep schedule that allows them to get the recommended 7-9 hours of sleep each night.

- Sense of Purpose

Having a sense of purpose and meaning in life is another important aspect of longevity. People in Blue Zones tend to have a clear sense of why they wake up in the morning, and they have a reason to live. They have a sense of belonging and feel valued in their communities.

- Strong Family Values

Family values are essential in Blue Zones, and people tend to have close relationships with their family members. They take care of their elderly parents and grandparents, and they often live in multi-generational households. This helps to provide a sense of security, support, and purpose throughout their lives.

- Limited Technology Use

People in Blue Zones tend to use technology minimally. They don’t spend hours on their smartphones or in front of their computers, and they don’t have constant access to social media. Instead, they focus on building meaningful relationships and engaging in real-life activities.

- Community Involvement

Community involvement is another important aspect of longevity in Blue Zones. People are often involved in their local communities, whether it be through volunteer work, attending community events, or participating in religious or spiritual activities. This helps to provide a sense of belonging and social support throughout their lives.

- Natural Movement

Finally, people in Blue Zones engage in natural movement throughout their daily lives. They don’t spend hours sitting at a desk or in front of a TV. Instead, they engage in activities that require movement, such as walking, gardening, and cooking. This natural movement helps to keep them active and healthy throughout their lives.

10 Longevity Lifestyle Tips

- Eat a Plant-Based Diet

To increase your chances of living a long and healthy life, it’s essential to eat a plant-based diet that is rich in whole foods, fruits, vegetables, whole grains, nuts, and legumes. Avoid processed food and sugar and limit your intake of meat.

- Stay Active

Engage in physical activity regularly. You don’t need to hit the gym or have a structured exercise program. Instead, incorporate movement into your daily routine, such as walking, gardening, or cooking.

- Manage Stress

Find ways to manage stress, such as practicing relaxation techniques, spending time with loved ones, and taking time for yourself. Find activities that bring you joy and help you relax.

- Build Strong Relationships

Cultivate strong relationships with family, friends, and community members. Spend time with them regularly and support each other in times of need.

- Get Enough Sleep

Prioritise sleep and follow a regular sleep schedule that allows you to get the recommended 7-9 hours of sleep each night. Take naps during the day if necessary.

- Find Your Purpose

Develop a sense of purpose and meaning in your life. Find a reason to wake up each morning and pursue your passions and interests.

- Prioritise Family Values

Prioritise family values and take care of your elderly parents and grandparents. Live in multi-generational households if possible.

- Limit Technology Use

Limit your use of technology and social media. Focus on building real-life relationships and engaging in meaningful activities.

- Get Involved in Your Community

Get involved in your local community through volunteer work, attending community events, or participating in religious or spiritual activities.

- Engage in Natural Movement

Engage in natural movement throughout your daily life, such as walking, gardening, or cooking. Find ways to incorporate movement into your daily routine.

Conclusion

Living a long and healthy life is something that we all aspire to achieve. By studying the habits and lifestyles of the longest living people on the planet, we can gain insight into what it takes to live a long and healthy life. By incorporating these best practices and longevity lifestyle tips into your life, you can increase your chances of living a long and healthy life filled with purpose, joy, and meaning. Remember that living a long and healthy life is not just about the number of years you live but about the quality of life you lead.

In conclusion, the best practices of the longest living people on the planet are focused on living a balanced and purposeful life that prioritises strong relationships, a healthy lifestyle, and a sense of community. By implementing these practices in your daily life, you can increase your chances of living a long and fulfilling life.

It’s important to note that making changes to your lifestyle can be challenging, but it’s essential to take small steps and be consistent. Building habits takes time, but it’s worth it in the long run. Start by making small changes, such as incorporating more plant-based foods into your diet or taking a daily walk, and build from there.

Living a long and healthy life is not just about the number of years you live, but also about the quality of life you lead. By prioritising your health, relationships, and community involvement, you can increase your chances of living a fulfilling and meaningful life.

The ten longevity lifestyle tips that you can incorporate into your life to improve your chances of living a long and healthy life:

- Eat a plant-based diet

- Stay active

- Manage stress

- Build strong relationships

- Get enough sleep

- Find your purpose

- Prioritise family values

- Limit technology use

- Get involved in your community

- Engage in natural movement

Remember, it’s never too late to start living a healthier and more purposeful life. Take small steps and be consistent in your efforts. By incorporating these best practices into your life, you can improve your overall well-being and increase your chances of living a long and healthy life.

UK Retirement Ponzi Scheme

Promissory Obligations to People Who Retire in the UK: Is It a Ponzi Scheme of Unfunded Future Pension Liabilities?

Retirement is a significant milestone in one’s life, a time when individuals expect to reap the rewards of their years of hard work and contributions to society. In the United Kingdom (UK), like many other countries, retirement is often associated with receiving a pension, which is a form of financial support provided by the government or private institutions to individuals who have reached a certain age or have met specific eligibility criteria.

Pensions in the UK are typically funded through various mechanisms, including state-funded programs such as the State Pension, which is a social security benefit provided by the government, and private pension schemes established by employers or individuals. However, there has been growing concern and debate about the sustainability of these pension systems, with some critics arguing that they are akin to a Ponzi scheme of unfunded future pension liabilities. In this article, we will explore the concept of promissory obligations to people who retire in the UK and examine whether or not it can be considered a Ponzi scheme.

To understand the concept of promissory obligations in the context of retirement in the UK, we need to first understand how the pension system works. The UK pension system is a pay-as-you-go system, which means that current workers’ contributions are used to pay the pensions of current retirees, rather than being invested to fund their own future pensions. In other words, the current generation of workers pays for the pensions of the current generation of retirees, with the expectation that future generations of workers will do the same for them when they retire. This system is often referred to as a “generational contract,” where the younger generation promises to support the older generation in their retirement in exchange for the expectation of receiving support from future generations when they retire.

