15 Transformative Steps to Reinvent Yourself After 55 in the UK

Reinventing oneself is not exclusive to any age group; it’s a journey of continuous growth and self-discovery. However, for individuals over 55 in the UK, embarking on this journey can be particularly empowering and liberating. Whether driven by a desire for personal fulfillment, a career change, or simply a new chapter in life, reinvention offers endless possibilities. Here are 15 transformative steps to help you reinvent yourself after 55 in the UK.

- Reflect on Your Passions and Strengths: Take time to reflect on what truly ignites your passion and what you excel at. Consider your hobbies, past experiences, and skills acquired over the years. Identifying your strengths will lay the foundation for your reinvention journey.

- Set Clear Goals: Define specific, achievable goals that align with your passions and strengths. Whether it’s starting a new business, pursuing further education, or exploring a creative endeavour, clarity in your objectives will guide your reinvention process.

- Embrace Lifelong Learning: In today’s fast-paced world, continuous learning is key to staying relevant and adaptable. Explore educational opportunities such as online courses, workshops, or even pursuing a degree in a field of interest. Lifelong learning not only enhances your skills but also keeps your mind sharp and engaged.

- Network and Seek Mentors: Surround yourself with individuals who inspire and support your reinvention journey. Networking events, industry seminars, and online communities are great places to connect with like-minded individuals and potential mentors who can offer guidance and valuable insights.

- Embrace Technology: Embrace technology as a tool to facilitate your reinvention efforts. From building an online presence to learning new digital skills, technology opens up a world of opportunities for career transitions, networking, and personal growth.

- Explore Flexible Work Arrangements: With the rise of remote work and flexible schedules, explore opportunities that allow you to balance work with other passions and interests. Consider freelancing, consulting, or part-time roles that offer flexibility and autonomy.

- Cultivate Resilience: Reinvention often involves stepping out of your comfort zone and facing challenges along the way. Cultivate resilience by embracing failure as a learning opportunity, practicing self-care, and maintaining a positive mindset even in the face of setbacks.

- Volunteer and Give Back: Engage in volunteer work or community service as a way to contribute to society while exploring new interests and passions. Not only does volunteering provide a sense of fulfillment, but it also expands your social network and exposes you to new experiences.

- Prioritise Health and Wellness: Investing in your physical and mental well-being is essential for a successful reinvention journey. Prioritise regular exercise, healthy eating, and stress management techniques such as meditation or mindfulness to ensure you have the energy and resilience to pursue your goals.

- Embrace Creativity: Tap into your creative side and explore artistic endeavours such as painting, writing, or music. Creativity not only fosters self-expression but also stimulates innovation and problem-solving skills, essential qualities for reinvention.

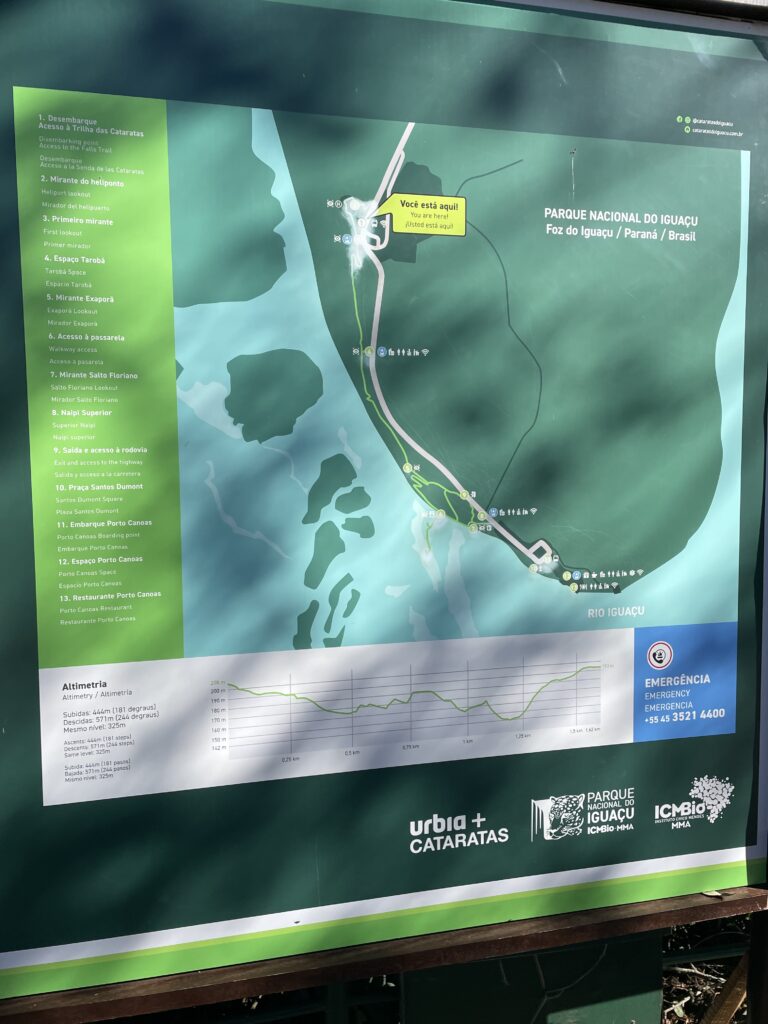

- Travel and Explore New Cultures: Travelling provides an opportunity to gain new perspectives, broaden your horizons, and immerse yourself in different cultures. Whether it’s a solo adventure or group tour, travelling can inspire creativity, spark new interests, and fuel your reinvention journey.

- Stay Curious and Open-Minded: Approach life with a curious and open-minded attitude, embracing new experiences and opportunities as they arise. Be willing to challenge assumptions, explore unconventional paths, and adapt to changing circumstances on your journey of reinvention.

- Seek Professional Guidance: Consider seeking guidance from career coaches, counsellors, or therapists who specialise in midlife transitions. Professional support can provide valuable insights, clarity, and accountability as you navigate the complexities of reinvention.

- Celebrate Progress and Milestones: Celebrate your achievements, no matter how small, and acknowledge the progress you’ve made on your reinvention journey. Take time to reflect on your accomplishments, learn from your experiences, and recalibrate your goals as needed.

- Stay Connected to Your Purpose: Throughout your reinvention journey, stay connected to your core values and sense of purpose. Align your goals and actions with what truly matters to you, and let your passion and purpose drive your continued growth and transformation.

Reinventing yourself after 55 in the UK is an opportunity to embrace new beginnings, explore untapped potential, and create a life that aligns with your passions and aspirations. By reflecting on your strengths, setting clear goals, and embracing lifelong learning, you can embark on a transformative journey of self-discovery and personal growth. With resilience, curiosity, and an open mind, the possibilities for reinvention are endless, allowing you to write the next chapter of your life with confidence and purpose.