The Golden Years, Tarnished Dreams? Reclaiming Your Retirement Amidst the UK Cost of Living Crisis

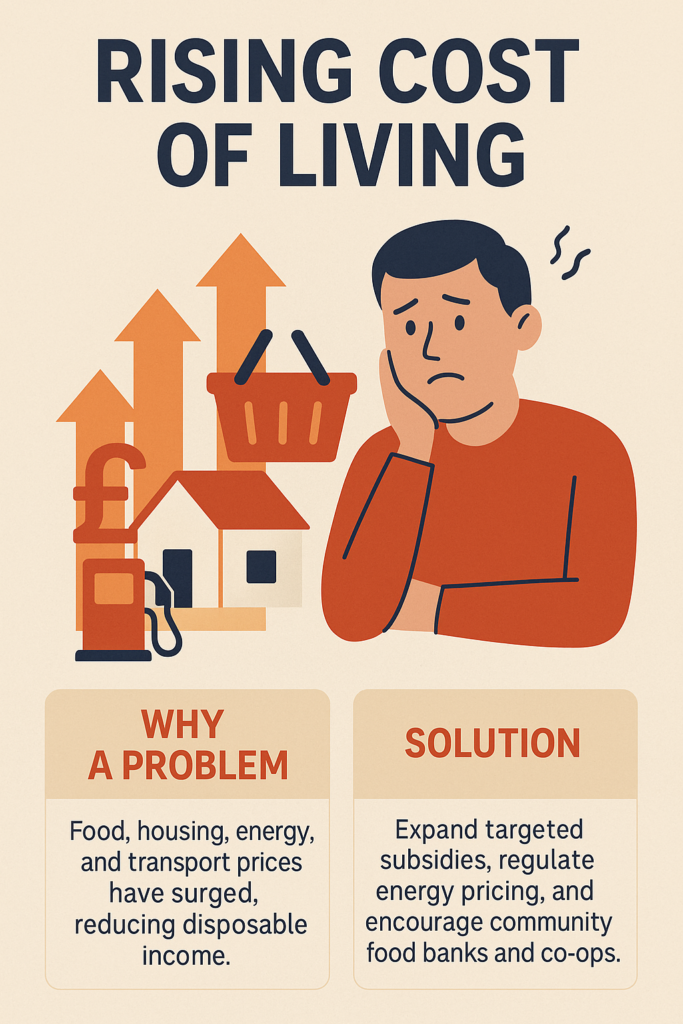

The headlines scream it: “Inflation Soars!”, “Pensioners Face Poverty!”, “Cost of Living Bites Hardest for Over 55s!” It’s enough to make your carefully planned retirement feel like it’s dissolving before your very eyes. In 2025, the relentless surge in the UK cost of living isn’t just a news story; it’s a stark reality reshaping the dreams of countless individuals over 55. The comfortable lifestyle you envisioned, the travel plans, the financial security – all feel increasingly out of reach as inflation relentlessly chips away at your hard-earned savings.

UK cost of living squeezing your retirement? Discover how to launch a PROFITABLE online side hustle! This eBook provides actionable steps & inspiring ideas for the over 55s in semi-retirement to boost income & live better. Unlock your potential & thrive! #UKRetirementSideHustle #Over55BizUK

But what if I told you this isn’t the end of the story? What if there’s a way to not just survive, but thrive in your semi-retirement?

This isn’t about pulling rabbits out of hats or some get-rich-quick scheme. This is about tapping into your wealth of experience, your unique skills, and the opportunities that the modern world presents to forge a new path – a side hustle that not only boosts your income but also injects purpose, passion, and a renewed sense of control into your life.

This eBook is your guide. We’ll delve into the stark realities of the UK’s cost of living crisis and its disproportionate impact on the over 55s. But more importantly, we’ll explore the exciting possibilities of creating your own side hustle – a venture tailored to your strengths and aspirations, designed to enhance your financial well-being and enrich your semi-retirement years.

Forget the image of a struggling retiree. Embrace the potential of a vibrant, fulfilling later life where you call the shots. Let’s embark on this journey together and discover how you can take control and build a brighter future, starting right now.

