The hum of anxiety, the quiet dread. It’s a feeling many know too well. The UK job market in 2025 is a landscape of shifting sands. You feel it, don’t you? “Better the devil you know,” they say. But what if the devil you know is slowly draining your life? Consider this: a recent study found that 72% of professionals are experiencing increased job-related stress due to economic uncertainty. That’s a staggering number. It’s not just about a paycheck. It’s about your life. It’s about your happiness, your health, your very well-being. Are you trading your potential for the illusion of stability? I know I’ve been there. Let’s explore how to break free. Let’s talk about the opportunity cost of staying put. Let’s talk about building a life you love. Welcome to your guide to navigating the 2025 UK job market and reclaiming your potential.

Are You Staying in Your Job Because of Uncertainty in the Marketplace?

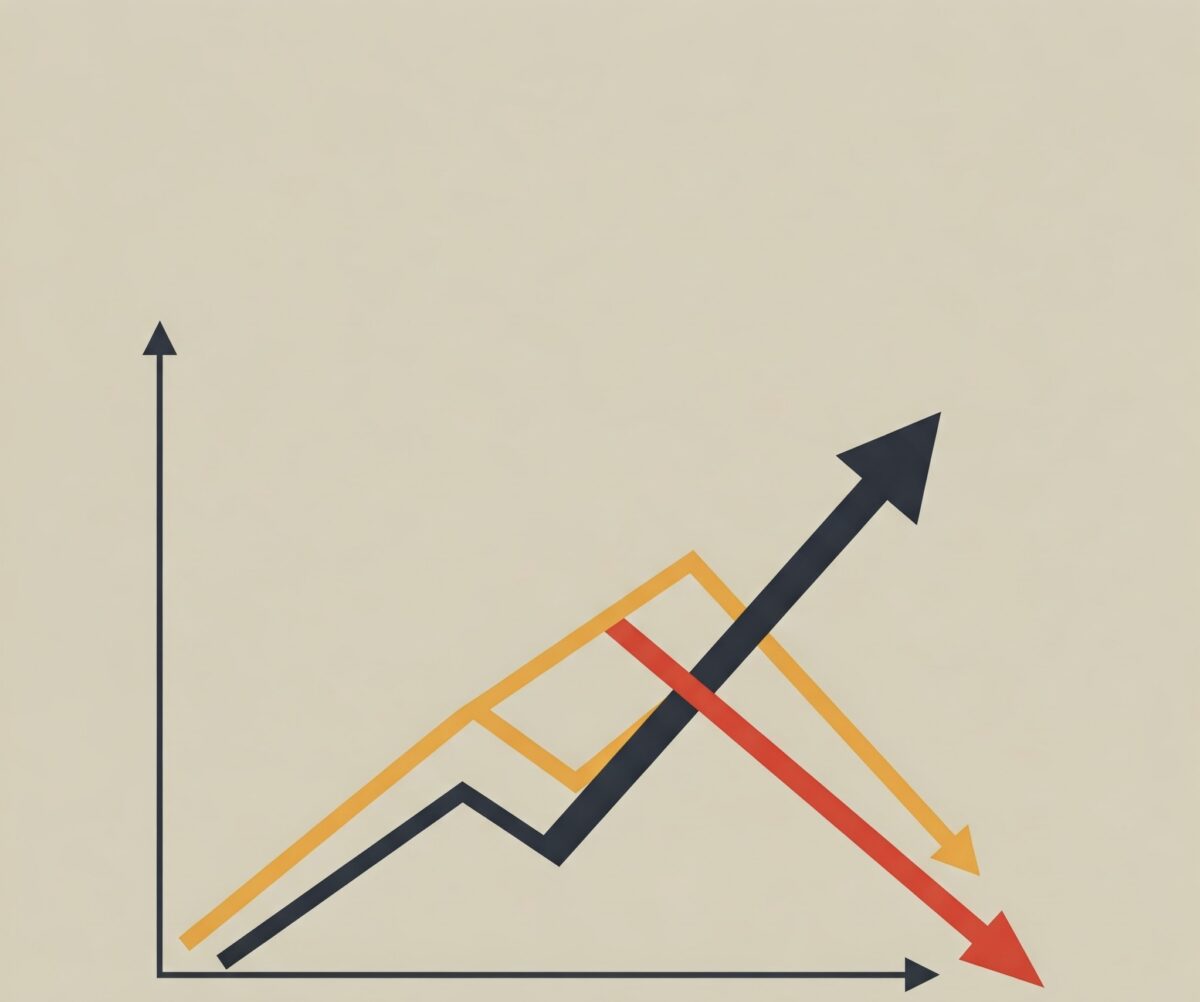

The year is 2025. The UK job market is a complex tapestry woven with threads of technological disruption, economic fluctuations, and evolving workplace dynamics. Many professionals find themselves in a state of limbo, clinging to their current positions, not out of passion or fulfillment, but out of fear. This fear is rooted in the pervasive uncertainty that characterises the current economic climate. But what is the true cost of this inertia?

The Illusion of Security

The allure of a steady paycheck and familiar routine can be powerful. It provides a sense of security, a buffer against the unknown. However, this perceived security often comes at a steep price. When you stay in a job that no longer aligns with your aspirations, you stagnate. Your skills become outdated. Your passion wanes. You become a cog in a machine, rather than a driver of your own destiny.

Opportunity Cost: The Hidden Price Tag

The concept of opportunity cost is fundamental to understanding the true impact of staying in a stagnant job. It’s not just about the money you’re leaving on the table. It’s about the experiences you’re missing, the skills you’re not developing, and the potential you’re not realising.

- Lifestyle: Are you sacrificing your dreams of travel, a better work-life balance, or a more fulfilling career? Are you missing out on precious moments with loved ones because you’re chained to a job that offers no joy?

- Happiness: Job satisfaction is intrinsically linked to overall happiness. When you’re unhappy at work, it bleeds into every aspect of your life. Are you settling for mediocrity when you could be thriving?

- Health: Chronic stress from a dissatisfying job can take a toll on your physical and mental health. Are you experiencing burnout, anxiety, or depression? Are you neglecting your well-being in the pursuit of a paycheck?