Under this system, the government and private employers make promises to workers that they will receive a certain level of pension benefits upon retirement based on their earnings and years of service. These promises create legal and moral obligations on the part of the government and employers to provide pensions to retirees as agreed. These promises, or promissory obligations, are often considered a form of social contract between the government/employers and workers, where workers contribute to the pension system throughout their working years with the expectation of receiving pension benefits in their retirement.

However, critics of the current pension system argue that these promissory obligations are unsustainable and can be likened to a Ponzi scheme. A Ponzi scheme is a fraudulent investment scheme where returns are paid to earlier investors using the capital of newer investors, rather than from profit earned by the operation of a legitimate business. Ponzi schemes eventually collapse when there are not enough new investors to pay returns to earlier investors, leading to financial losses for those who invested in the scheme.

Critics of the UK pension system argue that it shares some similarities with a Ponzi scheme, as it relies on current workers’ contributions to pay the pensions of current retirees, rather than being based on a sustainable funding mechanism. These critics argue that the system is unsustainable in the long term, as the aging population and increasing life expectancy mean that there will be fewer workers supporting more retirees, leading to a potential shortfall in funds to meet the pension obligations.

One of the main arguments put forth by critics is that the UK pension system is based on unfunded future pension liabilities. Unfunded pension liabilities refer to the difference between the present value of promised pension benefits and the assets set aside to meet those obligations. In other words, it means that the pension promises made to workers exceed the actual funds available to fulfill those promises. Critics argue that this creates a situation where the government and employers are making promises to workers that they may not be able to keep in the future, which is similar to the unsustainable nature of a Ponzi scheme.

One of the key aspects of a Ponzi scheme is the reliance on continuous inflows of new investors to pay returns to earlier investors. Similarly, the UK pension system relies on a continuous stream of contributions from current workers to pay pensions to current retirees. However, with the changing demographics and an aging population, there are concerns that there will be fewer workers in the future to support the increasing number of retirees, resulting in a potential shortfall in funds to meet the pension obligations.

Another similarity between the UK pension system and a Ponzi scheme is the lack of transparency and accountability in the management of funds. In a typical Ponzi scheme, the operator often uses complex investment strategies or misrepresents the returns to attract new investors and keep the scheme going. Similarly, in the UK pension system, the government and private employers may use accounting techniques or assumptions about future investment returns that may not be realistic, leading to a potential overestimation of the funds available to meet pension obligations. This lack of transparency and accountability can result in a false sense of security among retirees and workers, who may not fully understand the risks associated with unfunded pension liabilities.

Moreover, critics argue that the UK pension system also lacks the necessary safeguards to protect pensioners in case of a financial crisis or economic downturn. In a Ponzi scheme, when the inflow of new investors dries up, the scheme collapses, and investors lose their investments. Similarly, in the UK pension system, if there is a shortfall in funds due to changing demographics or economic challenges, there may not be enough resources to meet the promised pension benefits, potentially leaving retirees vulnerable and financially insecure in their retirement years.

Furthermore, critics point out that the UK pension system also faces challenges in terms of intergenerational fairness. The current system relies on younger generations to support the pensions of older generations, which can create an imbalance and burden for younger workers. With changing demographics and increased life expectancy, younger generations may face higher taxes or reduced benefits in the future to meet the pension obligations of the older generations, leading to intergenerational inequity and potential social tensions.

It’s important to note that not all experts agree with the notion that the UK pension system is a Ponzi scheme. Supporters of the system argue that it is a social contract between generations, and the pay-as-you-go mechanism, where current workers support current retirees, has been in place for many decades and has been sustainable thus far. They argue that the government and employers have made promises to workers based on certain assumptions, such as economic growth, investment returns, and demographic trends, and adjustments can be made in the future to ensure the system’s sustainability.

However, even supporters of the current system acknowledge that there are challenges and risks associated with unfunded pension liabilities. They emphasise the need for robust financial management, transparency, and accountability in the pension system to ensure that pensioners’ interests are protected and that the system remains sustainable in the long term. They also highlight the importance of considering factors such as changing demographics, economic conditions, and intergenerational fairness in the design and management of the pension system.

In recent years, there have been discussions and debates about potential reforms to the UK pension system to address the concerns raised by critics. Some of the proposed reforms include increasing the retirement age, reducing pension benefits, increasing contributions from workers and employers, introducing a funded pension system, or a combination of these measures. These reforms aim to ensure the sustainability of the pension system and mitigate the risks associated with unfunded pension liabilities.

In conclusion, the concept of promissory obligations to people who retire in the UK is a complex and contentious issue. While the UK pension system has been in place for many years and has provided financial support to millions of retirees, there are concerns and risks associated with unfunded pension liabilities that have led some critics to liken it to a Ponzi scheme. The reliance on continuous inflows of new workers to support current retirees, lack of transparency and accountability in fund management, potential vulnerability during financial crises, and issues of intergenerational fairness are some of the concerns raised by critics.

While supporters of the current system argue that it is a social contract between generations and has been sustainable thus far, they also acknowledge the need for robust financial management, transparency, and accountability to ensure its long-term sustainability. Proposed reforms, such as increasing retirement age, reducing pension benefits, increasing contributions, or introducing a funded pension system, have been discussed to address the concerns raised by critics.