Part 1: The Crushing Reality – Understanding the UK Cost of Living Crisis and Its Impact on the Over 55s

The air crackles with anxiety when the topic of finances arises, doesn’t it? Especially for those in their pre or early retirement years. The Office for National Statistics ONS has been criticised by UK parliamentarians for being grossly inaccurate. We all know the reality that UK inflation is higher than the ONS want us to believe! This isn’t just about slightly more expensive groceries; it’s a fundamental erosion of purchasing power that dramatically alters the landscape of retirement living.

Consider this: a pension pot that looked comfortable a few years ago now buys significantly less. The dream of leisurely travel becomes a logistical nightmare of budgeting and compromise. Even everyday essentials, like heating your home or putting food on the table, demand a larger and larger slice of your income.

Why are the Over 55s Particularly Vulnerable?

Several factors contribute to the heightened vulnerability of the over 55s to the current cost of living crisis:

- Fixed Incomes: Many retirees rely heavily on fixed pensions, the value of which doesn’t always keep pace with inflation. Unlike those still in employment who may see salary adjustments, pensioners often bear the brunt of rising prices without a corresponding increase in income.

- Savings Erosion: While some may have substantial savings, prolonged periods of high inflation can significantly deplete these reserves, especially if withdrawals are necessary to cover increasing living costs.

- Health Concerns: Older individuals often face higher healthcare expenses, which can escalate further with inflation in the healthcare sector. Unexpected medical bills can quickly derail even the most carefully planned budgets.

- Lower Earning Potential (for some): While this eBook champions the idea of a side hustle, the reality is that finding traditional employment in later life can be challenging for some due to age discrimination or health limitations.

- Emotional Impact: The stress and anxiety of financial insecurity can take a significant toll on mental and emotional well-being, impacting overall quality of life during what should be a period of relaxation and enjoyment.

The Lifestyle Goals Under Threat

What were those dreams you held onto as you diligently saved and planned for retirement? Perhaps it was:

- Travel and Exploration: Seeing the world, experiencing new cultures, and creating lasting memories.

- Hobbies and Interests: Dedicating time to passions like gardening, painting, learning a new language, or joining clubs.

- Supporting Family: Helping children or grandchildren financially, or simply enjoying more quality time together.

- Comfortable Living: Maintaining a certain standard of living, enjoying leisure activities, and not having to constantly worry about bills.

- Philanthropy: Giving back to causes you care about and making a positive impact on the world.

The relentless rise in the cost of living casts a long shadow over these aspirations, making them feel increasingly like distant fantasies rather than achievable realities. The fear of outliving savings, of being a burden on family, or of simply not being able to afford a decent quality of life can be overwhelming.

Inflation: The Silent Thief

Imagine your retirement income as a fixed-size pie. With each percentage point increase in inflation, the slices of that pie become smaller in terms of what they can buy. Over time, this silent thief can steal a significant portion of your purchasing power, leaving you with less and less to meet your needs and fulfill your desires.

Let’s illustrate with a simple example. If your annual pension is £20,000 and inflation is running at 5%, the real value of your pension decreases by £1,000 in just one year. Over several years, this erosion can be substantial.

The Psychological Toll

Beyond the financial implications, the cost of living crisis takes a significant psychological toll. The worry, the stress, the feeling of losing control – these emotions can be deeply damaging to mental and physical health. The narrative of a comfortable, worry-free retirement is being challenged, leading to feelings of disappointment, frustration, and even despair for some.

But it doesn’t have to be this way. There is a proactive and empowering response: embracing the potential of a side hustle.

Part 2: The Power of the Side Hustle – A Semi-Retirement Solution

Let’s shift gears. Instead of dwelling solely on the problem, let’s focus on a powerful solution: the side hustle. In the context of semi-retirement, a side hustle isn’t about grinding away at a second full-time job. It’s about strategically leveraging your skills, passions, and experience to create an additional income stream that complements your pension and savings, offering not just financial relief but also a sense of purpose and fulfillment.

Why a Side Hustle in Later Life Makes Sense

The idea of starting a business or taking on extra work in your 50s, 60s, or beyond might seem daunting at first. But consider the unique advantages you possess at this stage of life:

- Years of Experience: You’ve accumulated a wealth of knowledge and skills throughout your career. This experience is invaluable and can be monetised in countless ways, from consulting to mentoring to creating and selling products based on your expertise.

