Pick up retirement tips for a healthier wealthier happier retirement with CheeringupInfo

Make it more likely you can retire when you want to. Do the things you want to in retirement in UK and overseas. Increase your happiness in retirement. Live a happy retirement with CheeringupInfo. Prepare now for retirement and live as you want to in retirement. Life after 55 can be greatest years of your life. Make the 3rd Act of your life the best it can be.

Unretire Setup New Business Or Reinvent Yourself Aged Over 55 in UK

We are helping to inspire people over 55 to success in life living and business in UK

There are plenty of opportunities after 55 to live live a great life if you have the right attitude. Do not let wonderful things in your retirement life pass you bye.

Retirement Plan

Retirement TV

Happy Retirees

As we progress through life, one milestone that we all aim to reach is retirement. Retirement signifies the end of our working life, and the beginning of a new chapter of our lives. It is the time to enjoy the fruits of our labour, take up new hobbies and activities, and explore new places.

The UK is home to a significant number of retirees, and over the years, the population of happy retirees has been on the rise. In this article, we will explore who happy retirees in the UK are, what makes them happy, and how they live their retirement years.

Who are happy retirees in the UK?

Retirement is a time of significant change in a person’s life, and not everyone handles it in the same way. While some retirees struggle with the transition, others embrace it wholeheartedly. Happy retirees in the UK are individuals who have successfully transitioned into retirement and are enjoying their golden years to the fullest.

Happy retirees come from all walks of life, and their backgrounds are diverse. They may have had high-flying careers or been self-employed, while others may have worked in lower-paying jobs. However, what sets them apart is their ability to adapt to the changes that retirement brings and find joy in their new life.

What makes happy retirees in the UK happy?

Many factors contribute to the happiness of retirees in the UK. These include:

Financial stability

One of the primary concerns of retirees is financial stability. Happy retirees in the UK have planned for their retirement financially and are living comfortably within their means. They have saved and invested wisely, have no debt, and are not worried about their financial future.