As the UK population continues to age and economic conditions evolve, it is imperative to carefully consider the design and management of the pension system to ensure that it remains sustainable and meets the needs of retirees without burdening future generations. Transparency, accountability, and prudent financial management are essential to ensure that pensioners’ interests are protected, and the system is able to fulfill its promises in the long run.

While the UK pension system has provided financial support to retirees for many years, the issue of unfunded pension liabilities has raised concerns and led some critics to liken it to a Ponzi scheme. The reliance on continuous inflows of new workers, lack of transparency and accountability, potential vulnerability during financial crises, and issues of intergenerational fairness are some of the challenges faced by the system. However, reforms and careful management can help ensure the sustainability of the pension system and fulfill the promises made to retirees while safeguarding the interests of future generations. It is crucial to engage in thoughtful discussions and debates on potential reforms and consider various factors, such as changing demographics, economic conditions, and intergenerational fairness, to ensure a robust and sustainable pension system for the retirees of the UK.

Retiring Abroad Suggestions Reviews and Tips

Retirement is a significant milestone in life, and it often comes with a change in lifestyle and a search for new experiences. For many retirees, this means moving to a new place where they can enjoy a better quality of life, lower cost of living, and a welcoming community. Here are some of the best places to retire in the world:

Portugal

Portugal is a beautiful country with a mild climate, friendly people, and affordable cost of living. The healthcare system is also of high quality and accessible to all residents, including retirees. The Algarve region in southern Portugal is particularly popular among retirees due to its stunning beaches, year-round sunshine, and relaxed lifestyle.

Costa Rica

Costa Rica is known for its natural beauty, rich culture, and affordable cost of living. The country has a stable political climate, excellent healthcare, and a welcoming community. Retirees can enjoy a comfortable lifestyle in Costa Rica, surrounded by lush forests, beaches, and wildlife.

Spain

Spain is a popular destination for retirees due to its warm climate, rich culture, and affordable cost of living. The country is home to stunning architecture, delicious food, and a relaxed lifestyle. The southern region of Andalusia is particularly popular among retirees due to its mild climate and charming towns.

Mexico

Mexico offers a warm climate, beautiful beaches, and a low cost of living. The country has a rich history, delicious cuisine, and welcoming culture. Retirees can enjoy a comfortable lifestyle in Mexico, surrounded by stunning natural landscapes and friendly locals.

Panama

Panama is a small country in Central America that offers a low cost of living, excellent healthcare, and a stable political climate. The country has a warm tropical climate, stunning beaches, and a rich cultural heritage. Retirees can enjoy a relaxed lifestyle in Panama, surrounded by beautiful natural scenery and a friendly community.

Thailand

Thailand is a popular destination for retirees due to its warm climate, affordable cost of living, and vibrant culture. The country has a rich history, stunning natural beauty, and delicious cuisine. Retirees can enjoy a comfortable lifestyle in Thailand, surrounded by friendly locals, stunning beaches, and a welcoming community.

Malta

Malta is a small island nation in the Mediterranean Sea that offers a warm climate, rich culture, and affordable cost of living. The country has a stable political climate, excellent healthcare, and a relaxed lifestyle. Retirees can enjoy a comfortable lifestyle in Malta, surrounded by stunning natural scenery and a friendly community.

There are many great places to retire in the world, each with its unique culture, climate, and lifestyle. Whether you prefer the warm climate and relaxed lifestyle of Portugal, the natural beauty and affordable cost of living of Costa Rica, or the rich cultural heritage of Thailand, there is a retirement destination that will suit your needs and preferences.

What you need to know if you live in UK but want to retire abroad

Retiring abroad is a dream for many people. The lure of warmer weather, lower living costs, and a slower pace of life can be very appealing. But before you make the move, there are a few things you need to know.

Can I retire abroad from the UK?

Yes, you can retire abroad from the UK. However, there are a few things you need to do to make sure that you are eligible to receive your UK State Pension and other benefits.

Do I pay UK tax if I retire abroad?

Your tax status will depend on a number of factors, including the country you are moving to, your residency status, and your income. In general, if you are a UK resident, you will still have to pay UK tax on your worldwide income. However, there are a number of exemptions and reliefs that may apply.

Do I have to tell HMRC if I move abroad?

Yes, you have to tell HMRC if you move abroad. You can do this by completing a P85 form. This will help HMRC to ensure that you are paying the correct amount of tax.

Will I lose my UK pension if I move abroad?

No, you will not lose your UK pension if you move abroad. However, you may have to pay tax on your pension in the country you are living in. You should also check with the pension provider to see if there are any changes to the way your pension is paid out when you move abroad.

What are the benefits of retiring abroad?

There are a number of benefits to retiring abroad. These include:

- Lower living costs: In many countries, the cost of living is significantly lower than in the UK. This can help you to stretch your retirement savings further.

- Warmer weather: If you are looking for a warm and sunny retirement, there are many countries that offer this.

- A slower pace of life: If you are looking to relax and enjoy your retirement, a slower pace of life may be appealing.

- A new culture: Retiring abroad can be a great way to experience a new culture and meet new people.

What are the challenges of retiring abroad?

There are also a few challenges to retiring abroad. These include:

- Language barrier: If you are moving to a country where you do not speak the language, this can be a challenge.

- Culture shock: Moving to a new country can be a culture shock, and it can take some time to adjust.

- Healthcare: You need to make sure that you have adequate healthcare coverage when you move abroad.

- Loneliness: If you are moving to a country where you do not know anyone, you may feel lonely at first.

How do I choose the right country to retire to?

There are a number of factors to consider when choosing a country to retire to. These include:

- Cost of living: How much will it cost to live in the country you are considering?

- Climate: What kind of climate do you prefer?

- Culture: What kind of culture are you interested in?

- Healthcare: What is the quality of healthcare in the country?