- Established Networks: You’ve built relationships over the years – professional contacts, former colleagues, friends, and acquaintances. These networks can be a powerful source of leads, support, and collaboration for your side hustle.

- Financial Stability (potentially): While the cost of living is a concern, you may have some savings or a partial pension to provide a financial cushion as you launch your venture. This reduces the immediate pressure to generate significant income.

- Time Flexibility (in semi-retirement): Semi-retirement often offers more flexible time compared to full-time employment. This allows you to dedicate focused effort to building your side hustle without the constraints of a demanding 9-to-5 schedule.

- Passion and Purpose: A side hustle can be an opportunity to pursue long-held interests or passions that you didn’t have time for during your main career. This can bring a renewed sense of purpose and enjoyment to your life.

- Mental Stimulation: Engaging in a new venture can keep your mind sharp, challenge you in new ways, and prevent the stagnation that can sometimes accompany full retirement.

- Social Connection: Depending on the nature of your side hustle, it can provide opportunities for social interaction and connection with like-minded individuals, combating potential feelings of isolation in retirement.

What Exactly is a Side Hustle in Semi-Retirement?

It’s not one-size-fits-all. A side hustle in later life can take many forms, tailored to your individual circumstances and goals. Here are some examples:

- Consulting or Coaching: Leveraging your professional expertise to advise individuals or businesses in your field.

- Freelancing: Offering your skills in areas like writing, editing, graphic design, web development, or social media management on a project basis.

- Crafting and Selling: Turning a hobby like knitting, painting, woodworking, or jewelry making into a small business.

- Online Courses or Workshops: Sharing your knowledge and skills by creating and selling digital learning resources.

- Tutoring or Mentoring: Providing one-on-one guidance to students or younger professionals in your area of expertise.

- E-commerce: Selling curated products or items you’ve sourced or created through online platforms.

- Affiliate Marketing: Partnering with businesses to promote their products or services and earning a commission on sales.

- Property-Related Ventures: Managing a rental property or offering services related to home maintenance or gardening.

- Local Services: Providing services like dog walking, pet sitting, gardening, or handyman work in your community.

The key is to identify something that aligns with your skills, interests, and the amount of time and energy you’re willing to invest. It should feel less like a chore and more like an engaging and rewarding activity.

The Benefits Beyond the Bottom Line

While the financial boost is undoubtedly a significant advantage, the benefits of a side hustle in semi-retirement extend far beyond just extra income:

- Increased Financial Security: A consistent side income can provide a buffer against rising living costs, reduce reliance on savings, and offer greater peace of mind.

- Enhanced Sense of Purpose: Contributing your skills and knowledge can provide a renewed sense of purpose and accomplishment in retirement.

- Improved Mental and Physical Well-being: Staying active, engaged, and socially connected through your side hustle can have positive effects on both your mental and physical health.

- Personal Growth and Development: Learning new skills and navigating the challenges of running a small venture can be intellectually stimulating and foster personal growth.

- Greater Control Over Your Time and Life: A side hustle allows you to set your own hours, choose your projects, and be your own boss, offering a greater sense of control over your life in semi-retirement.

- Opportunity to Pursue Passions: It’s a chance to finally dedicate time to those hobbies or interests that you’ve always wanted to explore, potentially turning them into income-generating activities.

- Leaving a Legacy: For some, a side hustle can evolve into something more significant, a small business that can be passed on to family or sold for a profit.

Shifting Your Mindset: From “Retiree” to “Re-Engager”

The traditional view of retirement as a period of complete cessation of work is becoming increasingly outdated, especially in the face of economic realities and the desire for continued engagement. Embracing the concept of “semi-retirement” and viewing a side hustle as a positive and empowering choice is a crucial first step. It’s about reframing your perspective from one of passive withdrawal to one of active participation and continued growth.

This isn’t about having to work because you can’t afford not to. It’s about choosing to work in a way that is fulfilling, flexible, and financially beneficial, allowing you to live a richer and more secure semi-retirement.

