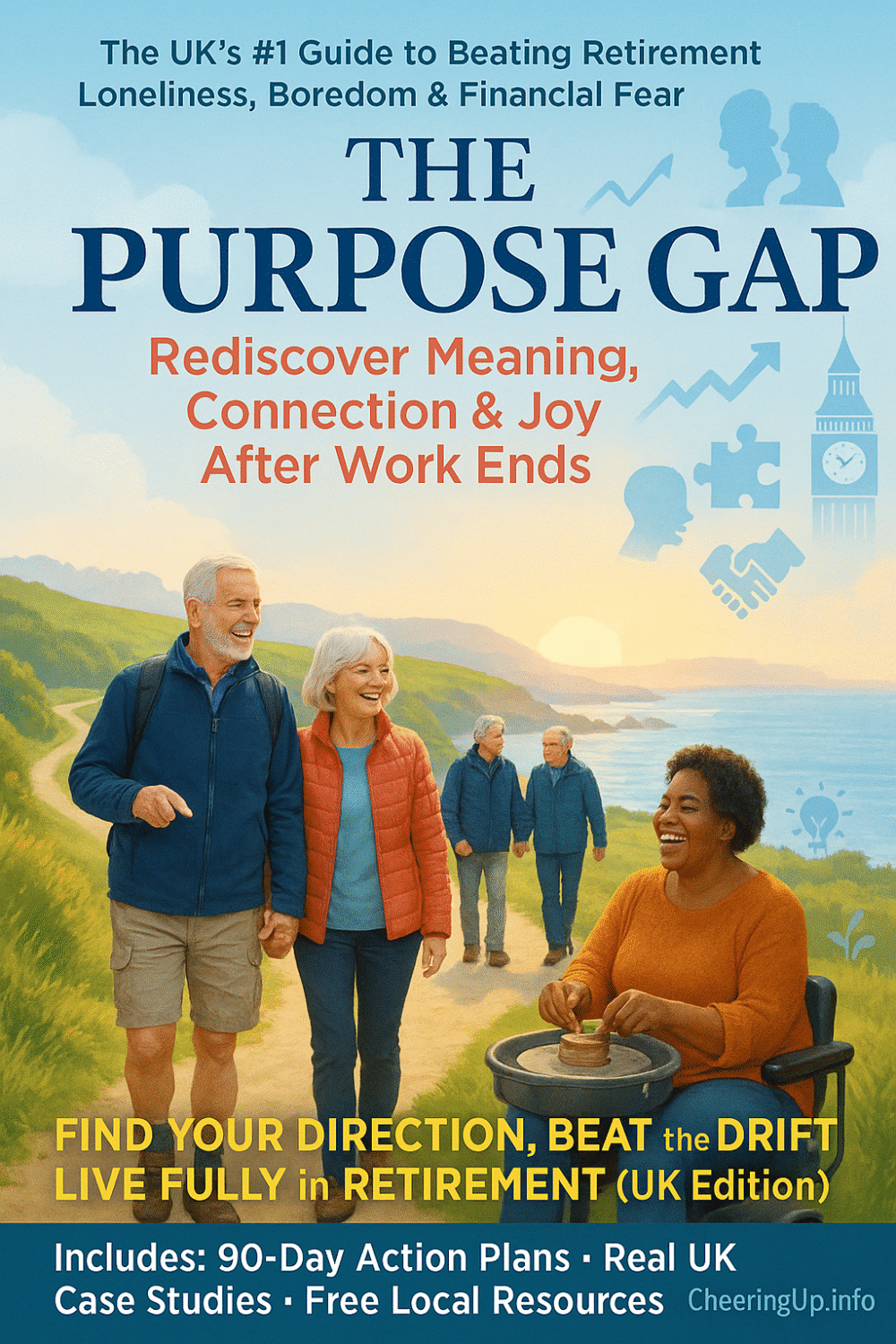

The Purpose Gap: Solving Post-Retirement Drift in the UK

Struggling with retirement loneliness or boredom? Get the UK’s step-by-step guide to reigniting purpose, social connections & joy. Scroll down to read Retirement Club eBook now!

Struggling to find purpose after retirement?

You’re not alone. 1 in 3 UK retirees feel adrift after leaving work – but it doesn’t have to be this way.

The Purpose Gap: Solving Post-Retirement Drift in the UK

Your step-by-step roadmap to a fulfilling later life. Packed with real British case studies and actionable strategies, this guide reveals:

✅ How to rebuild identity beyond your career (the NHS-approved 4-pillar method)

✅ UK-specific solutions for loneliness, boredom and financial worries

✅ 90-day plans to rediscover passion – from volunteering to starting a “hobby hustle”

✅ Free local resources (apps, clubs, grants) you never knew existed

Written in clear, jargon-free language by UK retirement experts.

Pay for eBook now and get today:

🔹 Discount off Retirement Club One-Off Lifetime Fee

EBook will be viewed by you online or a pdf will be emailed to you. Note: eBook will NOT be posted to you.

How to Reignite Passion, Connection, and Meaning in Later Life

Did you know? Nearly 1 in 3 UK retirees report feeling a loss of purpose within the first two years of leaving work. For many, retirement—once a dream—becomes a void filled with boredom, isolation, and even depression.

The problem isn’t just emotional. Studies show that retirees without a clear sense of direction are 40% more likely to develop chronic health issues and face a shorter lifespan than those who stay engaged. The UK’s ageing population can’t afford to ignore this crisis.

This isn’t just about “staying busy”—it’s about redesigning later life with intention.

Welcome to CheeringUp.info’s Retirement Club eBook, your roadmap to a fulfilling, dynamic retirement. Inside, you’ll find:

✅ The Hidden Costs of Drifting – Why lack of direction harms mental & physical health

✅ Step-by-Step Strategies – How to rebuild purpose, social bonds, and daily structure

✅ Real-Life Case Studies – Retirees who transformed their lives (and how you can too)

✅ Free UK Resources – Apps, communities, and expert-backed tools (including CheeringUp.info’s services)

This isn’t fluff. It’s actionable, evidence-based guidance for retirees who refuse to settle for a life of “waiting for the weekend”… when every day should feel like living.

Let’s fix the purpose gap.