- Visa requirements: What are the visa requirements for the country?

- Your personal preferences: What are your personal preferences for a retirement location?

Retiring abroad can be a great way to enjoy your golden years. However, it is important to do your research and plan carefully before you make the move. By considering the factors above, you can choose the right country for your retirement and make the most of your new life abroad.

Here are some additional tips for retiring abroad:

- Start planning early: The earlier you start planning, the more time you will have to research your options and make sure that you are making the right decision.

- Do your research: There are a number of resources available to help you research countries to retire to. These include government websites, travel websites, and retirement forums.

- Visit the country before you move: If possible, visit the country you are considering retiring to before you make the move. This will give you a chance to experience the culture and see if it is a good fit for you.

- Make sure you have adequate healthcare coverage: Healthcare can be expensive, so it is important to make sure that you have adequate coverage before you move abroad.

- Stay connected with friends and family: It is important to stay connected with your friends and family back home. This will help you to avoid feeling lonely and isolated.

Retiring abroad can be a wonderful experience. By following these tips, you can increase your chances of having a successful and enjoyable

Retiring Benefits UK

Cheeringup.Info Retirement Magazine will help you live the best retirement in the UK

As people enter their golden years, they often look forward to a more relaxed pace of life, time with family and friends, and the opportunity to pursue hobbies and interests they may not have had time for during their working years. However, retirement can also bring financial and health challenges. Fortunately, for retirees and people over 55 in the UK, there are a variety of resources and programs available to help them live better in retirement.

Financial Benefits

One of the primary concerns for retirees is managing their finances. Many people may worry about outliving their savings or not having enough income to cover their expenses. Fortunately, the UK government offers a range of financial support programs for older citizens.

State Pension: The state pension is a regular payment from the government that provides a basic level of income to retirees. The amount of the state pension depends on an individual’s National Insurance contributions.

Pension Credit: Pension credit is an income-related benefit that provides additional financial support to those with a low income. It can help to top up a pension or other income to a minimum amount.

Council Tax Reduction: Council Tax Reduction is a means-tested benefit that can help those on low incomes to pay their council tax bills.

Health Benefits

Retirees in the UK also have access to a range of health benefits, including:

NHS: The National Health Service (NHS) provides free healthcare to all UK residents, including retirees. This includes access to doctors, hospitals, and other medical services.

Prescription Discounts: Retirees over 60 are entitled to free prescriptions for all medications in England, Scotland, and Wales. In Northern Ireland, the age threshold is 65.

Free Eye Tests: Everyone over 60 in the UK is entitled to a free eye test every two years.

Mobility Support: The government provides a range of mobility support services, including free bus travel and disabled parking permits.

Social Benefits

Retirement can also bring social challenges, as people may find themselves with fewer opportunities to socialize and connect with others. Fortunately, the UK has a variety of programs and resources available to help retirees stay socially engaged.

Age UK: Age UK is a charity that provides a range of services to older people, including information and advice, befriending services, and social activities.

Community Centers: Many communities in the UK have community centers that offer a range of activities and events for older people, including exercise classes, hobby groups, and social events.

Volunteering: Volunteering can be a great way for retirees to stay socially engaged and give back to their communities. There are a variety of volunteering opportunities available in the UK, including charity work, mentoring, and tutoring.

Retirement can be a time of both excitement and uncertainty. However, retirees and people over 55 in the UK have access to a range of resources and programs that can help them live better in retirement. From financial support to healthcare benefits to social programs, the UK offers a wealth of resources to help retirees enjoy a fulfilling and comfortable retirement.

Read more in our Retirement Magazine

UK: Tips To Escape The Rat Race

Early Retirement in the UK: 10 Essential Tips to Achieve Financial Freedom and Enjoy Your Golden Years

The “rat race” is a term often used to describe the constant and competitive struggle of working to earn a living. It can be difficult to break free from the rat race, but with some strategic planning and hard work, it is possible. Here are ten tips on how to escape the rat race in the UK:

- Define your goals: To break free from the rat race, you need to know what you are working towards. Set specific and measurable goals, whether it’s financial freedom, a new career, or starting your own business.

- Create a budget: A budget is essential for managing your finances and achieving your financial goals. Track your spending, cut unnecessary expenses, and save as much as you can to reach your financial goals faster.

- Build a strong network: Networking is crucial for building new relationships and finding opportunities. Attend industry events, join professional groups, and connect with like-minded individuals.

- Invest in education: Learning new skills and knowledge can help you move forward in your career and increase your earning potential. Look for online courses, workshops, and seminars to expand your knowledge.

- Explore alternative income streams: Consider creating passive income streams, such as investing in stocks, property, or setting up an online business.

- Start a side hustle: Starting a side business or freelancing can help you earn extra money and gain experience in a new industry. It can also lead to a full-time career change.

- Reduce your debt: High levels of debt can keep you trapped in the rat race. Focus on paying off your debts as quickly as possible to free up your finances.

- Prioritise your health: Maintaining good health is essential for productivity and success. Prioritise exercise, healthy eating, and sleep to keep your body and mind in top condition.

- Find work-life balance: Avoid burning out by finding a healthy work-life balance. Set boundaries, take regular breaks, and make time for hobbies and activities outside of work.

- Take risks: Breaking free from the rat race requires taking risks and stepping outside of your comfort zone. Be prepared to take calculated risks and embrace change to achieve your goals.

In conclusion, breaking free from the rat race in the UK requires a combination of financial planning, networking, and personal development. By following these ten tips, you can take control of your finances, career, and life, and ultimately achieve your goals.