Part 3: Igniting Your Spark – Brainstorming Side Hustle Ideas Tailored to You

Now comes the exciting part: exploring the possibilities! What kind of side hustle could you create? The best starting point is to look inwards. What are your skills, your passions, your experiences?

Unearthing Your Skills and Expertise

Think back over your career. What were you good at? What tasks did you enjoy? What problems did you solve? Don’t just focus on your formal job titles. Consider the soft skills you’ve developed – communication, leadership, problem-solving, organisation, creativity.

- Make a List: Grab a pen and paper and start brainstorming. List all your previous jobs, responsibilities, and accomplishments.

- Identify Transferable Skills: For each item on your list, identify the underlying skills you used. For example, if you managed a team, you have leadership, communication, and organisational skills. If you wrote reports, you have writing and analytical skills.

- Consider Your Hobbies and Interests: What do you enjoy doing in your spare time? Are you a keen gardener, a talented baker, a tech enthusiast, a bookworm? Often, passions can be monetised.

- Ask for Feedback: Talk to friends, family, and former colleagues. What do they see as your strengths? What are you known for? Sometimes, others can identify skills you might take for granted.

Matching Your Skills and Interests to Potential Side Hustles

Once you have a good understanding of your skills and interests, start thinking about how they could translate into a side hustle. Here are some examples to get your creative juices flowing:

- The Seasoned Professional: If you have decades of experience in finance, marketing, HR, or project management, consulting or coaching could be a natural fit. You can offer your expertise to businesses or individuals on a flexible basis.

- The Wordsmith: If you have a knack for writing, consider freelance writing, editing, proofreading, or even writing and self-publishing eBooks on topics you know well.

- The Creative Soul: If you enjoy crafting, painting, knitting, or making jewelry, platforms like Etsy or local craft fairs offer avenues to sell your creations. You could also teach workshops or create online tutorials.

- The Tech Whiz: If you’re comfortable with technology, you could offer services like website design, social media management, tech support, or online tutoring in specific software or skills.

- The Green Thumb: If you love gardening, you could offer gardening services, sell plants or produce, or even run workshops on gardening techniques.

- The Knowledge Sharer: If you have expertise in a particular subject, creating and selling online courses or offering personalised tutoring can be rewarding and profitable.

- The Connector: If you’re a natural networker, affiliate marketing or becoming a virtual assistant connecting businesses with resources could be a good option.

- The Local Helper: If you enjoy helping others in your community, consider offering services like pet sitting, dog walking, handyman tasks, or running errands for busy individuals.

Brainstorming Techniques to Spark Ideas

If you’re feeling stuck, try these brainstorming techniques:

- Mind Mapping: Start with “Side Hustle” in the centre of a page and branch out with related ideas – your skills, your interests, problems you could solve, potential target audiences.

- Problem/Solution: Think about common problems people face in your community or online. Could you offer a service or product that solves one of these problems?

- Trend Analysis: Research current trends in online businesses and see if any align with your interests and skills.

- “What If?” Scenarios: Ask yourself “What if I could get paid to… [insert your hobby/skill here]?”

- Combine Interests: Could you combine two or more of your interests into a unique side hustle? For example, if you love photography and local history, you could offer historical photo tours.

Evaluating Your Side Hustle Ideas

Once you have a list of potential side hustles, it’s time to evaluate them based on several factors:

- Viability: Is there a demand for what you’re offering? Are people willing to pay for it?

- Profitability: Can you realistically earn a decent income from this venture, considering your time and effort?

- Sustainability: Can you maintain this side hustle in the long term, given your energy levels and other commitments?

- Enjoyment: Will you actually enjoy doing this? A side hustle should be fulfilling, not just a source of income.

- Startup Costs: What initial investment will be required in terms of time, money, and resources?

- Flexibility: Does the side hustle offer the flexibility you need in your semi-retirement lifestyle?

- Learning Curve: Are you willing to learn new skills that might be required to run this venture?

Choosing the Right Fit

There’s no right or wrong answer when it comes to choosing a side hustle. The best one for you will be the one that aligns with your individual circumstances, goals, and preferences. Don’t be afraid to experiment and try different things. Your first idea might not be the perfect one, and that’s okay. The key is to start exploring and taking action.