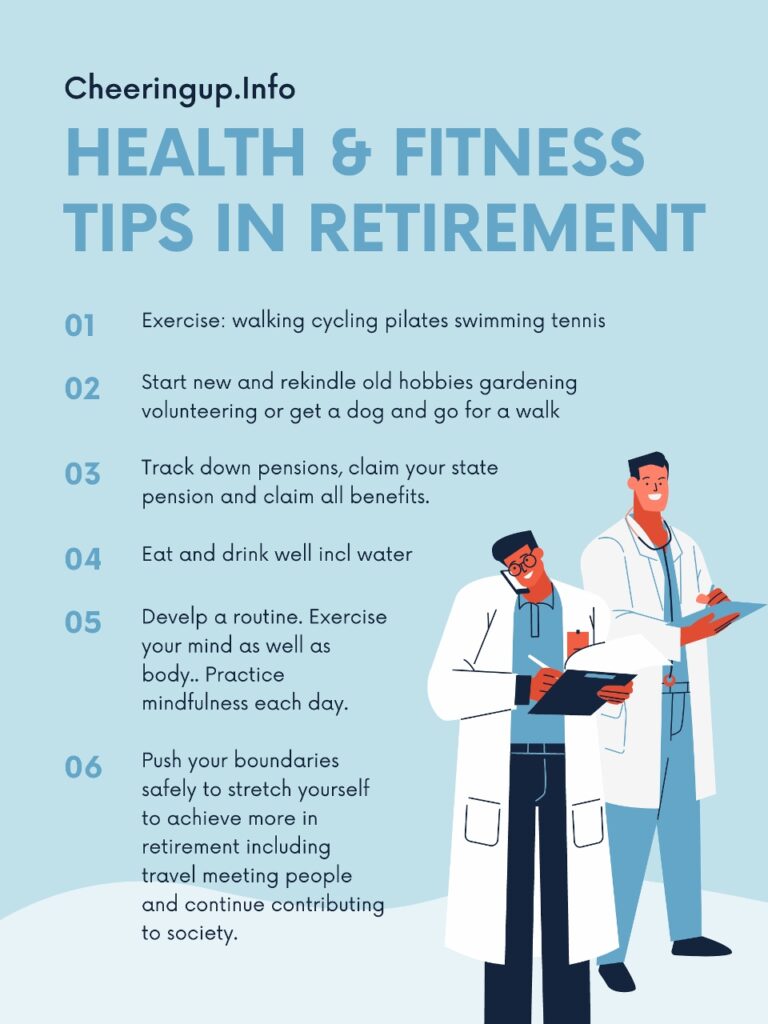

Good health

Good health is crucial to happiness in retirement. Happy retirees in the UK take care of themselves physically, emotionally and mentally. They eat healthily, exercise regularly, and take steps to manage their stress levels. They also engage in activities that promote their mental wellbeing, such as reading, meditating, and spending time with family and friends.

Strong relationships

Retirement provides the opportunity to strengthen existing relationships and build new ones. Happy retirees in the UK have strong social networks, consisting of family, friends, and community groups. They stay connected with their loved ones, engage in social activities, and volunteer in their communities. These relationships provide a sense of belonging and purpose, which contributes to their happiness.

Pursuing hobbies and interests

Retirement provides the opportunity to pursue hobbies and interests that may have been neglected during the working years. Happy retirees in the UK have found new hobbies or have rekindled old ones. They may have taken up gardening, painting, playing music, or travelling. Pursuing these interests gives them a sense of fulfilment and adds excitement to their lives.

Continuing education

Learning does not stop after retirement. Happy retirees in the UK are curious about the world and are continuously learning new things. They may take courses online or attend local classes. This pursuit of knowledge keeps them mentally stimulated and engaged.

How do happy retirees in the UK live their retirement years?

Happy retirees in the UK lead fulfilling lives during their retirement years. They have a good work-life balance and are intentional about how they spend their time. Here are some ways happy retirees in the UK live their retirement years:

Travel

Retirement provides the opportunity to travel and explore new places. Happy retirees in the UK take advantage of this and travel frequently. They may explore different parts of the UK or visit other countries. Travel provides an opportunity to experience different cultures, meet new people, and create lasting memories.

Volunteer work

Volunteering provides retirees with the opportunity to give back to their communities and make a difference in the lives of others. Happy retirees in the UK volunteer their time and skills in various ways, such as mentoring young people, helping the elderly, or working with charities. Volunteering provides a sense of purpose and fulfilment and keeps retirees engaged with their communities.

Physical activity

Physical activity is crucial to good health and happiness in retirement. Happy retirees in the UK engage in various physical activities, such as walking, swimming, cycling, and yoga. They may also participate in sports, such as golf, tennis, or bowls. Physical activity provides an opportunity to stay fit, socialise with others, and maintain a sense of purpose.

Family time

Retirement provides an opportunity to spend more time with family. Happy retirees in the UK value their relationships with family members and spend quality time with them. They may help care for grandchildren, host family gatherings, or take family vacations. This time spent with loved ones creates cherished memories and strengthens family bonds.

Pursuing passions

Retirement provides an opportunity to pursue passions that may have been neglected during the working years. Happy retirees in the UK may take up new hobbies, start a business, or volunteer in a field they are passionate about. Pursuing passions provides a sense of purpose and fulfilment and allows retirees to leave a legacy.

Retirement can be a time of great joy and fulfilment, especially for those who have planned well for their retirement. Happy retirees in the UK have successfully transitioned into retirement and are enjoying their golden years to the fullest. They are financially stable, have good health, strong relationships, pursue hobbies and interests, and are engaged in their communities. They lead fulfilling lives, travel, volunteer, engage in physical activity, spend time with family, and pursue their passions. Retirement can be a time of great adventure and growth, and happy retirees in the UK are living proof of that.

#CheeringupInfo #CheeringupTV #RetirementLife #RetirementMagazine #RetirementClub