Living long happy healthy wealthy life UK

The UK is a wonderful place to live with its rich history, stunning countryside, vibrant cities and strong economy. However, despite its many advantages, many people still struggle to achieve a long, happy, healthy and wealthy life. In this article, we will explore some tips and advice on how to live a fulfilling life in the UK.

Health: The first step to living a long, happy and healthy life is to prioritise your health. Regular exercise, a balanced diet and good sleep habits are essential for a healthy lifestyle. The NHS provides many resources for maintaining good health, including online health assessments, GP services, and preventative care services. In addition, there are many gyms, parks and outdoor spaces where you can enjoy exercise and stay active.

Happiness: Happiness is a crucial aspect of a fulfilling life, and there are many ways to increase happiness levels in the UK. Spending time with friends and family, volunteering, and participating in hobbies and interests can all help improve mental wellbeing. It is also important to take care of your mental health, and the NHS provides many resources for mental health support, including talking therapies and medication.

Wealth: Wealth and financial stability can greatly improve quality of life, and there are many ways to build wealth in the UK. Investing in stocks, bonds, and real estate can all help build wealth over time. It is also important to live within your means and save regularly. The UK government provides resources for financial planning and investment, including the Money Advice Service and the Pension Advisory Service.

Longevity: Finally, longevity is a key factor in living a long and happy life, and there are many ways to increase lifespan in the UK. In addition to maintaining good health habits, it is important to avoid risky behaviors such as smoking and excessive alcohol consumption. The UK has a strong healthcare system and many preventative health services, including flu shots and cancer screenings, which can help improve lifespan.

In conclusion, living a long, happy, healthy and wealthy life in the UK is achievable with the right mindset and habits. By prioritising health, happiness, wealth and longevity, you can enjoy a fulfilling life in this wonderful country.

Tips from the experts on how to live to be a centenarian in UK

Unlock the Secrets to Living a Long and Healthy Life: Insider Tips from UK Centenarians

Living to be a centenarian, or reaching the age of 100, is becoming increasingly common in the United Kingdom. According to Age Concern UK, the number of centenarians in the UK has quadrupled over the past 30 years, and is projected to continue to increase in the coming years. So, what can you do to increase your chances of reaching this milestone? Here are some tips based on research from the Gerontology Research Group, the Institute for Aging Research at the Albert Einstein College of Medicine, and other experts in the field of aging and longevity.

- Maintain a healthy lifestyle: One of the most important factors in achieving a long and healthy life is maintaining a healthy lifestyle. This includes eating a balanced diet rich in fruits and vegetables, getting regular exercise, and avoiding smoking and excessive alcohol consumption.

- Stay socially active: Social connections and engagement have been shown to be important for maintaining both physical and mental health as we age. Volunteer work, joining clubs or groups with similar interests, and staying in touch with friends and family are all great ways to stay socially active.

- Keep your brain active: Keeping your brain active and challenged has been shown to help maintain cognitive function and reduce the risk of age-related diseases such as dementia. Activities such as reading, puzzles, and learning new skills can all help to keep the brain active.

- Manage stress: Chronic stress can take a toll on both physical and mental health, so it’s important to find ways to manage stress effectively. Yoga, meditation, and other relaxation techniques can be helpful in reducing stress levels.

- Get regular check-ups: Regular check-ups with your doctor can help to catch and treat any health issues early, which can help to prevent more serious problems down the line.

- Consider taking supplement: There are some supplements that have been shown to have potential benefits for aging such as omega-3s, vitamin D, and coenzyme Q10, but it’s important to talk to your doctor before starting any new supplements.

- Don’t forget about genetics: It’s important to note that genetics also plays a role in determining lifespan, so if you have a family history of longevity, you may be more likely to live a longer life.

Living to be a centenarian is becoming more common in the UK, and by following these tips, you can increase your chances of reaching this milestone. Remember, however, that no one can predict the future, and it’s important to focus on living a healthy and fulfilling life at every stage.

YourStrideUK’s highest rated emergency alarm service for the elderly

YourStride is the UK’s highest rated emergency alarm service for the elderly. Trusted by thousands of happy customers, our watch offers uninterrupted 24/7 emergency help at the push of a button – inside or outside the home.

Personal Alarm Watch is the UK’s highest rated emergency alarm service for the elderly. Trusted by thousands of happy customers, our watch offers uninterrupted 24/7 emergency help at the push of a button – inside or outside the home.

Make A Will Online Promotion

Make a Will Online allows customers to create a solicitor-checked will in minutes at an unbeatable price. Make a Will Online is the only online wills specialist to provide the security of having a fully qualified solicitor check your will.

Make a Will Online: your peace of mind

Make a Will Online allows customers to create a solicitor-checked will in minutes at an unbeatable price. Priced from only £60 customers can create a will in three quick and easy steps. Make a Will Online is the only online wills specialist to provide the security of having a fully qualified solicitor check your will and get in touch directly with legal advice if needed. We provide the best service to customers at the price. Bar. None.

Why do customers love Make a Will Online?

- The only online wills specialist to have a fully qualified solicitor check every will

- Make a second will with your spouse, partner or a friend for just £30

- Don’t take our word for it. ✰ ✰ ✰ ✰ ✰. 97% find our service “Great” or “Excellent” on Trustpilot.