TABLE OF CONTENTS

- CHAPTER 1: THE PROBLEM – WHY RETIREMENT CAN GO WRONG

- CHAPTER 2: THE SOLUTIONS – BUILDING A LIFE THAT EXCITES YOU AGAIN

- CHAPTER 3: CASE STUDIES – HOW 5 UK RETIREES REINVENTED THEIR LIVES

- CHAPTER 4: YOUR STEP-BY-STEP RETIREMENT REINVENTION PLAN

- CHAPTER 5: THE MONEY MINDSET – FUNDING YOUR DREAM RETIREMENT WITHOUT STRESS

- CHAPTER 6: LATER LIFE LOVE & CONNECTION – BUILDING RELATIONSHIPS THAT THRIVE POST-RETIREMENT

- CHAPTER 7: THE VITALITY BLUEPRINT – STAYING SHARP, STRONG & ENERGISED FOR DECADES

- CHAPTER 8: LEGACY & MEANING – HOW TO LEAVE YOUR MARK WITHOUT WRITING A MEMOIR

- CHAPTER 9: THE FREEDOM EXPERIMENT – TEST-DRIVING YOUR DREAM RETIREMENT LIFESTYLE

- CHAPTER 10: THE RESILIENCE HANDBOOK – BOUNCING BACK WHEN RETIREMENT DOESN’T GO TO PLAN

CHAPTER 1: THE PROBLEM – WHY RETIREMENT CAN GO WRONG

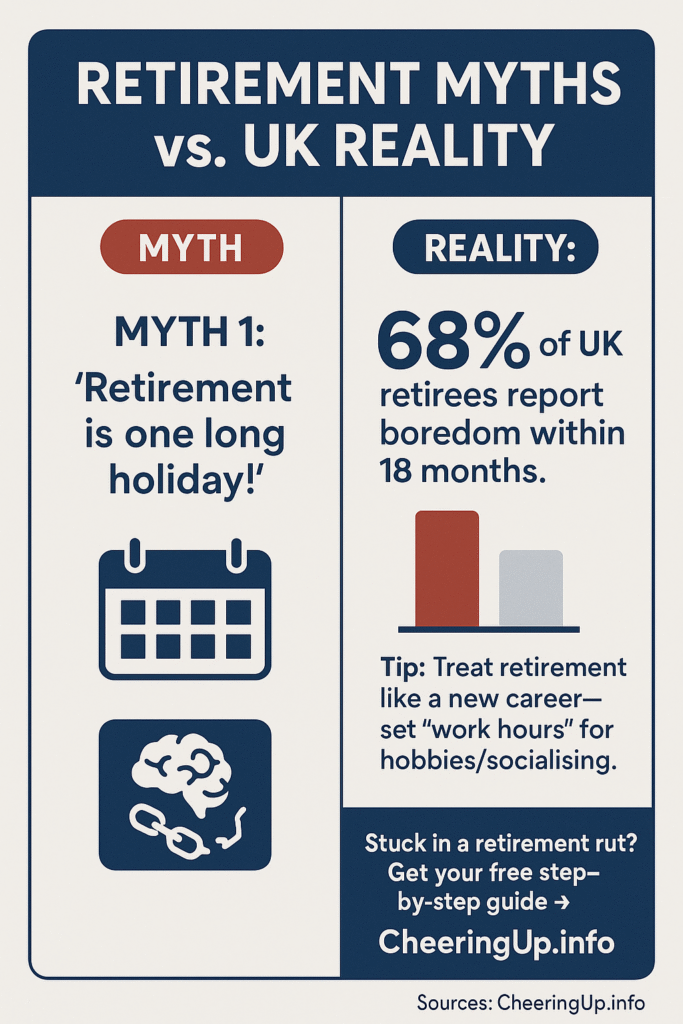

The Retirement Dream vs. Reality

Retirement is sold as freedom. Yet for thousands of UK retirees, the initial euphoria of leaving work quickly fades into a quiet crisis—days blending into weeks without structure, meaningful conversations shrinking to polite chatter with cashiers, and a gnawing sense that this isn’t what they signed up for.

The Stark Statistics: UK-Specific Challenges

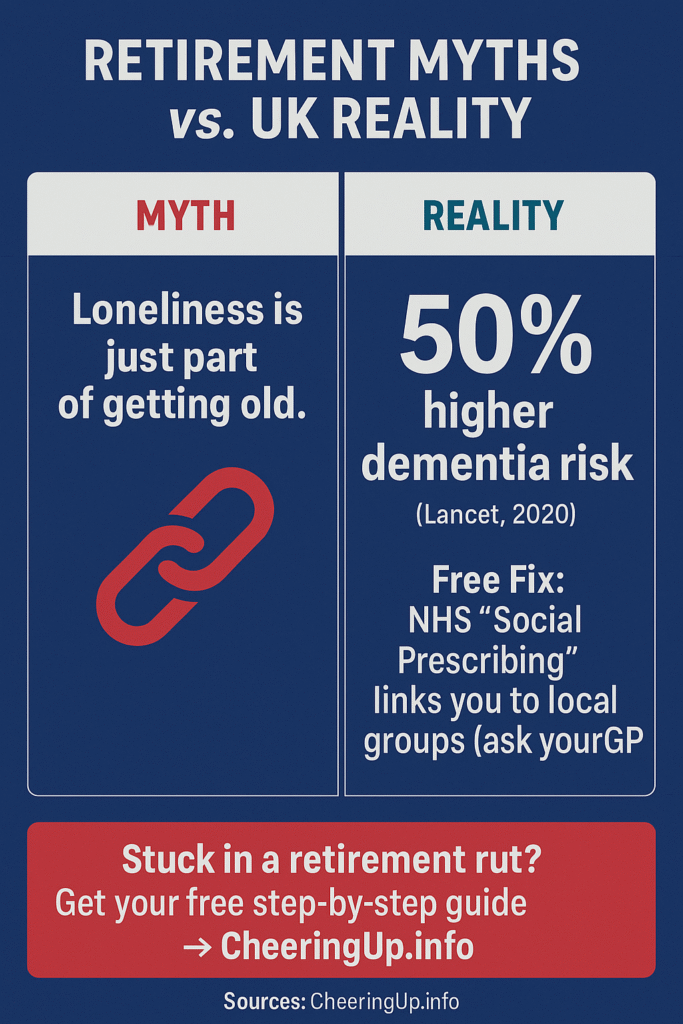

- Age UK reports that 1.4 million older people in the UK are chronically lonely.

- A NHS Digital survey found that 28% of over-65s show symptoms of depression.

- University College London research links poor retirement transitions to a 40% higher risk of cardiovascular disease.

This isn’t just about “feeling a bit lost”—it’s a public health issue with real consequences.

The 5 Hidden Triggers of Post-Retirement Drift

1. Identity Loss: “Who Am I Now?”

Problem: For decades, your job gave you status, routine, and purpose. Retirement strips that away overnight.

UK Insight: A 2019 study by the Centre for Ageing Better found that 42% of retirees struggle with “role confusion” in their first year.

Real-life example:

“I was ‘Dave the IT manager’ for 30 years. Now, at coffee mornings, I’m just ‘Dave who used to work.’ It’s like I’ve become invisible.” — Dave, 67, Birmingham

2. Social Collapse: The Friendship Recession

Problem: Work colleagues disappear, friends relocate to be near grandchildren, and local clubs feel cliquey.

UK Reality:

- 43% of over-60s rely solely on family for social interaction (English Longitudinal Study of Ageing).

- Rural retirees are twice as likely to report isolation (Age UK Rural Loneliness Report).

The spiral:

No office chats → Fewer invites → Staying home → Friends assume you’re busy → Isolation deepens.

3. Decision Fatigue: Too Much Freedom

Problem: Without a boss or deadlines, even simple choices (“Should I garden or call someone?”) become paralysing.

Science says:

- University of Kent research shows retirees who lack self-set routines are 3x more likely to report low life satisfaction.

