Imagine waking up one day with the news that you have only six months left to live. While this may seem like a daunting thought, it can also serve as a powerful catalyst for seizing the present moment and making the most out of life. Even if this scenario isn’t a reality, adopting the mindset of living as if you only have six months left can inspire you to prioritise what truly matters and embrace life with renewed vigour and intentionality. In this article, we’ll explore 24 actionable things to do now if you thought you only had six months to live, reminding you to cherish each day and live with purpose and passion.

Carpe Diem: 24 Things to Do Now If You Thought You Only Had 6 Months to Live

- Express Gratitude Daily Start each day by expressing gratitude for the blessings in your life. Take a moment to appreciate the people, experiences, and opportunities that enrich your existence, fostering a sense of abundance and joy.

- Tell Your Loved Ones You Love Them Don’t wait for a special occasion to express your love and appreciation to those who matter most. Reach out to your family and friends regularly, letting them know how much they mean to you and how grateful you are for their presence in your life.

- Forgive and Seek Forgiveness Release any lingering resentment or grudges, and forgive those who have wronged you. Similarly, seek forgiveness from those you may have hurt or wronged in the past, fostering healing and reconciliation in your relationships.

- Embrace New Experiences Step out of your comfort zone and embrace new experiences that ignite your passion and curiosity. Whether it’s travelling to a new destination, trying a new hobby, or learning a new skill, embrace the adventure of life with an open heart and mind.

- Spend Quality Time with Loved Ones Prioritise quality time with your loved ones, creating lasting memories and deepening your connections. Whether it’s sharing a meal, going for a walk, or simply having heartfelt conversations, cherish the moments you have together.

- Live in the Present Moment Practice mindfulness and presence, savouring the beauty and richness of each moment. Let go of worries about the past or future, and fully immerse yourself in the here and now, embracing life’s precious moments as they unfold.

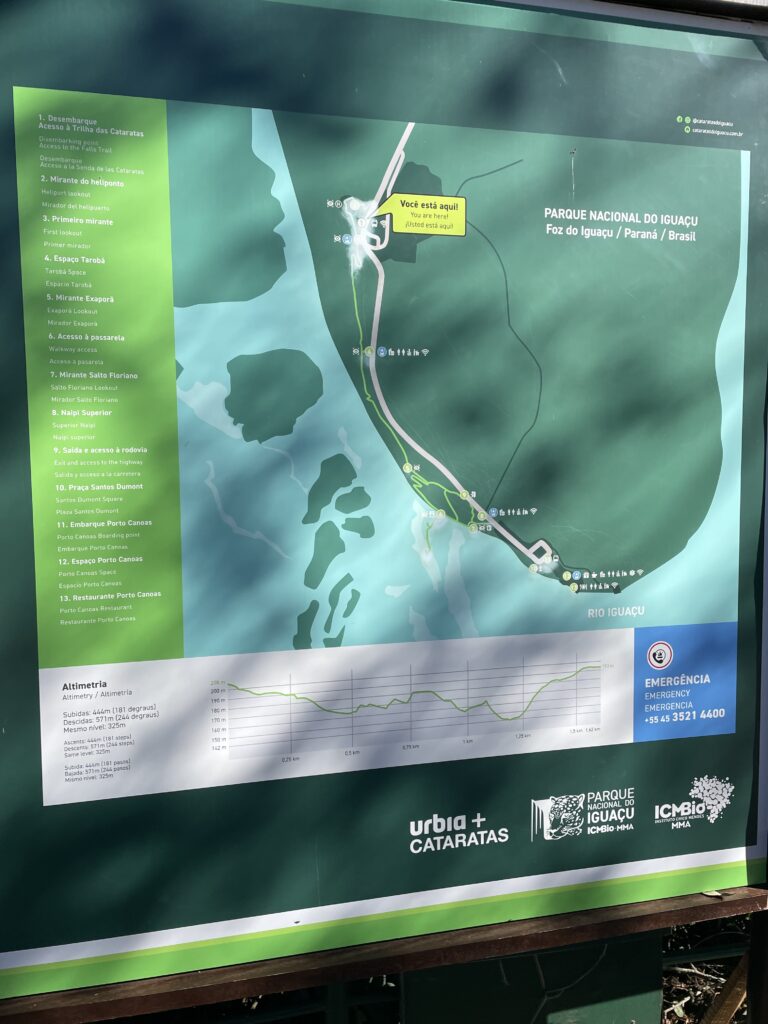

- Travel to Your Dream Destination If there’s a destination you’ve always dreamed of visiting, don’t wait any longer—make plans to travel there now. Whether it’s exploring exotic landscapes, immersing yourself in different cultures, or simply relaxing on a beach, seize the opportunity to fulfill your wanderlust.