- Clear explanations and a simple 3 step process

- No printer no problem! We can professionally print and send wills for as little as £15

- Guaranteed check by a solicitor within 2 working days

- Solicitor-manned helplines for customers

Retirement Living Magazine Articles and Live Online Broadcasting Including Live Videostreaming

Over 55s Alternatives To Pub Crawls

- Wine tasting tours

- Art gallery visits

- Historical walking tours

- Museum hopping

- Garden tours

- Scenic boat rides

- Food and cooking classes

- Dance or music lessons

- Nature walks or hikes

- Book club meetings or literary events

Will Triple Lock Stay In UK

No is the simple answer! Nothing has been announced yet, but the UK government has made a mess of budgeting under Liz Truss. If it was possible to keep triple lock prior to this misgovernment, it is highly unlikely the very expensive triple lock cost will be retained. The UK government has already indicated it will cut costs in the tens of billions so skiping triple lock cost for another year will be one of the first to be scored out with big red pen.

What is a flexible retirement plan?

Flexible retirement planning informs your decisions on flexing into and out of retirement at the right time for you. Changing economic and personal circumstances means how flexible retirement plan should enable you to maintain the best retirement lifestyle at your disposal. Build into your flexible retirement plan the ability to dynamically change what you do in retirement when you want to change what you do in retirement.

There are many business leaders in the UK calling upon retired persons to rejoin the workforce. Retirement is not a once in a lifestyle decision. It did not be. If you want or need to re-join the workforce, there are opportunities including part-time as well as full-time work.

Energy bills are forecast to top £4,200 in January 2023 as the cost of living in the UK continues to escalate. The energy price cap is set to rise by more than £650 by January, meaning a typical household will pay the equivalent of £4,266 a year in the first quarter 2023.

Cheeringup.info

Furthermore, you may be happy to remain in retirement, but not persist with the same elements within your retirement lifestyle. This again is your prerogative. That is, if you have the flexible retirement plan in place to enable you to pivot and change retirement lifestyle direction when you want to. Whereas initially, you were happy chilling in your home, you may decide after longer reflection that travelling the world is best for you. If you have planned your retirement as effectively as possible, you may be able to pick and choose more than a few just let your retirement happen.

Don’t think of on retirement as returning to your old job type. Instead, think about the retirement lifestyle you want, the income you want or need to make it worthwhile for you and the compromises that you will not make for any job.

Beat Inflation In UK By Exploring Retirement Lifestyle Abroad

Funeral regulation UK from 29 July 2022

Pre-paid funeral plans will fall under Financial Conduct Authority (FCA) regulation from 29 July 2022.

- Legally sold and administered funeral plans will be covered by the Financial Services Compensation Scheme (FSCS) should a company go bust.

- You will also be able to complain to the Financial Ombudsman Service (FOS) if you think you’ve been mistreated by a provider.

- Check that your funeral plan provider is authorised by the Financial Conduct Authority FCA

Any funeral plan provider that isn’t authorised by the FCA will be committing a criminal offence if it attempts to sell or administer a contract after 29 July.

How do you find out about forgotten pensions?

How does the stock market affect my pension?

Why are pension funds underfunded?

This is not a case where pensioners lose out. However, when a business collapses and a pension find for employees is underfunded, the fund is protected by law but the underfunded element remains underfunded. What this means is that the employees of the failed business will receive a lower pension than they should have cause the employer had not paid into the pension pot what it should have.

This is a pension scandal that has played out repeatedly for years. This pension scandal could be prevented if our politicians forced employers to fully fund your pension pot as you do every week or month. Why don’t you write to your MP to ask them to stop this pension provision scandal?

When paying into your pension pot remember pensions are like all other investments. Your retirement fund may not turn out to be as big as you thought it would be for a host of reasons, including your employer underfunding your pension pot.

How to do I resign beautifully During The Big Quit

The Big Quit or The Great Resignation kind of started in 2021 after a year of lockdowns and when people had a look at themselves, their life so far and asked themselves what they wanted for the rest of their lives.

Perhaps they also listened to vicenarians talking and realised life is not all about working, climbing the slippery career pole or making as much money as humanly possible.

Each Big Quitter had their own reasons for resigning from job into retirement. However, together they created what became known as The Great Resignation taking part in the Big Quit where a mass of skilled, experienced and fed up people at normal working age decided to stop working. When covid restrictions began to lift they thought I don’t need this shit in my life, but more importantly said to themselves and their bosses, I won’t have this shit in my life anymore – and left their jobs!

Many of their employers thought, we don’t need you either! However, more and more people have joined the Great Resignation into 2022 and employers have mow found in the UK that there are more than half a million jobs once vacated by older people in last couple years that are not being refilled by suitably experienced and willing workers. In addition there are more than half a million other job vacancies needing filled. The UK continues to have record job vacancies and joint record low unemployment levels. Now there is a global recession coming in 2023 that will reduce job vacancies but in the meantime many people are seizing the opportunity to unretire on their terms. For those that can and want to retire in UK …

Tips for happy retirement in UK

Our Retirement Magazine is free to read. It is aimed at providing tips, resources and inspiration for a better retirement in UK should you choose to make some changes to your retirement plans or retired life.

What are the fears of retirement?

People on fixed income should rightly be fearful of short-term future in UK and that may include those in retirement. Whatever your age and circumstances, pre-retirement or post-retirement, this period has never been more frightening as an investor. The vast majority of people in retirement or planning for retirement are probably investors in one way or another.

- Many people are more or less forced to put aside a portion of their income into a pension via investment products like automatic pension enrolment

- Even if you have no money you can invest or want to invest, your cash buying spending power is dictated to in a large part how investments are performing, underperforming or over-performing

- If you have already retired many will be relying on investments in their retirement fund to pay retirement income. Even the state pension has some element of reliance on investment performance and goes up more or less based on the likes of UK inflation as well as political interference or interjection.

If you were not a little scared right now you would either mot be normal, be already destitute or very very rich!