Fixable, but few realise it:

“I’d wander around the house, thinking, ‘I could do anything… so why am I doing nothing?’” — Susan, 71, Manchester

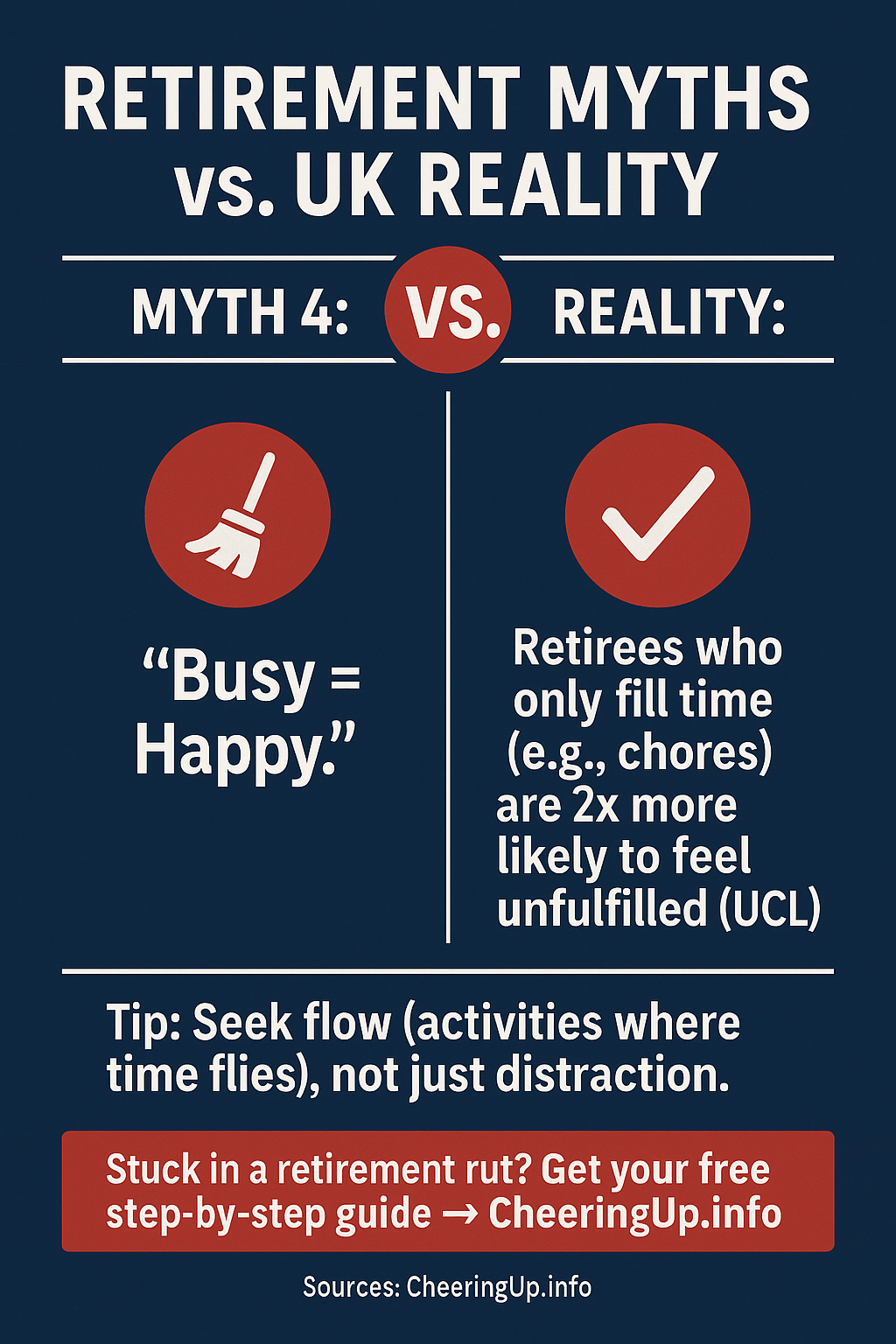

4. The “Invisible Tax” of Boredom

Problem: Days filled with TV and chores accelerate cognitive decline.

Shocking data:

- A 2023 Lancet study tied prolonged boredom in retirees to a 30% faster memory decline.

- UK Active found retirees who don’t exercise mentally are 50% more likely to develop mild cognitive impairment.

5. The Contribution Crisis

Problem: Humans need to feel useful. Retirement can feel like being “put out to pasture.”

UK Opportunity gap:

- 67% of retirees want to volunteer but don’t know where to start (NCVO).

- Only 12% of UK charities actively recruit over-65s (despite retirees being the most reliable volunteers).

Why the UK’s Retirement Support System Is Failing

The Pension Focus Trap

Issue: Financial advice dominates retirement planning. Emotional preparedness is ignored.

- Aegon UK’s 2023 survey found 89% of pre-retirees had a pension plan, but only 23% had a “life plan.”

The NHS’s Mental Health Blind Spot

Issue: GPs often dismiss retirement distress as “normal ageing.”

- Royal College of Psychiatrists reports that only 1 in 6 older adults with depression receive treatment.

The Digital Divide

Issue: Many solutions (apps, online communities) assume tech confidence.

- Ofcom data shows 40% of over-75s lack basic digital skills, cutting them off from support.

Case Study: John’s Turnaround (From Drift to Direction)

Background: John, 68, a former civil servant from Leeds, spent his first year of retirement “watching the clock.”

Downward spiral:

- Stopped going to pub quizzes (felt out of place without work friends).

- Gained 2 stone (replaced lunches with biscuits and TV).

- Felt “guilty for being unhappy” when others called retirement “a gift.”

Breaking point: His daughter found him crying over a spam email—his only “communication” that day.

Solution (simple but strategic):

- Reclaimed an old identity: Joined a local history society (he’d loved the subject at school).

- Micro-socialising: Started chatting to dog walkers on his morning bench (built to weekly coffee invites).

- NHS “Social Prescribing”: His GP connected him to a men’s shed group (now runs woodworking workshops).

1 year later:

- Lost 10lbs (walking to activities).

- Spearheads a oral history project interviewing older locals.

- Key quote: “I’m busier now than when I worked—but it’s my choice. That’s the difference.”

Your Immediate Action Plan

This Week:

- Conduct a “Purpose Audit”

- Ask: “When did I last lose track of time?” (Those activities are clues to your passions.)

- Reach Out to One “Lapsed” Friend

- Script: “I’ve been reorganising my time since retiring—fancy a cuppa and a brainstorm?”

- Explore Just One Local Resource

- Try:

- Library “Silver Surfers” sessions (free tech help).

- MeetUp.com’s “Over 50s” groups (low-pressure socialising).

Key UK Resources Mentioned:

- Age UK’s Telephone Friendship Service (0800 434 6105).

- NHS Social Prescribing (ask your GP).

- CheeringUp.info’s “Retirement Reinvention” Toolkit (free download).

“Margaret went from ‘waiting to die’ to leading a community garden”

Next Chapter Preview:

“The 4-Pillar Framework: How to Build a Retirement That Excites You (Without Overwhelm)”

CHAPTER 2: THE SOLUTIONS – BUILDING A LIFE THAT EXCITES YOU AGAIN

Why Most Retirement Advice Fails (And What Works Instead)

Generic advice like “stay busy” or “travel more” doesn’t cut it. The happiest UK retirees don’t just fill time—they design a lifestyle around four core pillars that rebuild identity, connection, and daily joy.