- Wealth: In a dynamic job market, staying put can mean falling behind. Are you missing out on opportunities for career advancement and higher earning potential? Are you limiting your financial growth and jeopardising your long-term security?

Review of the UK Job Marketplace in 2025

To understand the opportunity cost of inaction, it’s essential to grasp the current state of the UK job market. Several key trends are shaping the landscape:

- Technological Disruption: Artificial intelligence (AI), automation, and digital transformation are reshaping industries and creating new job roles while rendering others obsolete. The rise of remote work and the gig economy is changing the traditional employment model.

- Economic Uncertainty: Global economic fluctuations, inflation, and political instability are creating a volatile job market. Companies are hesitant to make long-term commitments, leading to increased job insecurity.

- Skills Gap: There’s a growing mismatch between the skills employers need and the skills workers possess. This skills gap is particularly pronounced in sectors like technology, healthcare, and green energy.

- Emphasis on Soft Skills: In an increasingly automated world, soft skills like communication, critical thinking, and emotional intelligence are becoming more valuable than ever.

- Focus on Sustainability: Companies are increasingly prioritising sustainability and environmental responsibility, creating new opportunities in green jobs and sustainable industries.

- The Rise of Flexible Working: Employees are demanding greater flexibility in their work arrangements, and companies are adapting to accommodate these demands.

Impact on Different Sectors

- Technology: The tech sector is booming, with high demand for software engineers, data scientists, and cybersecurity professionals. However, rapid technological advancements require continuous learning and adaptation.

- Healthcare: The healthcare sector is facing increasing demand due to an ageing population and advancements in medical technology. There’s a shortage of nurses, doctors, and other healthcare professionals.

- Green Energy: The transition to a sustainable economy is creating new opportunities in renewable energy, energy efficiency, and environmental management.

- Finance: The finance sector is undergoing significant transformation due to digitalisation and regulatory changes. There’s a growing demand for professionals with skills in fintech, data analytics, and risk management.

- Creative Industries: The creative industries are experiencing growth, driven by the demand for digital content and entertainment. However, competition is fierce, and professionals need to be highly skilled and adaptable.