Part 4: Laying the Foundations – Practical Steps to Launch Your Side Hustle

You’ve got an idea. Now it’s time to turn that idea into a reality. This section will guide you through the practical steps involved in launching your side hustle.

1. Define Your Offering and Target Audience:

- Be Specific: Don’t just say “I’ll offer consulting.” What kind of consulting? Who will you be consulting for? The more specific you are, the easier it will be to market your services.

- Identify Your Ideal Client: Who are you trying to reach? What are their needs and pain points? Understanding your target audience will help you tailor your offering and marketing efforts.

- Determine Your Unique Selling Proposition (USP): What makes your side hustle different or better than others? What unique value do you offer?

2. Develop a Basic Business Plan:

You don’t need a complex, formal business plan, but it’s helpful to outline some key aspects:

- Your Offering: Clearly define the products or services you will provide.

- Your Target Market: Who are your ideal customers or clients?

- Your Pricing Strategy: How will you price your products or services? Research what others in your niche are charging.

- Your Marketing and Sales Strategy: How will you reach your target audience and attract customers?

- Your Financial Projections (Basic): Estimate your potential income and expenses.

- Your Legal Structure (Sole Trader, etc.): Understand the basic legal requirements for your chosen business structure in the UK.

3. Set Up Your Online Presence (if applicable):

In today’s digital age, having some form of online presence is often essential, even for local service-based businesses.

- Website: A simple website or even a dedicated page on a platform like LinkedIn can lend credibility and make it easier for potential customers to find you.

- Domain Name and Hosting: Choose a memorable and relevant domain name and a reliable hosting provider.

- Website Builder: User-friendly platforms like WordPress, Wix, or Squarespace make it relatively easy to build a professional-looking website even without extensive technical skills.

- Content: Create clear and concise content that explains your offering, highlights your expertise, and provides contact information.

- Social Media: Determine which social media platforms your target audience uses and establish a presence there. Share valuable content and engage with potential customers.

4. Handle the Legal and Administrative Aspects:

While you’re not necessarily building a large corporation, it’s important to take care of the basic legal and administrative requirements:

- Inform HMRC: Depending on your earnings, you may need to register as self-employed with HMRC (Her Majesty’s Revenue and Customs). Familiarise yourself with your tax obligations.

- Business Insurance: Consider whether you need any form of business insurance, depending on the nature of your side hustle (e.g., public liability insurance if you’re working with clients in person).

- Data Protection (if applicable): If you’re handling personal data, ensure you comply with UK data protection regulations (GDPR).

- Banking: Consider opening a separate bank account for your side hustle to keep your business finances separate from your personal accounts.

5. Market Your Side Hustle Effectively:

Having a great offering is only half the battle; you need to let people know about it.

- Networking: Leverage your existing network of contacts. Let friends, family, and former colleagues know about your new venture.

- Online Marketing:

- Search Engine Optimisation (SEO): Optimise your website and online content so that it appears in search results when people search for relevant terms.

- Social Media Marketing: Share engaging content on social media to attract and connect with your target audience.

- Email Marketing: Build an email list and send out regular newsletters or updates to keep your audience informed.

- Online Advertising: Consider paid advertising options like Google Ads or social media ads to reach a wider audience.

- Offline Marketing (if applicable):

- Local Networking: Attend local business events or community gatherings.

- Flyers and Business Cards: Distribute these in relevant locations.

- Word-of-Mouth: Encourage satisfied customers to spread the word.

6. Manage Your Time and Energy Wisely:

Remember, this is a side hustle in semi-retirement. It shouldn’t become a source of stress or overwhelm.

- Set Realistic Goals: Don’t expect to become a millionaire overnight. Start with achievable goals and gradually scale up as you feel comfortable.

- Schedule Dedicated Time: Allocate specific times for working on your side hustle, just as you would for any other important commitment.

- Prioritise Tasks: Focus on the most important and impactful tasks first.

- Learn to Delegate (if possible): As your side hustle grows, consider whether you can outsource certain tasks to free up your time.