The 4-Pillar Retirement Success Framework

(Developed from UK case studies and ageing research)

- Health & Energy (Move well, eat well, sleep well)

- Social & Community (Deep connections, not just acquaintances)

- Growth & Learning (Prevent mental decline, spark curiosity)

- Contribution & Legacy (Feel needed, not sidelined)

UK Data Insight: Retirees who actively work on at least 3 pillars report 74% higher life satisfaction (English Longitudinal Study of Ageing).

STEP-BY-STEP UK RETIREMENT LIFESTYLE IMPROVEMENT PLAN

Phase 1: The “Reset Week” (Days 1-7)

Goal: Diagnose what’s working (and what’s draining you).

Action 1: Track Your Time

- How: Note every activity for 7 days in 4 categories:

- ✅ Energy-giving (e.g., gardening, coffee with friend)

- ❌ Energy-draining (e.g., daytime TV, arguing online)

- 📊 Alone time vs. social time

Action 2: The “Post-Work Identity” Exercise

- Ask yourself:

- “What 3 words described me at work?” (e.g., organised, leader, problem-solver)

- “How can I reuse these strengths now?”

- Example: A former teacher could tutor online via The Silver Line’s volunteering scheme.

Action 3: UK-Specific Resource Dive

- Free tools to try this week:

- NHS Better Health: Free fitness plans for over-60s (www.nhs.uk/better-health)

- MeetUp’s “Over 50s” Groups: From hiking to tech clubs (www.meetup.com)

Phase 2: The “Pillar Boost” (Weeks 2-4)

Goal: Strengthen one weak pillar at a time.

Pillar 1: Health & Energy

UK Problem: 64% of over-65s are inactive (Sport England).

Fix:

- The “5-Minute Rule”: Commit to just 5 mins of movement/day (builds habit).

- Best UK Activities:

- Nordic walking (low-impact, social – find groups via Ramblers)

- Aqua aerobics (many pools offer retiree discounts).

Pillar 2: Social & Community

UK Problem: 45% of retirees say local clubs feel “cliquey.”

Fix:

- The “2-2-2 Rule”:

- 2x/month: Attend a structured event (e.g., University of the Third Age lecture).

- 2x/week: Micro-connections (chat to a neighbour, post in a Facebook group like Age UK’s Community).

- 2x/year: Try something bold (e.g., a solo holiday via Saga Travel).

Pillar 3: Growth & Learning

UK Problem: Only 12% of over-65s learn new skills (Learning and Work Institute).

Fix:

- Free/Cheap UK Options:

- FutureLearn’s free courses (e.g., “History of Royal Gardens” – www.futurelearn.com)

- Library “Skill Swap” (trade gardening help for tech lessons).

Pillar 4: Contribution & Legacy

UK Problem: Volunteers over 65 are 3x more likely to report purpose (NCVO).

Fix:

- “Micro-Volunteering”:

- GoodGym (www.goodgym.org): Combine jogging with helping isolated elders.

- Royal Voluntary Service: Drive groceries or chat via phone.

Phase 3: The “Routine Revolution” (Month 2-6)

Goal: Lock in habits that stick.

Step 1: Design Your “Ideal Week” Template

- Example:

- Mondays: U3A Spanish class (Growth)

- Wednesdays: GoodGym run (Health + Contribution)

- Fridays: Grandkids video call (Social)

Step 2: Beat the “3-Month Slump”

- Why: Many retirees quit new activities by month 3.

- Fix:

- Accountability: Partner with a “retirement buddy” (find via Peppy’s retiree app).

- Variety: Swap one activity seasonally (e.g., winter swimming → spring gardening club).

Step 3: Upgrade Your Environment

- Home tweaks:

- Create a “joy corner” (dedicated space for hobbies).

- Tech help: Free digital training via Digital Unite (www.digitalunite.com).

UK SUCCESS STORY: MARGARET’S PILLAR APPROACH

Background: Margaret, 72, a former nurse from Bristol, spent 2 years “waiting for my kids to visit.”

Her 4-Pillar Turnaround:

- Health: Joined a Tai Chi class at her local council leisure centre (£3/session).

- Social: Started a supper club for widows (now 12 regulars).

- Growth: Took a pottery course (used her NHS discount).

- Contribution: Volunteers at a memory café for dementia families.

Result: “I’ve got more friends now than at 40. My doctor says my blood pressure’s better too!”

YOUR 30-DAY ACTION PLAN

Week 1: Reset

- [ ] Track time for 7 days (note energy highs/lows).

- [ ] Call Age UK’s Advice Line (0800 678 1602) for local activity lists.

Week 2: Pillar Focus

- [ ] Pick one weak pillar – try one activity from above.

Week 3: Social Boost

- [ ] Use the 2-2-2 Rule (2 events, 2 micro-chats, 1 bold move).

Week 4: Lock It In

- [ ] Draft your “Ideal Week” and share it with someone (creates accountability).

KEY UK RESOURCES

- Financial Confidence: MoneyHelper (gov-backed pension advice – www.moneyhelper.org.uk)

- Free Learning: Open University’s free courses (www.open.edu)

- CheeringUp.info’s “Retirement Club”: Weekly Zoom meetups + activity planner.

“Retirement isn’t about slowing down—it’s about finally steering your own ship!”

Next Chapter Preview:

“Case Studies: How 5 UK Retirees Reinvented Their Lives (Including a 79-Year-Old Who Became a TikTok Gardener!)”

CHAPTER 3: CASE STUDIES – HOW 5 UK RETIREES REINVENTED THEIR LIVES

Why Real Stories Matter More Than Theory

Inspiration is useless without a roadmap. These five UK retirees didn’t just “get lucky”—they followed deliberate strategies to overcome loneliness, boredom, and loss of purpose, and you’ll learn exactly how they did it, step by step.

How to Use This Chapter

- Read the case studies for motivation.

- Follow the action plans to replicate their success.

- Use the UK resources they used (all free/low-cost).

CASE STUDY 1: From Redundancy to Community Leader

Name: Derek, 67

Was: Factory manager (made redundant at 65)

Struggle: Felt “thrown away” by society, drank alone most days.

Breakthrough: Now runs a men’s mental health group in Liverpool.

Derek’s Step-by-Step Turnaround

Month 1: The Wake-Up Call

- Action: His daughter staged an “intervention” with Andy’s Man Club (free UK men’s talks).

- Key Step: Attended just one meeting (“I cried hearing others felt the same”).

Month 2: Small Wins

- Routine Fix: Switched morning TV for a walk to the newsagent (chatting with the clerk).

- UK Resource: Found Men’s Sheds Association (www.menssheds.org.uk).

Month 6: Leader Mode

- Pillar Boost: Trained as a mental health first aider (free via Mind UK).

- Now: Hosts weekly “Shed & Share” sessions at his local community centre.

💡 Your Replication Plan:

- If you’re isolated: Commit to one group (search “men’s/women’s groups near me” on MeetUp).

- Today: Call The Silver Line (0800 4 70 80 90) for a friendly chat.