Inflation in the UK is killing the lifestyle of people on fixed income living in retirement in UK. It will get worse over 2022 before it gets better. The better will not be price reductions, just prices will stop going up as fast – inflation in UK will slow as interest rates are pumped up fast and the Bank of England destroys money supply. Quantitative Easing QE has been flipped and we are now in a period of the opposite – Quantitative Tightening which equals less cheap money to borrow for housing, cars and holidays. Now is maybe the time to lock-in 0 percent finance deals, fixed rate mortgage or other guaranteed low debt costs. The cost of money is definitely going to rise in UK and globally.

The impact of rising inflation is most painfully felt from the rising cost of the basic necessities of living. We have already seen that with fuel and energy, but the coming global food crisis is foing to bring with it surging price of food in UK. Many more millions around the world will be plunged into starvation according to United Nation’s March 2022 report. In addition, to not accessing food the poorest nations will not be able to pain their debt built up during the pandemic.

Your retirement strategy will depend how far you are from retirement and what retirement fund you have if you have already retired in UK

CheeringupInfo

If you have retired you must surely have felt the impact of inflation when you fill up your car, pay your heating bill or been to buy food? If you have not retired, you maybe benefiting from increased wages. However most will still be net losers after inflation has been taking into account as well as the increase in National Insurance.

Your National Insurance payment does not pay for your retirement. It pays the pension of those who have already retired. Your pension amount will be based purely on political decisions of all those in government between now and the time you retire. If the push up pensions ahead of inflation you will increase your standard of living in retirement. Or to put it another way, if politicians do mot ensure pensions keep pace with inflation then pensioners standard of living will fall – those already retired and those who will reach retirement age in future.

CheeringupInfo

If you are planning for your retirement in future you need to factor in the impact of inflation on your retirement lifestyle. Your investment strategy for the retirement lifestyle you want needs to take into account inflation. For decades inflation has been at or near 2 percent. At least for a short while inflation in UK could be 5 times that high! For a longer period of time ahead its going to be double that.

If you have not retired yet you may need to either readjust the comfortable retirement lifestyle you can afford, commit more of your current income to saving for your retirement or take more risk with the retirement fund you are building – more risk may mean more reward but as they saying goes your retirement fund could reduce as well as increase with extra risk taking.

Whether you are pre-retirement or post-retirement in UK, rising inflation means you may need to make changes now to enjoy your life now or later.

Brutal Truths About Retirement In UK

Many people do not know what they want out of retirement in the UK. It is difficult to find the time to analyse what it is you should do for the 3rd and last act of your life on earth.

- Why do you have things in your life you do now and why do you want them in your life when you retire?

- What if you make the wrong choices?

- What do you do when your retirement plan does not go as you planned? No life plan goes the way you plan it to go at any time of your life so why should your retirement plan go exactly the way you write it down!

- How do you ensure your retirement fund is adequate for your retirement plans? How will expected and unexpected lifestyle costs impact on your ability to lead the life in retirement you want for yourself?

- When do you want to retire? How will you ensure you build up a big enough retirement fund to finance your retirement plan? What impact will this have on your lifestyle before retirement? What compromises are you prepared to make?

- Where do you want to retire? How does that enhance or detract from your retirement lifestyle plans?

- Who do you want in your life in retirement? It is not mandatory to do everything you love to do with anyone else. Some things you may want to do on your own? However, if you do want someone else to join you on your dream retirement journey, will the chosen other people you want to join you want to join you?

When planning for a retirement in the UK you need to know what makes you happy in life now and what you really want to do in retirement in future. For some retirement offers the opportunity to do something completely different for the remaining years of life on earth. More likely retirement just gives you the opportunity to spend your time doing the things you love doing before you retire.

Planning for retirement is not just about an organisation taking money out of your wage every month until you retire. Getting the most out of your retirement may not just about retiring and carrying on with your life pre-retirement. If you are happy just drifting into the retirement phase of your life then great. Remember though the majority of people get to the end of their life and regret things they didn’t do in their life. Make sure you are not one of those people. The brutal truths about retirement in the UK is that if people starting questioning themselves about what a great retirement looks like for them they need to answer difficult questions like the bullet points above. The truthful answers more result in decisions like:

- Change of people you have around you who do not really have your best interests at heart

- Taking personal responsibility for a successful life in retirement or a bad end to your life

- You are going to have to be flexible, resilient and determined in retirement. Life in retirement does not mean life is going to be easy and stress free. Solving problems in retirement is just as necessary as solving problems pre-retirement.

- Your retirement fund is going to limit your retirement choices. You need to know what are the Deal Breakers. Deal breakers should dictate when and how you retire. Early retirement may become possible when you know your Retirement Deal Breakers. Alternatively, you may need or want to work longer.

- Where you want to retire could be crucial in terms of the rest of your life. Not wanting to sell your family home could restrict you. Relocating, downsizing or equity release could promote increased freedom in retirement lifestyle choices.

- Who you want to be with until you die could include decisions like divorce, dating, leaving friends and family behind or putting yourself in places which may expose you to new relationships.

No one can create your retirement plan for you. What maybe unimportant to some may be critically important for others. Whether you are retired now or have started thinking about retirement life seriously, you need to start answering serious questions and potentially face some brutal home truths that will guide the last years of your life on earth.

How To Enjoy Life In Retirement Years

Retirement Age Life Living Lifestyle Business Magazine To Boost Quality Of Your Retirement Life in UK

“I want to be in the moment, mindful of my privilege to be alive and well, feeling and loving every moment of life in retirement in UK, with an affordable practical loving retirement life UK I can sustain until I die, so I live the life I can, within my retirement life budget. I do not want to live a life in retirement in UK that wastes my ability, love, desire and energy to live well to the end.”

