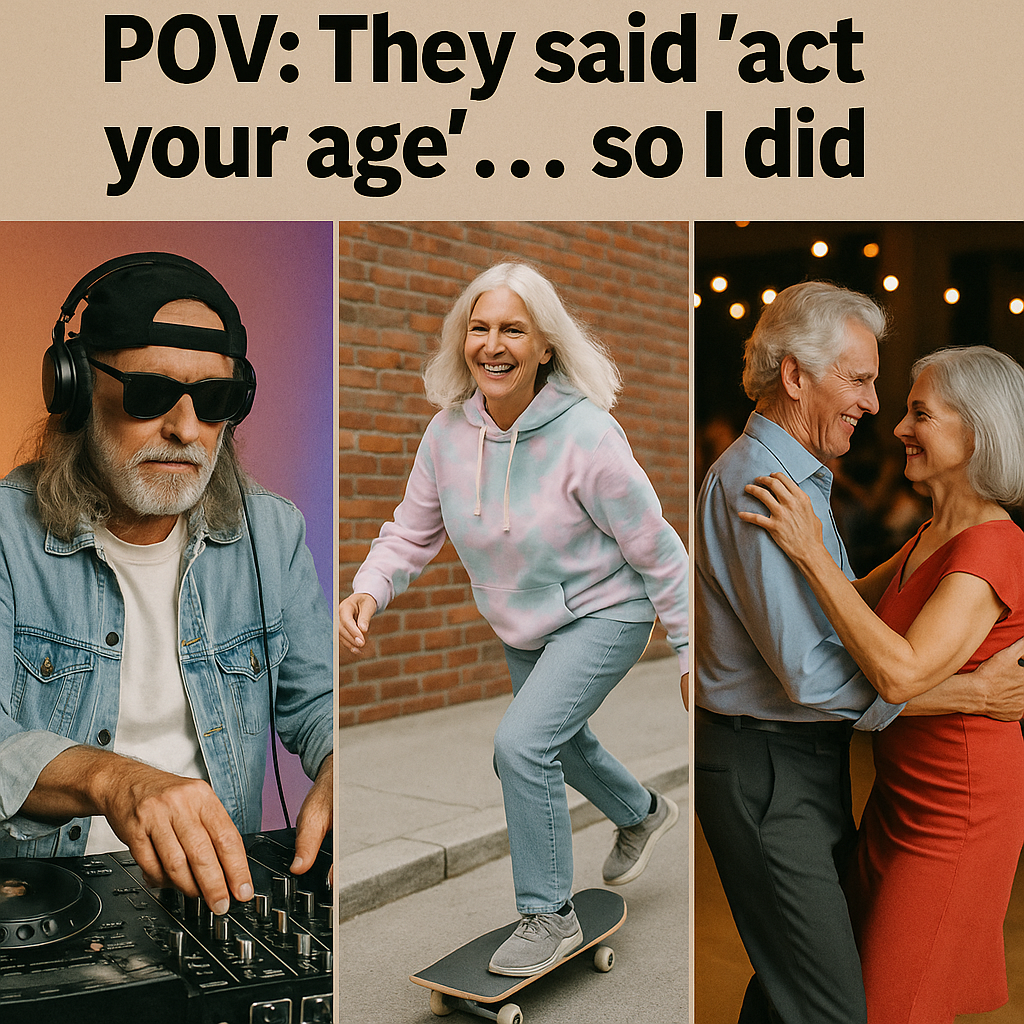

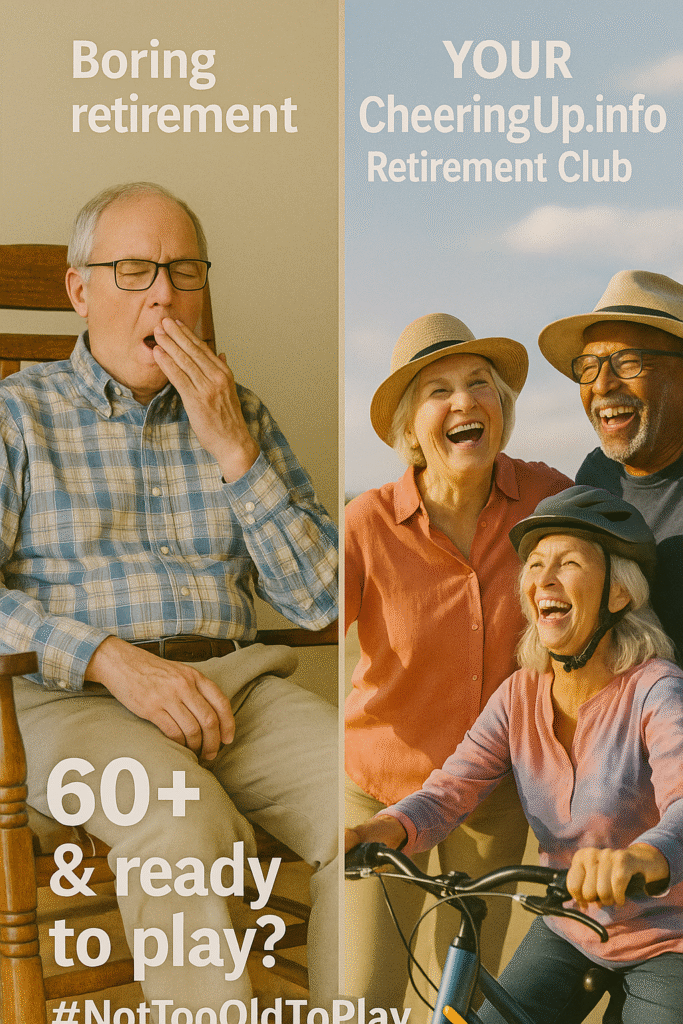

“We don’t stop playing because we grow old; we grow old because we stop playing.” George Bernard Shaw nailed it. Yet somewhere along the way, society decided that playtime ends with retirement. Nonsense. The most vibrant 60-somethings I know aren’t the ones who’ve perfected their golf swing—they’re the ones still trying new things, laughing loudly, and occasionally embarrassing their grandchildren.

Lifestyle tips that work in the UK

Here’s the truth: joy is a choice, not an accident. And the science backs it up. A 2022 University College London study found that adults over 60 who regularly engage in playful activities—whether dancing, painting, or even video games—report 37% lower stress levels and a 23% reduced risk of cognitive decline. Play isn’t frivolous; it’s a survival tool.

But let’s get controversial: If you’re bored in your 60s, you’re doing it wrong. This isn’t about “staying young” — it’s about refusing to let life shrink. The happiest retirees aren’t the ones with the biggest pensions; they’re the ones who still take risks. They join improv classes. They backpack through Portugal. They start podcasts. They flirt. (Yes, really.)

Here’s your challenge: Swap one hour of TV tonight for something that makes you feel alive. Call an old friend and reminisce. Try a salsa lesson. Write that ridiculous novel. The magnetic energy of play doesn’t just make you happier — it makes you interesting. And isn’t that the ultimate rebellion against aging?

Now, let’s dive into how you can engineer more play into your life — because the best time to start is today.

(Article continues…)