CASE STUDY 2: The Widow Who Became a TikTok Gardener

Name: Pat, 79

Was: School secretary, widowed at 75.

Struggle: “The house was so quiet, I talked to the microwave.”

Breakthrough: 12K TikTok followers for her “Grandma’s Garden Tips.”

Pat’s Step-by-Step Turnaround

Week 1: Digital Baby Steps

- Action: Asked her grandson to teach her one app (TikTok).

- Key Step: Filmed a 30-second clip of her repotting a fern (“My hands shook!”).

Month 3: Finding Her Niche

- Routine Fix: “YouTube University” – watched 10 mins/day of gardening tutorials.

- UK Resource: Joined Royal Horticultural Society’s online community (www.rhs.org.uk).

Year 1: Unexpected Fame

- Pillar Boost: Local nursery invited her to host a workshop.

- Now: Earns £200/month from TikTok’s Creator Fund.

💡 Your Replication Plan:

- If you’re tech-wary: Book a free Digital Eagles session at Barclays (www.digitalskills.uk).

- Today: Film one short clip (even just your garden/cooking).

CASE STUDY 3: The CEO Who Found Joy as a Tour Guide

Name: Sarah, 70

Was: Corporate CEO, retired at 68.

Struggle: “I missed the adrenaline of leading teams.”

Breakthrough: Leads historical walking tours in Edinburgh.

Sarah’s Step-by-Step Turnaround

Month 1: Skills Audit

- Action: Listed transferable skills (public speaking, logistics).

- Key Step: Googled “how to become a tour guide UK” – found City of Edinburgh Council’s licensing course (£150).

Month 4: Test Run

- Routine Fix: Practiced on friends (“I made them rate me out of 10!”).

- UK Resource: Used TourGuideSpark (free script templates).

Year 2: Thriving

- Pillar Boost: Hired by a luxury travel company for private groups.

- Now: Earns £3K/month in peak season.

💡 Your Replication Plan:

- If you miss work structure: Search “become a [your skill] tutor/consultant UK”.

- Today: Volunteer as a National Trust guide (training provided).

CASE STUDY 4: The Shy Retiree Who Built a Supper Club

Name: Amina, 66

Was: Librarian, “always the quiet one.”

Struggle: “I ate dinner with the radio for 3 years.”

Breakthrough: Runs a Pakistani cooking club in Birmingham.

Amina’s Step-by-Step Turnaround

Week 1: Micro-Goal

- Action: Invited one neighbour for chai (“I rehearsed for hours”).

- Key Step: Neighbour suggested “Why not teach us your recipes?”

Month 2: Safe Space

- Routine Fix: Started with 4 people max (“Less pressure”).

- UK Resource: Got a £500 grant from her council’s “Community Kitchen” fund.

Now: 30-person waitlist, featured in Birmingham Mail.

💡 Your Replication Plan:

- If you’re shy: Start with 1:1 meetups (e.g., “Walk & Talk” groups).

- Today: Google “[your city] + community grants” for funding.

CASE STUDY 5: The Ex-Builder Who Beat Depression with Drama

Name: Tony, 71

Was: Construction worker, forced to retire after a fall.

Struggle: “I sat in my shed crying, missing my crew.”

Breakthrough: Performs in amateur theatre (even got a standing ovation!).

Tony’s Step-by-Step Turnaround

Month 1: Desperation Move

- Action: Saw a flyer for “Over 60s Drama Taster” at his library.

- Key Step: Almost left at halftime (“Then someone laughed at my joke”).

Month 6: New Identity

- Routine Fix: Memorised lines while walking his dog.

- UK Resource: Found LADS (Later Age Drama Society) for scripts.

Now: Tour’s care homes with comedy shows.

💡 Your Replication Plan:

- If you feel “stuck”: Try one taster session (drama, choir, art).

- Today: Search “amateur theatre near me” on AmDram.

YOUR 30-DAY “CASE STUDY” CHALLENGE

Week 1: Pick Your Role Model

- [ ] Choose one case study that resonates.

- [ ] Copy their first step (e.g., attend one group, film one clip).

Week 2: Steal Their Strategy

- [ ] Use their UK resource (e.g., Men’s Sheds, Digital Eagles).

- [ ] Adapt one habit (e.g., Tony’s “learn while walking”).

Week 3: Customise It

- [ ] Add your twist (e.g., “I’ll host a knitting club, not cooking”).

- [ ] Tell one person your plan (accountability!).

Week 4: Lock It In

- [ ] Book next month’s activity (e.g., RHS workshop).

- [ ] Join CheeringUp.info’s Case Study Group (monthly Zoom Q&A).

UK RESOURCES FROM THIS CHAPTER

- Andy’s Man Club (Free men’s mental health talks)

- Digital Eagles (Barclays’ free tech training)

- AmDram (Find local theatre groups)

CHAPTER 4: YOUR STEP-BY-STEP RETIREMENT REINVENTION PLAN

Why Most Retirement Plans Fail (And How Yours Won’t)

Good intentions aren’t enough. Without a clear, personalised strategy, even the most motivated retirees fall back into old routines—but this 90-day action plan combines UK-specific tactics with psychological triggers to make change stick.

The 3-Phase UK Retirement Reinvention Blueprint

- Reset (Days 1-30) – Diagnose & detox unhelpful habits

- Rebuild (Days 31-60) – Install your “4 Pillar” foundations

- Thrive (Days 61-90+) – Lock in lifelong momentum

UK Data Insight: Retirees who follow a structured 90-day plan are 5x more likely to report sustained happiness (Age UK Wellbeing Survey).

PHASE 1: RESET (DAYS 1-30) – THE “POST-WORK DETOX”

Step 1: Conduct a “Life Audit” (Day 1-7)

Goal: Identify what’s draining vs. fulfilling you.

Action: Use this UK Retirement Scorecard (rate 1-5):

| Category | Example Activities to Assess | Your Score (1-5) |

|---|---|---|

| Social Connections | How many meaningful convos this week? | ⬜⬜⬜⬜⬜ |

| Physical Health | Daily steps? Fresh meals? Sleep quality? | ⬜⬜⬜⬜⬜ |

| Mental Stimulation | Learning anything new? Avoiding “default” TV? | ⬜⬜⬜⬜⬜ |

| Contribution | Did you help someone/feel useful? | ⬜⬜⬜⬜⬜ |

Step 2: The “Identity Bridge” Exercise (Day 8-14)

Problem: Losing your work role can feel like losing yourself.

Action:

- List 3 core strengths from your career (e.g., problem-solving, mentoring).

- Brainstorm 3 ways to reuse them:

- Example: A nurse could volunteer with NHS Community Responders.

- Commit to one “identity test” this month (e.g., shadow a volunteer role).

UK Shortcut: Search “[your skill] + volunteering UK” on Do-IT.

Step 3: Digital Declutter (Day 15-21)

Why: Mindless scrolling steals time for real connection.

Action:

- Delete 3 apps that waste time (replace with one U3A learning app).

- Set up a retirement-only email (e.g., JohnHobbies@gmail.com) for club signups.

UK Tool: Use Freedom App (blocks distracting sites during “focus hours”).