9 Ways to Overcome Uncertainty in the UK Job Marketplace to Increase the Chances of Developing a Secure Career Development in 2025

Navigating the uncertainty of the 2025 UK job market requires a proactive and strategic approach. Here are nine actionable steps to take:

- Embrace Lifelong Learning: The skills gap is a reality. Invest in your professional development by acquiring new skills and staying up-to-date with industry trends. Take online courses, attend workshops, and pursue certifications. Focus on skills that are in high demand, such as data analysis, AI, and digital marketing.

- Build a Strong Network: Networking is crucial for career advancement. Attend industry events, join professional organisations, and connect with people on LinkedIn. Build genuine relationships and seek out mentors who can provide guidance and support.

- Develop Transferable Skills: Focus on developing skills that are applicable across different industries and job roles. These include communication, problem-solving, critical thinking, and adaptability. These skills will make you more resilient in a changing job market.

- Embrace Flexibility and Adaptability: Be open to new opportunities and willing to adapt to changing circumstances. Consider flexible work arrangements, such as remote work or freelance projects. Be prepared to pivot your career if necessary.

- Build a Strong Online Presence: Your online presence is your professional brand. Create a compelling LinkedIn profile, showcase your skills and accomplishments, and engage with industry content. Consider building a personal website or blog to demonstrate your expertise.

- Explore Emerging Industries: Identify industries that are experiencing growth and invest in the skills needed to succeed in those sectors. Consider opportunities in green energy, AI, and healthcare.

- Prioritise Mental and Physical Well-being: Job uncertainty can be stressful. Prioritise your mental and physical health by practicing self-care, managing stress, and maintaining a healthy work-life balance.

- Financial Planning: Create a financial safety net. Have a contingency fund that will allow you to navigate periods of unemployment or career transition. Plan your finances with a long term view.

- Seek Professional Guidance: Consider working with a career coach or mentor who can provide personalised guidance and support. They can help you identify your strengths, develop a career plan, and navigate the job market.

Join CheeringUp.info Lifestyle Improvement Club

Are you ready to take control of your career and create a life you love? I believe you are. You deserve more than just a job. You deserve a fulfilling career and a vibrant life. That’s why I created CheeringUp.info Lifestyle Improvement Club.

We are a community of like-minded professionals who are committed to personal and professional growth. We provide the resources, support, and inspiration you need to navigate the challenges of the modern job market and achieve your goals.

What We Offer:

- Exclusive Content: Access to in-depth articles, videos, and podcasts on career development, personal growth, and well-being.

- Live Workshops and Webinars: Learn from industry experts and gain practical skills to enhance your career.

- Networking Opportunities: Connect with a supportive community of professionals and build valuable relationships.

- Personalized Coaching: Receive one-on-one coaching to help you achieve your specific career goals.

- Resource Library: Access to a wealth of resources, including templates, checklists, and guides.

- Community Forums: Engage in discussions, share experiences, and receive support from fellow members.

Why Join Lifestyle Improvement Club?

- Gain Clarity: Define your career goals and develop a clear roadmap for success.

- Build Confidence: Overcome self-doubt and develop the confidence to pursue your dreams.

- Expand Your Network: Connect with a community of professionals and build valuable relationships.

- Enhance Your Skills: Acquire new skills and stay ahead of the curve in a rapidly changing job market.

- Improve Your Well-being: Prioritise your mental and physical health and create a balanced and fulfilling life.

Don’t let uncertainty hold you back. Take the first step towards a brighter future. Join CheeringUp.info Lifestyle Improvement Club today! Visit CheeringUp.info

Get help to protect and grow your business faster

Find out more about Lifestyle Improvement Club Corporate Membership

Subscribe for free lifestyle improvement tips reviews and money saving ideas

Read more lifestyle improvement articles and view videos for free

Read more articles and view videos:

- What is the opportunity cost of staying in a stagnant job UK 2025?

- How to overcome job market uncertainty and build career security UK 2025 guide

- Impact of technological disruption on job market and career development UK 2025

- Nine actionable steps for secure career development in the UK job market 2025

- Lifestyle improvement and overcoming job uncertainty in the 2025 UK economy

Relevant hashtags :

- #UKJobMarket2025

- #CareerDevelopmentUK

- #OvercomingUncertainty

- #LifestyleImprovement

- #FutureOfWorkUK

- #CheeringUpInfo

- #CheeringupTV

What is the opportunity cost of staying in a stagnant job UK 2025