Why Image Logo Advertising for Lifestyle Products and Services is Cost-Effective in the UK

Image logo advertising is a potent tool for promoting lifestyle products and services in the UK. It combines visual appeal with brand recognition to create a memorable impact on consumers. This approach not only enhances brand visibility but also fosters a deeper connection with the target audience, ultimately proving to be cost-effective. Here’s why image logo advertising is beneficial and how to maximise its impact:

The Power of Visual Branding

Visual branding, particularly through image logos, is crucial in lifestyle marketing. It helps in establishing an immediate connection with the audience. According to studies, humans process images 60,000 times faster than text, and nearly 90% of information transmitted to the brain is visual. This makes image logo advertising an effective way to capture attention quickly and convey brand messages succinctly.

- Enhanced Brand Recognition: Consistent use of a well-designed logo helps in creating a strong visual identity for your brand. It makes your brand easily recognisable, which is essential in a crowded market.

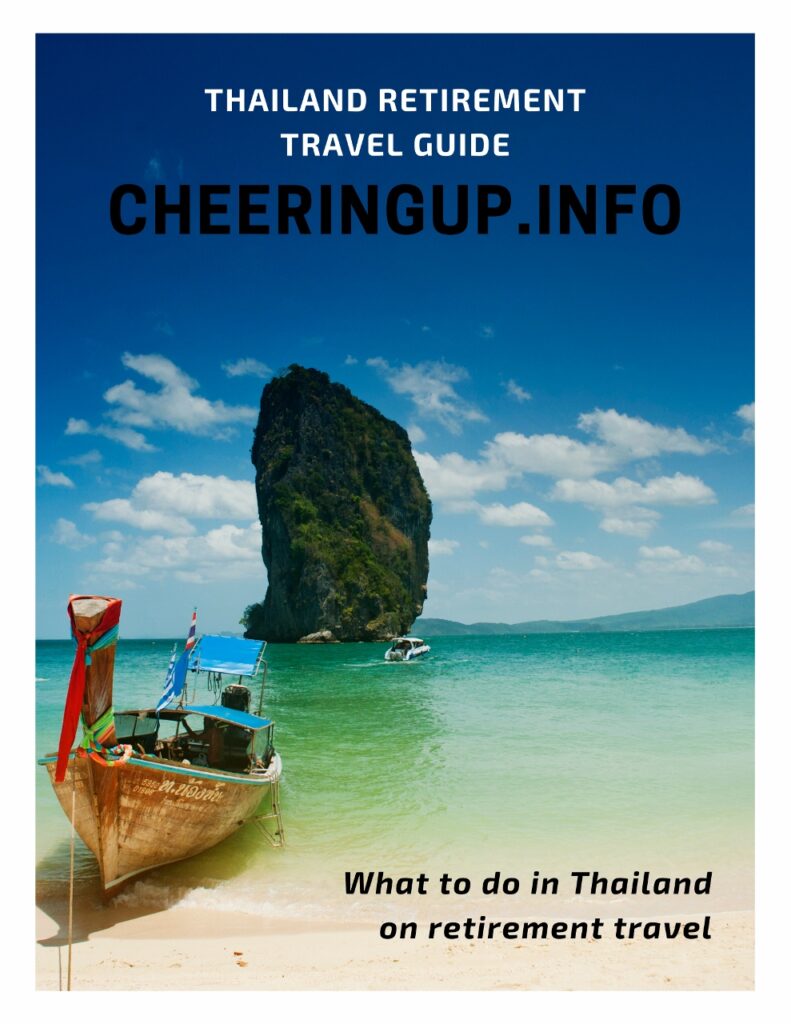

- Emotional Connection: Images evoke emotions. By using images that reflect the lifestyle your brand promotes, you can create an emotional bond with your audience. For instance, using images of happy, active individuals for a fitness brand can inspire and motivate potential customers.