- Take Breaks and Avoid Burnout: Ensure you’re still enjoying your semi-retirement. Don’t let your side hustle consume all your time and energy.

7. Track Your Progress and Adapt:

Monitor your income, expenses, and the effectiveness of your marketing efforts. Be prepared to adapt your approach based on what’s working and what’s not.

- Use Tracking Tools: Utilise spreadsheets or accounting software to keep track of your finances.

- Analyse Your Results: Regularly review your website traffic, social media engagement, and sales data.

- Seek Feedback: Ask your customers or clients for feedback on your products or services.

- Be Willing to Pivot: If something isn’t working, don’t be afraid to change your strategy or even your offering.

CheeringUp.info Examples of Resources and Services to Support Your Side Hustle:

CheeringUp.info is committed to empowering individuals over 55 to lead fulfilling and financially secure lives. Here are some examples of resources and services you might find helpful as you embark on your side hustle journey:

- Online Courses and Workshops: Access curated or in-house developed courses on topics like starting a small online business, social media for beginners, basic website creation, and freelancing essentials.

- Mentorship Programmes: Connect with experienced entrepreneurs or individuals who have successfully launched side hustles in later life for guidance and support.

- Community Forums: Join online forums where you can connect with other aspiring and current side hustlers over 55, share experiences, ask questions, and find encouragement.

- Resource Library: Access a library of helpful articles, guides, and templates on topics like business planning, marketing, legal considerations, and time management for side hustlers.

- Directory of UK-Specific Business Support Organisations: Find links and information for organisations in the UK that offer support and advice to small businesses and startups.

- Financial Planning Resources: Access tools and information to help you integrate your side hustle income into your overall financial plan and manage your wealth effectively in semi-retirement.

- Technology Tutorials: Step-by-step guides and tutorials on using various online tools and platforms relevant to running a side hustle.

- Mindset and Motivation Resources: Articles and tips to help you overcome challenges, stay motivated, and maintain a positive mindset throughout your entrepreneurial journey.

- Success Stories: Read inspiring stories of other individuals over 55 in the UK who have successfully launched and grown their side hustles.

Part 5: Growing and Sustaining Your Side Hustle for Long-Term Lifestyle Improvement

You’ve launched your side hustle! Congratulations! But the journey doesn’t end there. To truly enhance your lifestyle in semi-retirement, you’ll want to focus on growth and sustainability.

Strategies for Growth:

- Upselling and Cross-selling: Offer additional products or services to your existing customers or clients.

- Building Relationships: Cultivate strong relationships with your customers. Loyal customers are more likely to make repeat purchases and refer others.

- Seeking Testimonials and Reviews: Positive feedback can significantly boost your credibility and attract new customers.

- Expanding Your Reach: Explore new marketing channels and target new customer segments.

- Collaborations and Partnerships: Partner with other businesses or individuals in complementary niches.

- Continuous Learning: Stay updated on industry trends and seek opportunities to improve your skills and knowledge.

- Investing in Your Business (wisely): Reinvest a portion of your profits back into your side hustle to fuel further growth (e.g., upgrading your website, investing in marketing tools).

Ensuring Sustainability:

- Streamlining Your Processes: Look for ways to automate or simplify your workflows to save time and energy.

- Managing Your Finances Effectively: Track your income and expenses carefully and ensure your pricing remains profitable.

- Maintaining a Healthy Work-Life Balance: Don’t let your side hustle take over your life. Prioritise your well-being and make time for other activities you enjoy.

- Adapting to Change: The business landscape is constantly evolving. Be prepared to adapt your strategies and offerings as needed.

- Building a Support Network: Connect with other entrepreneurs or mentors for ongoing support and advice.

- Reviewing Your Goals Regularly: Periodically revisit your initial goals for your side hustle and make adjustments as your circumstances or priorities change.

Wealth Management Considerations:

As your side hustle generates income, it’s important to integrate this into your overall wealth management strategy. Consider:

- Tax Planning: Understand how your side hustle income will be taxed and plan accordingly to minimise your tax liability. Seek advice from a tax professional if needed.

- Savings and Investments: Consider reinvesting some of your side hustle income or adding it to your existing savings and investment portfolio.