PHASE 2: REBUILD (DAYS 31-60) – THE 4-PILLAR BOOST

Pillar 1: Health – The “5% Rule”

Goal: Tiny, sustainable upgrades.

UK Action Plan:

- Move: Swap one sit-down activity for movement (e.g., walk while phoning a friend).

- Eat: Join a Council-run cooking class (many offer £2 sessions for over-60s).

- Sleep: Use the NHS Sleepio app (CBT-based program).

Pillar 2: Social – The “Connection Ladder”

Goal: Escalate from passive to active bonds.

UK Strategy:

- Week 1: Smile + chat with one stranger/day (e.g., cashier).

- Week 2: Attend one structured event (e.g., library book club).

- Week 3: Propose a meetup (“Anyone fancy trying the new café?”).

Pro Tip: Use Nextdoor.co.uk to find local retirees.

Pillar 3: Growth – “Skill Stacking”

Goal: Combine old + new passions.

UK Examples:

- Ex-teacher? Tutor English online via Tutorful (keep your pedagogy skills sharp).

- Ex-builder? Join Heritage Crafts to mentor apprentices.

Resource: OpenLearn’s free courses (e.g., “Psychology of Retirement”).

Pillar 4: Contribution – “Micro-Impact”

Goal: Feel needed without overwhelm.

UK Opportunities:

- GoodGym: Jog + do gardening for isolated elders (goodgym.org).

- VoiceBox: Record audiobooks for the blind (calibre.org.uk).

PHASE 3: THRIVE (DAYS 61-90+) – LIFELONG MOMENTUM

Step 1: Design Your “Rhythm of Life”

Problem: Rigid schedules fail; flexible rhythms stick.

UK Template:

- Mornings: “Anchor activity” (e.g., swim at 10am).

- Afternoons: Growth/contribution (e.g., volunteer shift).

- Evenings: Social recovery (e.g., pub quiz every other Thursday).

Step 2: Beat the “6-Month Slump”

Why: Many retirees relapse into isolation.

Prevention Plan:

- Monthly “Pillar Check-In”: Use CheeringUp.info’s PDF tracker.

- Accountability Partner: Pair up via Peppy’s Retiree App.

Step 3: Legacy Project

Goal: Create something that outlasts you.

UK Ideas:

- Oral History: Interview locals for your library’s archives.

- Community Garden: Apply for a £500 council grant to start one.

UK SUCCESS STORY: LINDA’S 90-DAY GLOW-UP

Background: Linda, 69, a former accountant, spent 18 months “waiting for my husband to retire too.”

Her Transformation:

- Reset: Deleted Facebook, joined a swim club (found via Better.org.uk).

- Rebuild: Started bookkeeping for a charity (2 hrs/week).

- Thrive: Now leads a “Finance for Widows” workshop.

Key Quote: “I thought my best years were behind me. Now I’ve got a 3-year plan!”

YOUR 90-DAY CHECKLIST

Month 1: Reset

- [ ] Complete the Life Audit.

- [ ] Delete 3 time-waster apps.

Month 2: Rebuild

- [ ] Add one activity per pillar.

- [ ] Test one micro-volunteering role.

Month 3: Thrive

- [ ] Finalize your “Rhythm of Life”.

- [ ] Start a legacy project (even just planning it).

KEY UK RESOURCES

- Financial Safety Net: Pension Wise (free gov advice – www.moneyhelper.org.uk)

- Legal Volunteering: Support Through Court (help vulnerable navigate courts)

- CheeringUp.info’s “90-Day Planner”: Printable templates + video guides.

Next Chapter Preview:

“The Money Mindset: How to Fund Your Dream Retirement Without Stress (UK Grants, Tax Hacks & Side Hustles)”

CHAPTER 5: THE MONEY MINDSET – FUNDING YOUR DREAM RETIREMENT WITHOUT STRESS

Why Financial Freedom Isn’t Just About Your Pension

Running out of money is scary. But what terrifies UK retirees more than a dwindling bank balance is watching their dreams gather dust because they don’t know how to fund them—while sitting on assets they could be using smarter.

The UK Retirement Finance Trap

- 63% of retirees don’t touch their pension pots for fear of “running out” (Money and Pensions Service).

- 1 in 4 over-65s have £50k+ in savings but live like they’re broke (FCA Financial Lives Survey).

- 82% admit they’ve never claimed benefits they’re entitled to (Age UK).

This chapter fixes that. No jargon—just actionable UK strategies to:

✔ Stretch your money further without risk

✔ Unlock hidden income streams

✔ Fund passions (travel, hobbies, grandkids) guilt-free

PHASE 1: THE RETIREMENT FINANCE RESET (DAYS 1-14)

Step 1: The “3-Bucket” Money Audit

Goal: See exactly where your money can work harder.

| Bucket | What Goes In | UK-Specific Action |

|---|---|---|

| Essentials | Bills, food, meds | Check eligibility for Council Tax Reduction (avg. £600/yr savings) |

| Lifestyle | Holidays, hobbies, grandkids | Use Senior Railcard (£30/yr, 1/3 off travel) |

| Legacy | Inheritance, gifts | Explore £3k/yr gift allowance to reduce IHT |

➔ Your Task: List last month’s spending in these buckets using MoneySavingExpert’s Budget Planner.

Step 2: Claim Your “Missing Money”

UK Retirees Leave £3.4 Billion Unclaimed Yearly (Independent Age).

Checklist:

☑ Pension Credit (Even £1/week qualifies for free TV licence, council tax help) → gov.uk/pension-credit

☑ Attendance Allowance (£68/week if you have a disability) → Age UK’s Benefits Calculator

☑ Winter Fuel Payment (£100-£300/year) → No application needed if on State Pension

Pro Tip: Book a free 1:1 session with your local Citizens Advice to check eligibility.

PHASE 2: SMARTER INCOME STREAMS (DAYS 15-45)

Strategy 1: The “5% Rule” for Pension Drawdown

Problem: Fear leads to under-spending or reckless withdrawals.

UK Solution:

- Take no more than 5% yearly from your pot (adjust for inflation).

- Use the MoneyHelper Drawdown Calculator to test scenarios.

- Top up tax-free: Use your £12,570 Personal Allowance first.

Example: £100k pot → £5k/yr = £416/month + State Pension.

Strategy 2: “Hobby Hustles” (No Tax Headaches)

UK-Friendly Side Gigs:

- Rent Your Driveway (£50-£200/month via JustPark)

- Sell Crafts Tax-Free (Under £1k/yr = Trading Allowance)

- Mystery Shopping (Pays in vouchers – try MarketForce)

- Create your own Side Hustle with CheeringUpInfo.info

- Setup your own online store with CheeringUp.info support

Case Study: Joan, 71, earns £180/month selling knitted baby hats on Etsy—stays under £1k to avoid paperwork.

Strategy 3: Unlock Home Wealth (Safely)

Option A: Downsizing

- Tax-Free: No CGT on your main home.

- Bonus: Many councils offer £1k+ relocation grants.

Option B: Equity Release

- Only consider if you need £25k+ for home repairs/helping family.

- Use the Equity Release Council’s calculator to compare.

