Find like minded people to engage with and act together with to improve your life in the UK

To make this life a wonderful adventure takes thought and effort. We are not cattle or sheep. Lets not follow the herd. Do not act like sheep. We are not machines automatically following our masters. Lets make the life we want for ourselves not the life we are given.

This is not a political message. We do not care what left wing union leaders think we want. Nor do we care what right wing political leaders say they are going to do for us. We need to take back control from our failed institutions and organisational bodies.

No longer a life of right or left thinking people

CheeringupInfo

This means thinking for ourselves and acting as one together to improve life in the UK. It requires us to engage with whats going on now and engage with each other to coordinate action not words.

We are not here as your soundbox so that you can shout at the walls and hear your thoughts reflected back pointlessly. You do not need self serving leaders to speak and act for you. Act for yourself and with others in coordinated way to force change for the better.

Meet up online. Engage by messages. Coordinate your action to get more of what you want and less of what you do not.

Promote and market your business on CheeringupInfo for 12 months

Place your products and services in front of new buyers interested in your business offering before your competitors sell to them.

Link into your existing sales process or use our eCommerce solutions to increase your sales cash flow and profit.

Increase the source of your revenue streams more profitably. Grow your business faster more sustainably.

Read lifestyle improvement articles and watch video stream trending on CheeringupInfo

| Marketplaces | Exhibitions |

| Save Money | Magazines |

Maybe it won’t work out, but at least seeing if it does will be the greatest adventure of my life

Life is full of adventures, big and small. Some adventures are planned, while others are unexpected. But no matter how they come about, adventures are what make life worth living.

Here are a few quotes about adventure that will inspire you to seek out new experiences and live your life to the fullest:

The biggest adventure is to live your life. – Joseph Campbell

Joseph Campbell

Life is an adventure. It’s a journey of discovery. It’s a chance to learn and grow. – Oprah Winfrey

Oprah Winfrey

The purpose of life is to live it, to taste experience to the utmost, to reach out eagerly and without fear for newer and richer experience. – Eleanor Roosevelt

Eleanor Roosevelt

Life is a daring adventure or nothing at all. – Helen Keller

Helen Keller

These quotes remind us that life is meant to be lived, not just existed. So don’t be afraid to step outside of your comfort zone and try new things. You never know where your next adventure might lead you.

Here are a few ideas for adventures you can try:

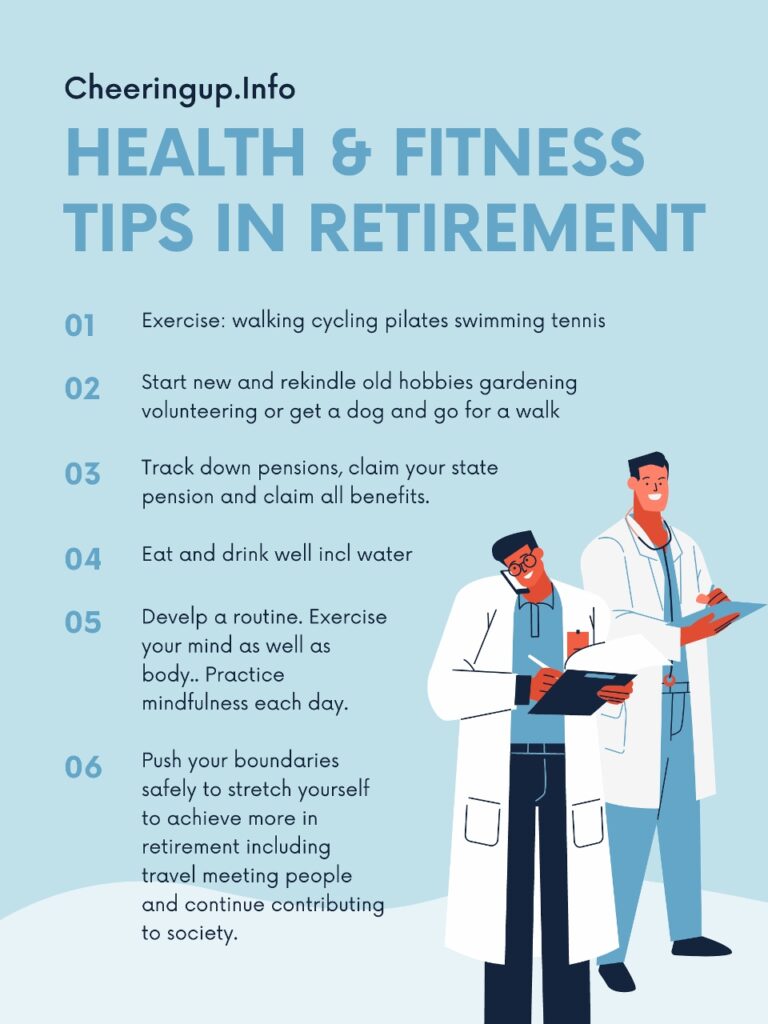

- Travel to a new place. There’s no better way to learn about different cultures and see new things than by travelling.

- Learn a new skill. Whether it’s cooking, painting, or playing an instrument, learning a new skill can open up a whole new world of possibilities.

- Volunteer your time. Helping others is a great way to give back to your community and make a difference in the world.

- Meet new people. One of the best ways to experience new things is to meet new people. Get out there and meet your neighbours, join a club, or take a class.

No matter what adventure you choose, make sure you enjoy the journey. Life is too short to take things for granted. So go out there and explore the world. You never know what you might discover.

Life adventure quotes

Here are a few more quotes about life and adventure:

- Life is a journey, not a destination. – Ralph Waldo Emerson

- The best way to predict the future is to create it. – Abraham Lincoln

- The only way to do great work is to love what you do. – Steve Jobs

- The only person you are destined to become is the person you decide to be. – Ralph Waldo Emerson

- The journey of a thousand miles begins with a single step. – Lao Tzu

These quotes remind us that life is a journey, not a destination. It’s up to us to create our own future and to love what we do. So don’t be afraid to take risks and step outside of your comfort zone. The best things in life are often waiting for us on the other side of fear.

Unique adventure quotes

Here are a few more unique adventure quotes:

- The world is a book and those who do not travel read only a page. – Saint Augustine

- The greatest glory in living lies not in never falling, but in rising every time we fall. – Nelson Mandela

- The best and most beautiful things in the world cannot be seen or even touched – they must be felt with the heart. – Helen Keller

- Adventure is worthwhile. – Amelia Earhart

- The world is a dangerous place, but not because of those who do evil. It is because of those who look on and do nothing. – Albert Einstein

These quotes remind us that the world is a beautiful and exciting place, and that we should never be afraid to explore it. So go out there and have some adventures! You won’t regret it.

Short quotes about adventure

Here are a few short quotes about adventure:

- Travel is the only thing you buy that makes you richer. – Unknown

- The journey of a thousand miles begins with a single step. – Lao Tzu

- Life is either a daring adventure or nothing at all. – Helen Keller

- The best and most beautiful things in the world cannot be seen or even touched – they must be felt with the heart. – Helen Keller

- Adventure is worthwhile. – Amelia Earhart

These quotes are a great reminder that life is meant to be lived to the fullest. So don’t be afraid to step outside of your comfort zone and have some adventures!

#CheeringupInfo #LifestyleMagazine #LifestyleTips #LifestyleAdvice #LifestyleMarketplace #LifeTips #LifeAdvice #LifestyleReviews #Inspiration #Motivation #Happiness #Mindfulness #Leadership

Make this life a wonderful adventure with CheeringupInfo