Experiencing The Joy Of Your 60s: You’re Not Too Old To Play!

Why You Should Read This Article

If you’re in your 60s (or beyond) and feel like life has become predictable, this article is your wake-up call. Retirement isn’t an ending — it’s a launchpad. The happiest, healthiest retirees don’t just “pass the time”—they design their days around curiosity, connection, and yes, play.

Here’s what you’ll gain by reading:

✅ Science-backed proof that playfulness boosts longevity, brain health, and happiness.

✅ Actionable strategies to inject more joy into daily life — no big budget or extreme effort required.

✅ Inspiring real-life stories of people in their 60s and 70s who are traveling, starting businesses, falling in love, and reinventing themselves.

✅ A roadmap to combat isolation—because loneliness is a silent killer, and play is the antidote.

✅ Exclusive access to the CheeringUp.info Retirement Club — a thriving UK community who refuse to slow down.

If you’re ready to make your 60s the most vibrant decade yet, keep reading.

Section 1: The Science of Play — Why Your Brain & Body Need It More Than Ever

The Shocking Truth: Play Isn’t Just for Kids

A 2023 Cambridge study found that adults over 60 who engage in regular playful activities (dancing, board games, creative hobbies) have:

✔ 31% lower risk of dementia

✔ Stronger social connections (reducing depression risk by 40%)

✔ Better physical mobility (playful movement beats rigid exercise routines)

But here’s the problem: Society tells us that “grown-ups” should be serious. Retirement becomes about resting—not living. That’s a mistake.

Actionable Strategy #1: The “Play Audit”

Ask yourself:

- When was the last time I did something just for fun?