- Write Letters of Appreciation Take the time to write heartfelt letters of appreciation to the people who have made a significant impact on your life. Express your gratitude, admiration, and love in words, leaving behind a meaningful legacy of kindness and appreciation.

- Create a Bucket List Compile a bucket list of all the experiences and achievements you want to fulfill in your lifetime. Whether it’s skydiving, running a marathon, or writing a book, document your dreams and aspirations, and take steps to turn them into reality.

- Make Amends with Yourself Forgive yourself for past mistakes or regrets, and let go of self-judgment and criticism. Embrace self-compassion and acceptance, recognising that you are worthy of love and forgiveness, just as you are.

- Spend Time in Nature Reconnect with the natural world by spending time outdoors, soaking in the beauty and tranquility of nature. Whether it’s going for a hike, camping under the stars, or simply taking a walk in the park, immerse yourself in the healing power of the great outdoors.

- Volunteer and Give Back Make a difference in the lives of others by volunteering your time and talents to causes you’re passionate about. Whether it’s serving meals at a homeless shelter, mentoring at-risk youth, or participating in environmental clean-up efforts, find ways to give back to your community and make a positive impact.

- Document Your Legacy Take the time to document your life story, memories, and reflections in writing or through multimedia. Create a legacy that future generations can cherish, preserving your wisdom, experiences, and values for years to come.

- Practice Random Acts of Kindness Spread kindness and positivity wherever you go by performing random acts of kindness for others. Whether it’s paying for someone’s coffee, offering a helping hand to a stranger, or leaving encouraging notes in public places, embrace the power of kindness to brighten someone’s day.

- Learn Something New Every Day Cultivate a curious and inquisitive mindset by committing to lifelong learning and personal growth. Challenge yourself to learn something new every day, whether it’s a new language, a musical instrument, or a fascinating tidbit of trivia, expanding your knowledge and horizons.

- Savour the Simple Pleasures Slow down and savour the simple pleasures of life, finding joy and beauty in everyday moments. Whether it’s enjoying a cup of coffee, watching the sunrise, or snuggling up with a good book, appreciate the little things that bring happiness and fulfillment.

- Take Care of Your Health Prioritise your physical and mental health by adopting healthy lifestyle habits that nourish your body and mind. Eat a balanced diet, exercise regularly, get plenty of rest, and practice stress management techniques to support your overall well-being.

- Let Go of Fear and Doubt Release fears and doubts that hold you back from living life to the fullest. Trust in your abilities and embrace uncertainty with courage and resilience, knowing that growth and transformation often lie on the other side of fear.

- Live Authentically and Unapologetically Be true to yourself and live authentically, embracing your unique quirks, passions, and values. Let go of societal expectations and judgments, and cultivate the courage to live life on your own terms, unapologetically and boldly.

- Create Meaningful Traditions Establish meaningful traditions and rituals that bring joy, connection, and meaning to your life. Whether it’s celebrating holidays, honoring milestones, or simply spending time together as a family, create rituals that foster a sense of belonging and continuity.

- Practice Radical Self-Acceptance Embrace yourself exactly as you are, flaws and all, with radical self-acceptance and self-love. Let go of the need for external validation and embrace your inherent worthiness, knowing that you are enough just as you are.

- Make Time for Play and Creativity Nurture your inner child and unleash your creativity by making time for play and artistic expression. Engage in activities that bring you joy and inspiration, whether it’s painting, dancing, singing, or playing a sport, reconnecting with the playful spirit within you.

- Celebrate Your Achievements Celebrate your achievements, no matter how big or small, and acknowledge the progress you’ve made on your journey. Take pride in your accomplishments and use them as fuel to propel you forward towards even greater heights.

- Live with No Regrets Finally, live each day with no regrets, knowing that you’ve lived fully and authentically. Embrace each experience, whether it’s joyful or challenging, as a valuable lesson and opportunity for growth. Approach life with a sense of adventure and curiosity, making the most out of every moment you have.

Conclusion:

Adopting the mindset of living as if you only have six months left can be a powerful catalyst for transformation and growth. By embracing gratitude, connection, and authenticity, you can create a life filled with purpose, passion, and fulfillment. Seize the present moment, cherish the people you love, and pursue your dreams with unwavering determination and enthusiasm. Remember, the time to live the life of your dreams is now—don’t wait for tomorrow, for tomorrow is never guaranteed. Carpe diem—seize the day—and make every moment count.

So, go ahead—start living your best life now, as if you only have six months left. You’ll be amazed at the joy, fulfillment, and abundance that awaits you when you embrace each day with open arms and a grateful heart.