CheeringupInfo

Living The Retired Life You Want With The Retirement Fund At Your Disposal

Living The Retirement Life You Want For Yourself With CheeringupInfo

More on improving retirement lifestyle in the UK with retirement essentials

Retirement Living Magazine For 0ver 55s To Discover How To Love Retirement UK Even More

UK retirement questions answers and ideas

Find out more about latest money politics culture food drink relationships holidays entertainment and opinions. We keep you connected with the outside world in the UK and beyond.

People do not think about retirement until it is too late. Retirement income compared to working income is usually substantially reduced as a result. Furthermore the lack of a retirement plan means that lifestyle in retirement is not as good as it could be. Reasons for lack of a great retirement plan include:

- I don’t really understand retirement planning

- I’m a while off retirement yet

- I have too many other things on my plate right now

It is likely that many people will live at least 20 to 30 years in retirement in the UK. That is a lot of time. How will you live it?

Are you currently living the retirement life you want to live? Are you living the retirement life you think you have to live instead of the retirement life you could live?

Do you know what retirement life you want when you do retire? Could you afford the retirement life you want for yourself? If you do not build the retirement income you will need to live the retirement lifestyle you want, what are you prepared to sacrifice to survive in retirement?

Get help to understand planning for and living in retirement in the UK including early retirement, if that is what you want. Help for over 55s to live a better life in retirement including latest deals discounts and special offers – make your retirement income go further at improving your retirement lifestyle.

Retirement Data Analysis UK

Helping you to prepare yourself for the best retirement lifestyle

Retirement Planning Calculator

How much should you be investing for your retirement pension fund

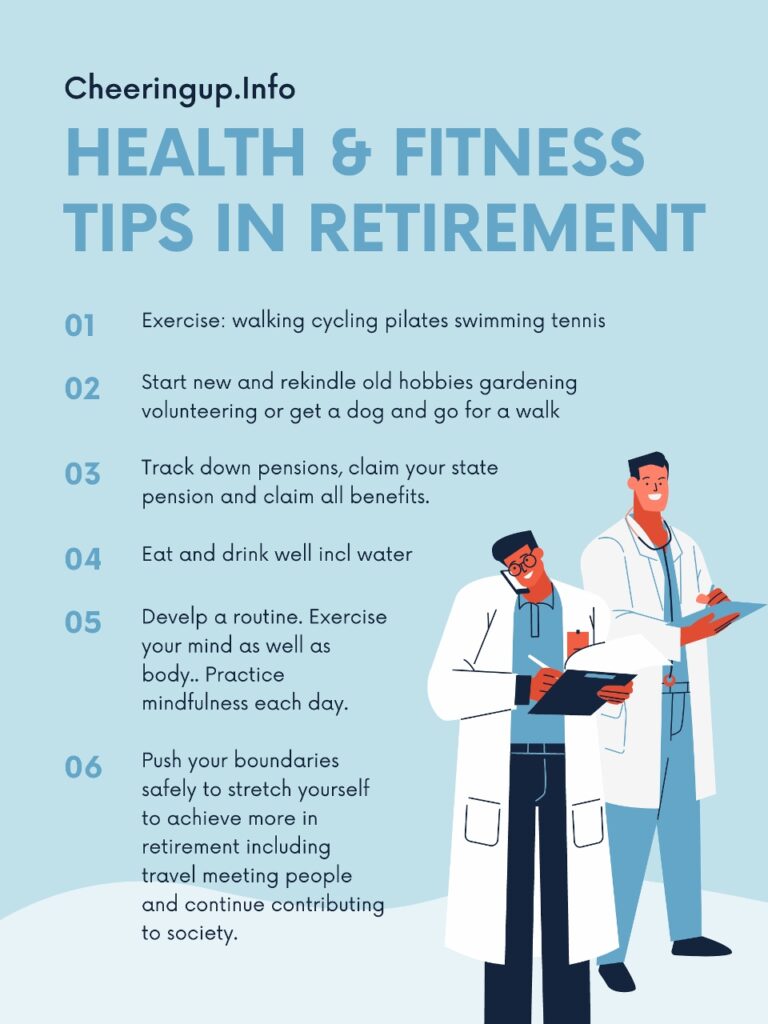

Retirement Health and Wellness

Easy ways to improve your Health and wellness in retirement

Retirement Savings Calculator

Simple ways to get your retirement finances in order in UK

Retirement Lifestyle Data Analysis

Make sure you use your retirement fund to maximise your enjoyment of life.

Retirement Plan and Retirement Options

Make The 3rd Act Of Your Life Your Best

Living The Third Act In Life Even Better Than What’s Gone Before With CheeringupInfo

Live your best third act! Make the rest of your life the best of your entire life! Learn about new ways to enjoy your life in retirement. Grow old disgracefully or give yourself the chance to live the most chilled stress free life you could wish for. If you want to create a new way of living this stage of your life we can help you.

The best part of getting older is losing inhibitions. There is no need to place restrictions on what you want in retirement. Plus the retirement phase of your life could be your longest – retiring at 67 means you could easily have 30 years whereas child rearing may last 20 and your teenage life even less. The best days of your life are not your school days but your retirement years.

Changing your life in retirement need not be an overnight thing – grow into it slowly and cultivate the things that bring you most joy. Make your Third Act anything you want it to be with help from CheeringupInfo.

Retirement Focus

The Day You Retire Should Be One Of The Best Days Of Your Life

Celebrate Retirement With Great New Life

The day you retire should be one of the best days of your life – you’ve picked the day of your retirement and everything is in place to live the retirement you want for yourself.

Your financial situation should be as strong as possible when you retire to give yourself the best chance of living the life you want in retirement. That takes careful evaluation and planning.