Retirement Planning Guru

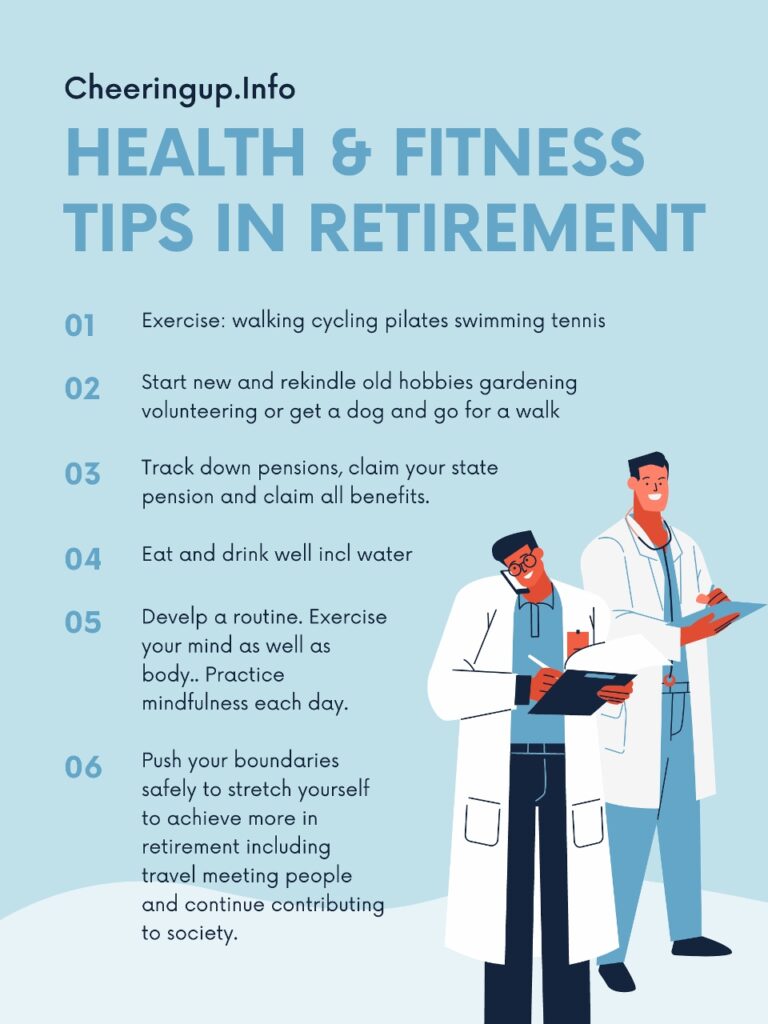

Plan to ensure a more comfortable retirement in UK. Find ways to improve your lifestyle in retirement. Pick up tips and advice on how to live beeter in retirement in UK.

Is your retirement a long way off or is it just around the corner. Use our retirement planning and retirement lifestyle services to improve your life now and in the future.

Explore the best ways to save for retirement in UK. Our financial mentors write to help you choose. Our online broadcasts explain the pitfalls and benefit of building retirement savings fund.

Sign up for free CheeringupInfo news or email editor@cheeringup.info

UK State Pension Entitlement

The state pension in the UK is a government-provided pension that is available to individuals who have reached the state pension age and have made sufficient National Insurance contributions during their working life.

As of April 2021, the full state pension amount is £175.20 per week. To qualify for the full state pension, an individual must have at least 35 years of National Insurance contributions. If an individual has less than 35 years of contributions, they will receive a proportionate amount of the full state pension.

The state pension age is currently 66 for both men and women, and it is set to increase to 67 between 2026 and 2028.

It’s important to note that the state pension is subject to change based on government policies and budget.

Also the pension credit and universal credit can be claimed by pensioners who have low income, this can be checked at the Department for Work and Pensions (DWP) website.

When will your finally finish work and retire?

Do you dream of travelling round the do you crave a simple comfortable retirement life with your friends and family all around you? What you want to do in your retirement is the starting point for retirement planning. It dictates the size of the retirement fund you will need to build before you retire.

Whether you choose early retirement or want to work UK state pension retirement age be better prepared financially with CheeringupInfo. The best retirement plans are the ones that are realistic. There are benefits and financial traps of retiring with all financial tools. In addition life events can get in the way of the best laid retirement plan so your retirement planning needs to be flexible enough to cope with illness unemployment and external factors lying outside your life that impact on your life.

Our personal finance experts financial advisers and retirees Retirement Guide Forum for people planning to retire in the UK

You can live off a modest retirement fund but not if you want to live like a popstar! As a guide you are probably looking at building a fund of half a million pounds to retire comfortably in the UK.

Plenty of retirement planning articles will help you make the right financial decisions yourself. Live and ondemand videostream to assess the different ways you can build a big enough retirement fund to fulfil your retirement living wishes when you retire in UK.

Retirement Lifestyle Guru

Living in the UK is fairly predictable in terms of cost of living. Inflation at the beginning of 2020 is relatively benign. This helps with retirement living budgeting. However this can change rapidly.

Even with benign UK inflation if you can lower your cost of living your retirement fund will go further. You can boost your retirement lifestyle with cost saving tips deals and special offers with CheeringupInfo.

Make sure you take advantage of all retirement age benefits. If they are on offer take them to live better in retirement in UK.

Furthermore any life at any age can be boring! We review ways in which you can enjoy your retirement even more. Read and watch reviews so you can pick the best activities experiences and products to enhance your retirement lifestyle.

Retire In Style

Read retirement planning and lifestyle enhance articles and watch videostream trending on CheeringupInfo

Promote and market your business to people interested in UK retirement issues on CheeringupInfo for 12 months

Put your products or services in front of new customers already interested in your type of business offering before your competitors do.

Link into your existing sales process direct from CheeringupInfo or use our eCommerce solutions to increase your sales cash flow and profit. Increase the sources of your revenue stream more sustainably. Grow your business faster with CheeringupInfo.

More retirement planning articles videos and deals to make retirement life better

More:

- Understanding the UK State Pension: What You Need to Know Before Retirement

- Maximising Your UK State Pension Entitlement: Tips and Tricks

- UK State Pension 101: A Beginner’s Guide

- Navigating the UK State Pension System: A Step-by-Step Guide

- The UK State Pension: What You’re Entitled to and How to Claim It

- UK State Pension Eligibility: How to Qualify and Apply

- UK State Pension Changes: What You Need to Know in 2023

- Retirement Planning with the UK State Pension: How to Make the Most of Your Benefits

- “UK State Pension: How to Check Your Entitlement and Claim Your Benefits”

- Preparing for Retirement with the UK State Pension: A Complete Guide

#CheeringupInfo #RetirementGuideForum #RetirementLife #RetireBetter #RetirementLiving #RetirementPlan #RetirementUK #RetirementExperts #RetirementMagazine #RetirementIncome #RetirementTips #RetireEarlyUK #RetirementLifestyle #RetireInStyle #RetirementGuide #RetirementPlanning #FinancialPlanning

Retirement guru for better retirement in UK with CheeringupInfo