- Pension Contributions: Depending on your circumstances, you might be able to make additional contributions to your pension.

- Estate Planning: Ensure your estate plan takes into account your side hustle and any assets associated with it.

The Long-Term Vision: A Fulfilling and Secure Semi-Retirement

Your side hustle isn’t just about making ends meet; it’s about creating a richer, more fulfilling, and more secure semi-retirement. It’s about:

- Maintaining Independence: Having greater control over your finances and reducing reliance on fixed income alone.

- Staying Engaged and Active: Keeping your mind and body active through meaningful work and social interaction.

- Pursuing Your Passions: Turning your hobbies and interests into income-generating activities.

- Leaving a Legacy: Potentially building something that can be passed on or sold in the future.

- Living Life on Your Own Terms: Having the financial flexibility to pursue your dreams and enjoy your later years to the fullest.

Final Thoughts: Embracing the Possibilities

The rising cost of living in the UK presents a significant challenge for those in or approaching retirement. However, it also presents an opportunity – an opportunity to reimagine what later life can look like. By embracing the power of a side hustle, you can take control of your financial future, reignite your passions, and build a semi-retirement that is not just comfortable, but truly vibrant and fulfilling.

You have a wealth of experience, valuable skills, and a lifetime of knowledge to draw upon. The digital age offers unprecedented opportunities to connect with customers and build a business on your own terms. It won’t always be easy, but with careful planning, consistent effort, and a positive mindset, you can create a side hustle that not only boosts your income but also enriches your life in countless ways.

Don’t let the headlines define your retirement. Take action, explore your potential, and build the future you deserve. Your golden years can still be truly golden.

Remember, resources and support are available. Websites like CheeringUp.info are here to provide guidance and connect you with the tools and community you need to succeed. The journey to a better semi-retirement starts now. Embrace it!

Extra Bonus For This eBook Purchase

Your purchase of this eBook entitles you to a free place in our Retirement Marketplace to promote your side hustle idea for free!

Join our Retirement Club

Target your marketing and advertising at over 55s UK for business growth

Find out more about Retirement Club Corporate Membership for business growth solutions

Subscribe for free retirement lifestyle improvement tips reviews and money saving ideas

Connect with us for free retirement lifestyle improvement tips

Read more retirement lifestyle improvement articles and view videos for free

Connect with us for free retirement lifestyle improvement articles and video alerts

UK cost of living squeezing your retirement? Discover how to launch a PROFITABLE online side hustle! This eBook provides actionable steps & inspiring ideas for the over 55s in semi-retirement to boost income & live better. Unlock your potential & thrive! #UKRetirementSideHustle #Over55BizUK

Reclaim your retirement! Learn to create a fulfilling & financially rewarding online side business in the UK. Tailored for the over 55s in semi-retirement, this eBook offers practical guidance & real-world examples. Start your journey today! #SideHustleUK #LaterLifeBizUK

Tired of rising costs? This essential UK eBook shows over 55s in semi-retirement how to generate extra income with online side hustles. Easy-to-follow strategies for financial freedom & a better lifestyle. Get your copy now! #BoostYourPensionUK #UKOver55s

Profitable online side hustles for UK seniors in semi-retirement. Learn how to start & succeed! Actionable advice & inspiring stories for the over 55s. Take control of your finances. #UKRetirement #SideHustle

Don’t let the UK cost of living dim your retirement dreams! This eBook empowers the over 55s in semi-retirement to launch profitable online side ventures. Discover flexible opportunities, leverage your skills & boost your income. Your guide to a better later life starts here. #Over55SideHustle #SemiRetirementIncome

Read more view more:

- Best side hustle ideas for UK retirees over 55 to boost income

- How to start a profitable online side business UK for seniors in semi retirement

- Flexible part time work from home for over 55s UK to supplement pension

- Easy to start low cost side hustles UK for over 55s with no experience

- UK side hustle opportunities for retired professionals leveraging skills and experience

Relevant hashtags:

- #UKRetirementSideHustle

- #Over55SideHustleUK

- #SemiRetirementIncomeUK

- #LaterLifeBizUK

- #BoostYourPensionUK

How to start a profitable online side business UK for seniors in semi retirement eBook