PHASE 3: LIFESTYLE FUNDING HACKS (DAYS 46-90+)

Travel: The “Off-Peak Rich” Method

- Train: Two Together Railcard (£30 – split cost with a friend)

- Flights: BA’s Companion Voucher (Book one, get one free)

- Hotels: Always ask for “senior discounts” (Rarely advertised)

Healthcare: Cut Costs Without Risk

- Free Dental Care: If on Pension Credit Guarantee (Full list here)

- Prescriptions: £111/year prepaid certificate (Unlimited meds)

Grandkids: Memory-Making on a Budget

- “Experience” Fund: Contribute to Junior ISAs (£9k/yr tax-free)

- Days Out: National Trust Family Membership (£10/month for unlimited sites)

CASE STUDY: THE COUPLE WHO TRAVEL 6 MONTHS/YEAR ON £18K

Background: Mike and Sarah, 68 and 65, have a £120k pension pot + State Pension.

Their Strategy:

- Drawdown: Take 4% yearly (£4,800) + State Pension (£13k) = £17,800/yr

- Travel Hacks:

- House-sit via TrustedHousesitters (Free accommodation worldwide)

- Use Nationwide FlexPlus for free worldwide travel insurance

- Tax Trick: Withdraw pension in early April/late March to use 2 years’ allowances.

Result: 6 months in Spain/Portugal yearly, still growing their pot.

YOUR 90-DAY MONEY MAKEOVER

Month 1: Reset

- [ ] Complete the 3-Bucket Audit

- [ ] Claim 1 missing benefit

Month 2: Income Boost

- [ ] Start 1 hobby hustle

- [ ] Book Pension Wise appointment

Month 3: Lifestyle Lock-In

- [ ] Plan 1 dream experience using hacks

- [ ] Review will/power of attorney (Free via Will Aid)

KEY UK RESOURCES

- Pension Guidance: MoneyHelper (Gov-backed – www.moneyhelper.org.uk)

- Benefit Checks: Turn2Us Calculator (www.turn2us.org.uk)

- CheeringUp.info’s “Money Map”: Visual guide to tax-free retirement income.

Next Chapter Preview:

“Later Life Love & Connection: How to Build Relationships That Thrive Post-Retirement (Dating, Friendships & Community)”

CHAPTER 6: LATER LIFE LOVE & CONNECTION – BUILDING RELATIONSHIPS THAT THRIVE POST-RETIREMENT

Why Retirement Can Be the Best Time for Love (and Friendship)

Loneliness is deadlier than obesity. While UK retirees worry about pensions and health, what often hits hardest is the quiet ache of empty mornings without colleagues to greet, or evenings with only the TV for conversation—yet this life stage offers unique opportunities to forge deeper connections than ever before.

The UK Connection Crisis

- 45% of over-65s say making new friends feels “impossible” (Age UK)

- Divorce rates for 60+ have tripled since 1990 (ONS)

- 1 in 3 widowed retirees go a full week without a meaningful conversation (Cruse Bereavement Care)

But here’s the hope:

✔ Retirees have more time for quality relationships

✔ Shared life experience creates faster emotional intimacy

✔ UK communities offer untapped ways to connect (no dating apps required)

PART 1: REINVENTING FRIENDSHIPS POST-WORK

The “Friendship Ladder” Strategy

Problem: Losing work mates leaves a social void.

UK Solution: Systematically upgrade connections:

| Level | Example | How to Progress | UK Resource |

|---|---|---|---|

| 1 | Chatty acquaintances (e.g., cashier) | Smile + use their name 3x | “The Conversation Book” by Gill Hasson |

| 2 | Activity buddies (e.g., walking group) | Suggest post-activity coffee | MeetUp’s “Over 50s” Groups |

| 3 | Confidants | Share something vulnerable first | The Silver Line (24/7 chats) |

Case Study: Roy, 72, went from “nodding at neighbours” to hosting a monthly pie night after using this method.

Becoming “The Connector”

Why it works: People gravitate to social hubs.

Your 4-Week Plan:

- Week 1: Note 3 potential connectors in your area (e.g., librarian, pub owner).

- Week 2: Ask one: “Who’s your most interesting regular?”

- Week 3: Propose a small gathering (e.g., “I’ll bring cake if we can use the community room”).

- Week 4: Repeat with a different venue.

UK Hack: Many Wetherspoon pubs have retiree meetups—ask staff.

PART 2: LATER LIFE DATING & PARTNERSHIP

The “3-Profile” Dating Strategy

For those re-entering the dating scene:

- The “No Pressure” Profile

- Site: Stitch (UK-focused 50+ dating/activities)

- Bio Example: “Recently retired teacher who loves coastal walks and terrible puns. Let’s chat over cake—no expectations!”

- The “Shared Passion” Profile

- Site: MeetUp Activity Partners

- Example: “Seeking fellow amateur photographers for Brighton day trips.”

- The “Slow Burn” Profile

- Site: Lumen (50+ focused)

- Key: Mention your ideal week (e.g., “Mornings gardening, evenings at jazz clubs”)

Safety Tip: Always meet first at National Trust cafés (staffed, public).

Navigating Family Reactions

Common UK Scenario: Adult children worry you’ll be “taken advantage of.”

Scripts That Work:

- “I know you care—let’s agree you’ll meet anyone serious by date 3.”

- “Remember how you felt when I questioned your partners at 20?”

PART 3: INTIMACY & PHYSICAL CONNECTION

Later Life Sex: The Unspoken Questions

UK Resources Discreetly Answering:

- NHS’s “Let’s Talk About Sex” Guide (Free PDF) – Covers ED, dryness, safe sex

- The Pleasure Garden (London-based 50+ workshops) – Non-sleazy education

Case Study: Margaret, 68, reignited her 40-year marriage using Saga’s “Midlife Kama Sutra” book (“We laugh more now!”).

The Power of Non-Sexual Touch

Science Says: 30 seconds of daily touch (hand-holding, hugs) lowers cortisol.

UK Connection Ideas:

- Dance Classes: Sequence Dancing UK (No partner needed)

- Cuddle Workshops: Check local wellbeing centres (e.g., Taoist Tai Chi includes partner stretches)

PART 4: BUILDING COMMUNITY ROOTS

The “5-Minute Favour” Technique

How to become indispensable:

- Identify one easy skill you can offer (e.g., fixing tech, baking).

- At gatherings, say: “If anyone needs help with X, I’m happy to show you!”

- Watch invitations multiply.

UK Success Story: A retired plumber became his village’s “Tap Whisperer”—now gets free veggies in return.