- What did I love as a child that I’ve abandoned? (Drawing? Cycling? Storytelling?)

- What’s one thing I’ve always wanted to try but thought, “I’m too old for that”?

Your assignment: This week, reintroduce one playful activity. It could be:

- Joining a local ukulele group (they’re everywhere, and no experience needed!)

- Taking a stand-up comedy workshop (laughter is the best anti-aging serum)

- Playing tourist in your own city (pretend you’re visiting for the first time)

Play isn’t a luxury—it’s a necessity.

Section 2: How to Build a Play-Filled Retirement (Even If You’re on a Budget)

“I Don’t Have Time/Money/Energy for This” – Debunked

Excuses are the enemy of joy. You don’t need:

🚫 A luxury cruise

🚫 A gym membership

🚫 Endless free time

You just need willingness.

Actionable Strategy #2: The “Micro-Play” Method

Small bursts of playfulness add up. Try:

- Morning dance party (One song. No skill required.)

- Storytelling at the pub (Strike up a conversation with a stranger—people love a good tale.)

- Gaming apps (Words With Friends keeps your brain sharp and connects you with others.)

Pro Tip: If you’re hesitant, start with CheeringUp.info’s “30-Day Play Challenge”—a free guide to rediscovering joy in small, daily doses.

Section 3: The Social Power of Play—How to Never Feel Lonely Again

Isolation is a Choice (And Play is the Cure)

A staggering 1.4 million older Brits report chronic loneliness. But here’s the good news: Playful people attract friends effortlessly.

Actionable Strategy #3: The “Play Magnet” Technique

Want to build instant connections? Do something slightly silly in public:

- Wear a hat that sparks conversation (A pirate hat? Why not?)

- Host a “bring your worst joke” coffee morning

- Join a theatre group (Many need older actors — no experience necessary!)

The secret? People are drawn to those who radiate joy.

Section 4: Love, Dating & Playfulness (Yes, It’s Possible After 60!)

“Dating at My Age? Ridiculous.” – Wrong.

The fastest-growing demographic on Tinder? People over 60.

Actionable Strategy #4: Flirt Like Nobody’s Watching

- Take a salsa class (physical touch + laughter = chemistry)

- Try speed dating (it’s less intimidating than you think)

- Use playful openers (“If we were stranded on a desert island, what’s the one book you’d bring?”)

Love isn’t just for the young—it’s for the young at heart.

Join the CheeringUp.info Retirement Club—Your Playful Tribe Awaits!

Why Join?

✔ Exclusive events (adventure trips, comedy nights, skill-swapping meetups)

✔ A supportive community of like-minded, fun-loving over-60s

✔ Business opportunities (Monetise your passion! We help retirees launch small ventures.)

Call to Action (For Individuals)

🚀 Click here to join now → Retirement Club

“Life begins at 60—if you let it.”

Call to Action (For Businesses Targeting Over-60s)

💡 Partner with us! The over-60s market is worth £320 billion in the UK. We help brands connect with this vibrant audience.

📩 Email us: editor@cheeringup.info

Final Thought: Your 60s Are What You Make Them

The clock is ticking — but not in the way you think. Every day is a chance to play harder, connect deeper, and live louder.

So, what’s your next move?

Join our Retirement Club with one-off lifetime fee

Protect and grow your business with Retirement Club Corporate Business Membership

Subscribe for free retirement lifestyle improvement tips reviews and money saving ideas

Connect with us for retirement lifestyle improvement tips cost effectively

Read more retirement lifestyle improvement articles and videos

Connect with us for free retirement lifestyle improvement articles and videos

- Best ways to stay playful and active after 60 UK

- How to combat loneliness after 60 with fun activities

- Retirement hobbies for over 60s to boost happiness

- Why playfulness makes you age better in your 60s

- Marketing to over 60s UK: Why playful retirees spend more

- Combat Loneliness After 60 With These 7 Playful Social Activities

- Discover why playfulness is the secret to ageing better after 60

- Is play important after 60?

Relevant Hashtags:

1. #NotTooOldToPlay

2. #60AndThriving

3. #PlayMoreAgeLess

4. #RetirementRebels

5. #UKSilverSquad

#GreyHairDontCare #LaterLifeJoy

“Who says playtime ends at 60? Join the #RetirementRebels rewriting the rules → Retirement Club”

Best ways to stay playful and active after 60 UK