- Storytelling: Lifestyle brands thrive on storytelling. Images can tell a story at a glance, portraying the lifestyle your product supports. This storytelling aspect is vital in creating a narrative that resonates with your audience.

- Cost-Effectiveness: Compared to text-heavy ads, image logo advertising can be more cost-effective. It reduces the need for extensive copy and can be used across various platforms with minimal modifications, ensuring a consistent brand message.

Maximising the Impact of Image Logo Advertising

To ensure that your image logo advertising is as effective as possible, consider the following strategies:

- Know Your Audience: Understanding your target audience is crucial. Identify their preferences, values, and lifestyles. Tailor your images to reflect these aspects to make your ads more relatable and appealing.

- Quality Over Quantity: Invest in high-quality images. Professional photography and design can make a significant difference in how your brand is perceived. High-quality visuals convey professionalism and build trust.

- Consistency is Key: Maintain consistency in your visual branding. Use the same colour schemes, fonts, and style across all platforms. This helps in reinforcing your brand identity and making it more recognisable.

- Utilise Social Media: Social media platforms are ideal for image logo advertising. Platforms like Instagram, Pinterest, and Facebook are highly visual and can help you reach a larger audience. Use these platforms to showcase your products in a lifestyle context.

- Engage with User-Generated Content: Encourage your customers to share their own photos using your products. This not only provides authentic content but also builds a community around your brand. User-generated content can be a powerful testimonial and add credibility.

- Leverage Influencers: Collaborate with influencers who align with your brand’s lifestyle. Influencers can amplify your reach and add a layer of trust and authenticity to your advertising efforts.

- Adapt to Trends: Stay updated with the latest trends in visual marketing. Adapt your strategies to include new styles and formats that appeal to your audience.

Best Types of Images for UK Consumers

To resonate with UK consumers, consider the following types of images:

- Authentic and Relatable: Use images that feel genuine and relatable. Avoid overly staged or edited photos. Authenticity can help in building trust and connection.

- Cultural Relevance: Ensure your images reflect the cultural context of your target audience. This includes diversity and inclusion, which are highly valued in the UK.

- Seasonal and Local: Use seasonal themes and local landmarks to make your images more relatable to UK consumers. This could include autumn leaves, local festivals, or iconic locations.

- Lifestyle-Oriented: Showcase your products in real-life scenarios that your audience aspires to. For example, if you’re selling outdoor gear, use images of people hiking or camping in picturesque UK landscapes.

- High-Energy and Positive: Positive and high-energy images can be very appealing. They create a feel-good factor that can enhance the attractiveness of your brand.

Practical Tips for Effective Image Logo Advertising

- Optimise for Mobile: Ensure your images are optimised for mobile viewing. With a significant portion of internet traffic coming from mobile devices, this is crucial for reaching your audience effectively.

- SEO-Friendly: Use descriptive file names and alt text for your images. This can improve your search engine rankings and make your images more discoverable online.

- Call-to-Action: Include clear call-to-actions (CTAs) in your visual ads. Whether it’s to visit your website, follow your social media, or make a purchase, a strong CTA can drive engagement and conversions.

- A/B Testing: Conduct A/B testing to see which images perform best. This can provide valuable insights into what resonates most with your audience and help you refine your strategy.

- Analytics: Use analytics tools to track the performance of your image logo ads. Monitor metrics like engagement, click-through rates, and conversions to measure the effectiveness of your campaigns.

- Sustainability and Ethics: Highlight any sustainable and ethical practices in your visual content. UK consumers are increasingly conscious about sustainability, and showcasing your commitment can enhance your brand’s appeal.

Conclusion

Image logo advertising is a powerful and cost-effective tool for promoting lifestyle products and services in the UK. By focusing on visual storytelling, maintaining consistency, leveraging social media, and understanding your audience, you can create impactful ads that resonate with consumers. High-quality, authentic images that reflect the aspirations and lifestyles of your target audience can significantly enhance brand recognition and loyalty. With strategic implementation, image logo advertising can drive long-term success and growth for your business.