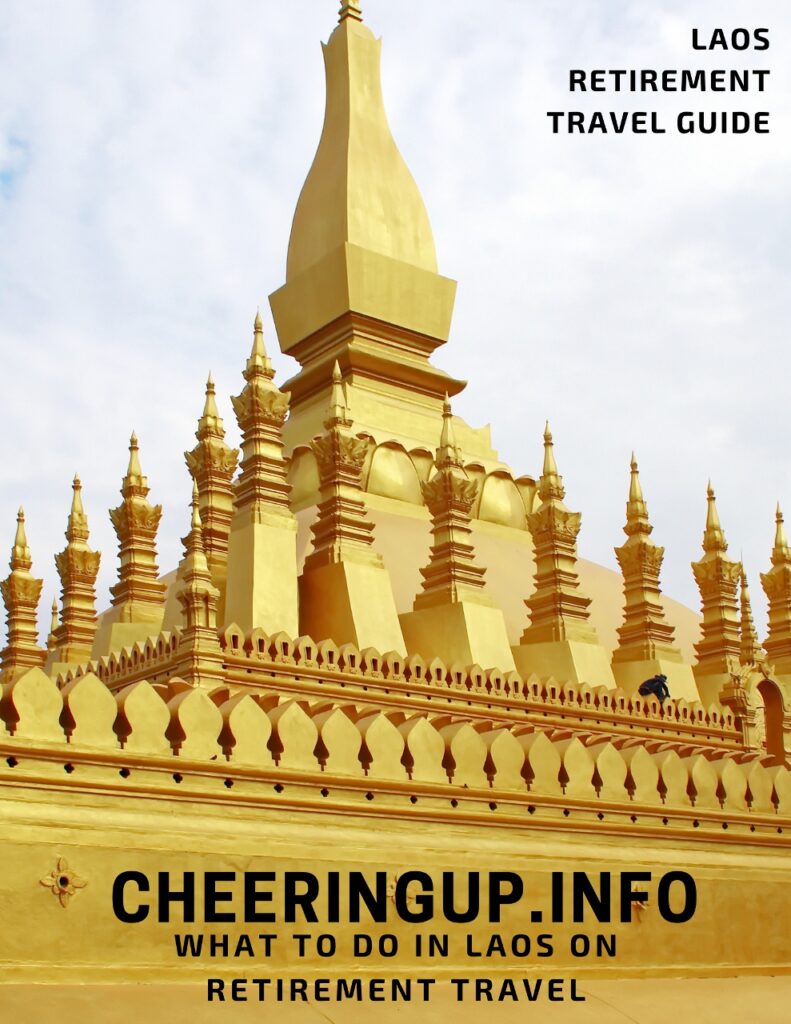

Discovering Luang Prabang including best Luang Prabang Food Luang Prabang Things To Do and Luang Prabang Accommodation

Take a look round Luang Prabang with us.

Retirement Club

4-Day Itinerary for Luang Prabang, Laos:

Why Visit Luang Prabang:

- UNESCO World Heritage City: Luang Prabang’s rich history, stunning temples, and traditional culture earned it a UNESCO World Heritage designation.

- Spiritual Center: Witness the daily alms-giving ceremony, a unique and spiritual experience. Explore the numerous temples and monasteries.

- Natural Beauty: Discover breathtaking waterfalls, lush landscapes, and the majestic Mekong River.

- Authentic Culture: Immerse yourself in Lao traditions, handicrafts, and delicious local cuisine.

Day 1: Exploring the City and Spiritual Heart

- Morning:

- Witness the Alms-Giving Ceremony: Rise early (around 5:30 AM) to observe the monks collecting alms from the locals. It’s a peaceful and deeply spiritual experience.

- Explore Wat Xieng Thong: This ornate temple is considered the most beautiful in Luang Prabang. Marvel at its intricate architecture and gold-leafed decorations.

- Climb Mount Phou Si: Hike or take the stairs to the top of Mount Phou Si for panoramic city views and stunning sunsets. Visit Wat Chom Si and Wat Prabat Tai Si along the way.

- Afternoon:

- Visit the Royal Palace Museum:Learn about Lao history and culture at the former royal palace, now a museum.

- Stroll through the Night Market:Browse for handicrafts, souvenirs, and local delicacies at the vibrant night market.

- Evening:

- Enjoy a Laotian Dinner: Sample traditional dishes like “khao soi” (coconut curry noodles) and “tam mak hoong” (papaya salad) at a local restaurant.

Day 2: Mekong River Cruise and Pak Ou Caves

- Morning:

- Take a Boat Trip on the Mekong River: Hire a longtail boat for a scenic cruise up the Mekong River. Enjoy the views of the riverbanks and villages.

- Visit Pak Ou Caves: Explore the Tham Ting and Tham Phoum caves filled with hundreds of Buddha statues.

- Afternoon:

- Learn about Lao Textiles: Visit a silk village or weaving workshop to see the traditional silk-making process and purchase beautiful textiles.

- Evening:

- Relax and Enjoy Local Entertainment: Catch a traditional Lao dance performance or attend a cooking class to learn how to prepare Lao dishes.

Day 3: Kuang Si Waterfall and Local Culture

- Morning:

- Hike to Kuang Si Waterfall: Take a tuk-tuk or motorbike to the stunning Kuang Si Waterfall. Swim in the turquoise pools, explore the bear sanctuary, and enjoy the lush surroundings.

- Afternoon:

- Visit a Hmong Village: Experience the unique culture of the Hmong people in a traditional village. Learn about their customs, crafts, and way of life.

- Evening:

- Sample Local Street Food: Explore the night market or street food stalls for a variety of delicious and affordable Lao dishes.

Day 4: Relax and Reflect

- Morning:

- Enjoy a Relaxing Morning: Take a yoga class, visit a spa, or simply relax by the Mekong River.

- Do some Last-Minute Shopping:Pick up any souvenirs or gifts you may have missed.

- Afternoon:

- Reflect on your Trip: Take some time to reflect on your experiences in Luang Prabang and appreciate the beauty and culture of this special place.

Logistics:

- Getting Around: Walking is the best way to explore the city centre. Tuk-tuks and motorbike taxis are readily available for longer distances.

- Respectful Dress: When visiting temples and participating in cultural activities, dress modestly and respectfully.

- Bargaining: Bargaining is expected at markets and with some vendors. Be polite and respectful when negotiating prices.

Enhancing the Tourist Experience:

- Learn a Few Lao Phrases: Basic Lao phrases will go a long way in showing respect and appreciation to the locals.

- Support Local Businesses: Choose locally owned restaurants, shops, and tours to contribute to the community.

- Be Mindful of Cultural Etiquette:Learn about local customs and traditions to ensure a respectful and enjoyable experience.

Additional Tips:

- Purchase a Luang Prabang City Card for discounted entry to major attractions and transportation.

- Take advantage of the many free activities like visiting temples and walking along the riverfront.

- Pack light, breathable clothing and comfortable shoes for exploring.

- Be prepared for the heat and humidity, especially during the dry season (November to April).

This itinerary provides a starting point for your exploration of Luang Prabang. Feel free to adjust it based on your interests and time constraints. With its rich culture, stunning scenery, and friendly people, Luang Prabang is sure to leave you with unforgettable memories.