Defining Your “Best Life” – A Guide for Thriving in Retirement as an Older Woman in the UK

Retirement – a time often romanticised as a period of freedom and relaxation. While this may be true, it’s also an opportunity for a profound personal transformation. For older women in the UK, retirement presents a unique chance to redefine what “best life” truly means.

Why Define Your Best Life in Retirement?

Many women dedicate their earlier years to family, careers, and societal expectations. Retirement offers a blank slate – a chance to rediscover passions, explore new possibilities, and ultimately, design a life that brings true fulfillment.

Here’s why defining your “best life” in retirement is crucial:

- Reclaim Your Identity: Retire beyond the roles of wife, mother, or employee. This is a chance to reconnect with your core self and pursue long-held dreams and desires.

- Live with Purpose: Retirement shouldn’t be about passively waiting for time to pass. Define what gives your life meaning and actively pursue it.

- Boost Wellbeing: Engaging in activities you find enjoyable combats boredom and loneliness, promoting overall physical and mental health.

- Embrace New Adventures: Let retirement be a catalyst for exploration – travel, hobbies, learning new skills – the possibilities are endless!

Opportunities and Challenges for Older Women in UK Retirement

The path to a fulfilling retirement for older women in the UK is paved with both opportunities and challenges:

Opportunities:

- Financial Independence: For many women, retirement can mean greater financial control, allowing you to invest in your passions and desired lifestyle.

- Free Time: No more work commitments mean more time for personal growth, leisure activities, and connecting with loved ones.

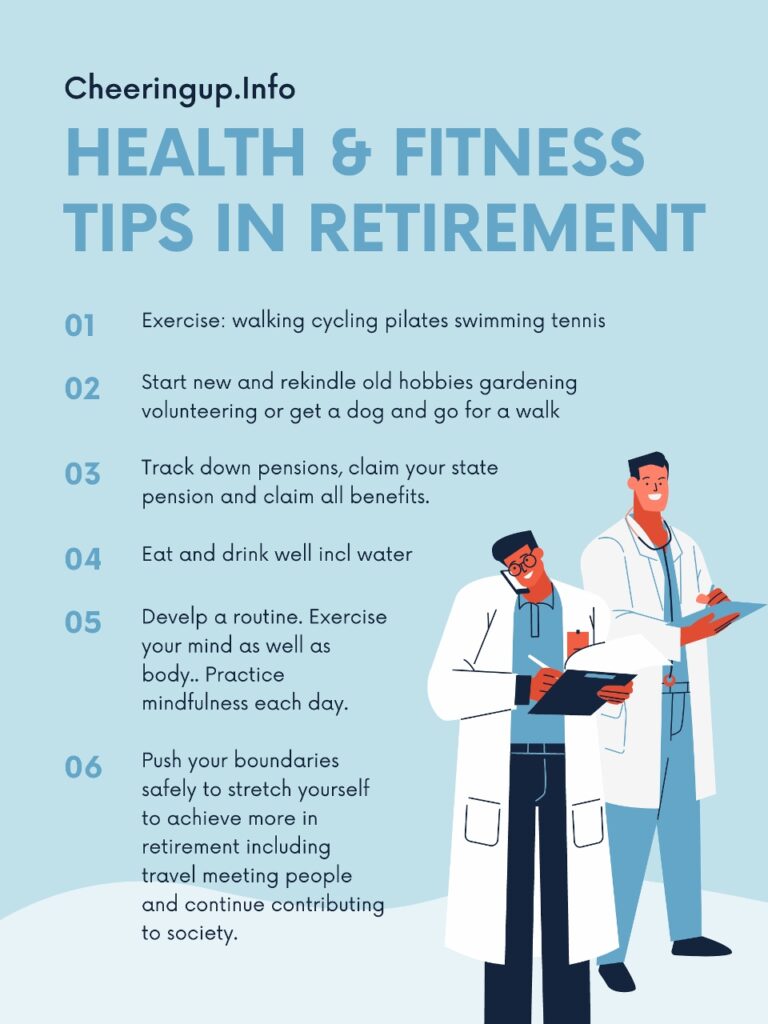

- Improved Health: Retirement allows you to prioritise your health with regular exercise, healthy eating habits, and preventative care.

- Greater Autonomy: Make your own decisions about where to live, how to spend your time, and how to live your life.

Challenges:

- Loss of Identity: The transition from a structured work life can lead to a sense of loss and uncertainty about one’s role.

- Social Isolation: Reduced work interactions and potential loss of loved ones can intensify feelings of loneliness.

- Financial Concerns: Limited income, rising living costs, and potential healthcare expenses can cause financial stress.

- Ageism: Negative societal attitudes towards older women can impact self-esteem and limit opportunities.

Solutions for a Fulfilling Retirement as an Older Woman in the UK

Embrace Lifelong Learning: Learn a new language, take a photography class, or join a book club. Challenge yourself intellectually and stay mentally sharp.

Explore Your Creativity: Painting, writing, music, dance – there’s no end to creative pursuits! Unleash your inner artist and express yourself.

Connect with Others: Join social clubs, volunteer, or reconnect with old friends. Building a strong social network combat loneliness and provides a sense of belonging.

Travel and Explore: Always dreamt of visiting Italy? Go for it! Retirement offers the freedom to explore new places and cultures.

Prioritise Your Wellbeing: Maintain a healthy lifestyle through exercise, nutritious meals, and regular health checkups. You are your own best health advocate.

Empower Yourself Financially: Develop a retirement budget, explore additional income opportunities, and seek financial advice from qualified professionals.

The Cheeringup.info Retirement Club: Your Partner in a Thriving Retirement

At the Cheeringup.info Retirement Club, we understand these challenges and opportunities. We are a supportive community specifically designed for older women in the UK like yourself. Here’s how we can empower you on your journey:

- Share Your Story: Connect with other women on our online forums and find support, inspiration, and valuable advice.

- Expert Resources: Access our library of articles, webinars, and workshops covering various topics related to health, finances, travel, and personal development.

- Social Connection: Participate in our online and offline events, build friendships, and find a network of like-minded women.

- Financial Guidance: While we don’t offer financial advice, we connect you with qualified financial advisers who specialise in issues relevant to women in retirement.

Join the Cheeringup.info Retirement Club Today!

Retirement is a chapter filled with possibilities and the chance to redefine your “best life.” Don’t navigate this journey alone. Join the Cheeringup.info Retirement Club, a supportive community designed to empower older women in the UK to live happy, fulfilling, and thriving retirements.

People planning for retirement or already retired will benefit from Retirement Club membership (one-off lifetime membership as opposed to annual membership is limited special deal for founding members only). Business leaders who can offer amazing deals to members will benefit from annual Corporate membership.

**We are your partners in crafting a retirement that is truly yours

Tags:

- women over 55 UK

- retirement for women UK

- women’s retirement

Get help to protect and grow your business faster

Subscribe for free lifestyle improvement tips and reviews

Read more lifestyle improvement articles for free

- best life for women over 55 UK

- how to enjoy retirement as a woman UK

- retirement planning for women UK

- women’s health and retirement

- financial security for women in retirement UK

- social life for retired women UK

- hobbies for women over 55 UK