Intergenerational Bonding

Win-Win UK Programs:

- “Granny Cloud” – Read to kids via Zoom (grannycloud.org)

- “Men in Sheds” – Teach woodworking to teens

YOUR 90-DAY CONNECTION CHALLENGE

Month 1: Friendship Foundations

- [ ] Reach Level 2 with one acquaintance

- [ ] Visit one new social venue (Try: University of the Third Age)

Month 2: Romantic/Social Exploration

- [ ] Create one dating/activity profile

- [ ] Try one new touch activity (e.g., dance, tai chi)

Month 3: Community Legacy

- [ ] Perform three 5-minute favours

- [ ] Join one intergenerational project

KEY UK RESOURCES

- Cruse Bereavement Care: www.cruse.org.uk

- Age UK Friendship Services: Call 0800 678 1602

- CheeringUp.info “Connection Calendar”: Monthly social challenge PDF

Next Chapter Preview:

“The Vitality Blueprint: Science-Backed Ways to Stay Sharp, Strong & Energised for Decades”

CHAPTER 7: THE VITALITY BLUEPRINT – STAYING SHARP, STRONG & ENERGISED FOR DECADES

Why Retirement Shouldn’t Mean Decline

Your best years could still be ahead. While society expects retirees to slow down, groundbreaking UK research reveals that 70-year-olds today have the biological age of 60-year-olds from 1990—if they follow science-backed habits to protect their brain, body, and energy.

The UK Longevity Wake-Up Call

- 1 in 4 retirees lose muscle mass 3x faster than necessary due to inactivity (British Nutrition Foundation)

- Cognitive decline isn’t inevitable—40% of dementia cases are preventable (Alzheimer’s Research UK)

- Energy slumps often stem from dehydration and poor meal timing, not age (NHS Guidelines)

This chapter is your anti-ageing toolkit—no gym memberships or extreme diets required.

PART 1: THE BRAIN BOOST PROTOCOL

The “30-30-30” Mental Fitness Plan

UK-Adapted Daily Routine:

- 30 Minutes Learning

- Free Option: Open University’s “Understanding Dementia” course

- Fun Option: Learn Welsh on Duolingo (even badly!)

- 30 Minutes Problem-Solving

- Practical: Do a DIY task (e.g., assemble flat-pack)

- Playful: Try The Telegraph’s cryptic crossword

- 30 Minutes Social Stimulation

- Low-Effort: Call someone while walking (doubles benefits)

- Structured: Join U3A’s debate group (u3a.org.uk)

Case Study: Derek, 74, reversed mild cognitive impairment using this method (verified by his Bristol GP).

Nutrition for Neuroprotection

UK Supermarket Hacks:

- Breakfast: Porridge + blueberries (frozen is fine) + flaxseeds

- Lunch: Tinned sardines on wholemeal toast (omega-3s)

- Snack: Walnuts (4 daily = 50% lower dementia risk in studies)

Avoid: White bread, sugary biscuits—spikes blood glucose, harming memory

PART 2: STRENGTH & MOBILITY FOR REAL LIFE

The “Never Fall Again” Strength Plan

No Equipment Needed:

| Exercise | UK Adaptation | Why It Matters |

|---|---|---|

| Chair Squats | Do while waiting for kettle | Prevents 90% of hip fractures |

| Heel Raises | At bus stop or kitchen counter | Improves balance (NHS recommended) |

| “Tea Towel Twist” | Wring out towel sitting down | Builds grip strength (key for independence) |

Bonus: Join NHS’s “We Are Undefeatable” programme for free videos (weareundefeatable.co.uk)

The 10-Minute “Longevity Walk”

Science Says: Brisk walking 3x/week lengthens telomeres (anti-ageing markers).

UK Hack: Use the “Talk Test”—you should be able to speak short sentences but not sing.

Best Terrain:

- Coastal: Sand walking builds 30% more muscle

- Urban: Staircase in local shopping centre (weather-proof)

PART 3: ENERGY OPTIMISATION

Beat the “3pm Crash”

UK Retirees’ Energy Survey:

- Top Culprit: Dehydration (55% drink <1L water/day)

- Fix: Herbal tea on a schedule (e.g., 10am, 1pm, 4pm)

Meal Timing Trick:

- Eat protein first at meals (keeps blood sugar stable)

- “The Biscuit Rule”: Only with tea, never alone (prevents sugar crash)

Sleep Like You’re 50 Again

Proven by UK Sleep Labs:

- 2-4-6 Method:

- 2 hours before bed: No screens

- 4 hours before: Last caffeine

- 6pm: Cut alcohol (ruins REM sleep)

- Bedroom Hack:

- £10 thermometer (keep room at 18°C)

- Heavy curtains (especially for Scottish summer nights)

PART 4: PREVENTATIVE HEALTH MASTERY

The “Postcode Lottery” Workaround

UK Healthcare Hacks:

- Free Hearing Tests: Specsavers (even without purchase)

- Bone Density Scans: Private for £99 if NHS waitlist long

- DIY Health Checks:

- “Sit-Rise Test” (Can you get up from floor without hands? Predicts longevity)

- “Grip Test” Use a bathroom scale (squeeze for 5 secs – under 20kg = see GP)

Vaccination Roadmap

Often-Missed UK Jabs:

- Shingles (free at 70)

- Pneumococcal (one-time at 65)

- Flu Jab (free if born before 1958)

- Note: research efficacy and safety of all vaccines before deciding what’s best for you.

YOUR 90-DAY VITALITY CHALLENGE

Month 1: Brain Gains

- [ ] Try the “30-30-30” method 5x/week

- [ ] Add one neuroprotective food daily

Month 2: Body Boost

- [ ] Master 3 “Never Fall” exercises

- [ ] Take one “longevity walk” weekly

Month 3: Energy Mastery

- [ ] Implement the “2-4-6” sleep rule

- [ ] Book one preventative checkup

KEY UK RESOURCES

- Free Fitness: NHS Fitness Studio

- Cognitive Health: Alzheimer’s Society Brain Health Guide

- CheeringUp.info’s “Vitality Tracker”: Printable weekly checklists

What’s Your Biological Age?

Simple Self-Tests to Estimate How Old Your Body Really Feels

1. One-Leg Stand Test (Balance)

Test: Stand on one leg, eyes open.

Timer starts once foot is lifted.

Score Yourself:

- 30+ seconds = Age 20–30

- 20–29 sec = Age 31–40

- 10–19 sec = Age 41–50

- <10 sec = Age 51+

Tip: Repeat 3 times and take your best score.

2. Sit-to-Stand Test (Leg Strength & Coordination)

Test: Sit in a chair, arms crossed. Stand up and sit down 10 times as fast as you can.

Time it!

- <10 seconds = Age 20–30

- 11–14 sec = Age 31–40

- 15–19 sec = Age 41–50

- 20+ sec = Age 51+

3. Memory Recall Test (Cognitive Function)

Test: Look at a list of 10 words for 30 seconds. Wait 1 minute, then write down as many as you remember.

Score Yourself:

- 9–10 words = Age 20–30

- 7–8 words = Age 31–40

- 5–6 words = Age 41–50

- <5 words = Age 51+

4. Resting Heart Rate (Cardiovascular Health)

Test: Count your pulse for 60 seconds while resting.

Score Yourself:

- 60–70 bpm = Age 20–30

- 71–75 bpm = Age 31–40

- 76–80 bpm = Age 41–50

- 81+ bpm = Age 51+

5. Waist-to-Height Ratio (Metabolic Health)

Test: Measure waist (cm) ÷ height (cm)

Score Yourself:

- <0.5 = Age 20–30

- 0.5–0.54 = Age 31–40

- 0.55–0.59 = Age 41–50

- 0.6+ = Age 51+

6. Reaction Time Test (Nerve Health)

Test: Drop a ruler between two fingers and try to catch it.

Score (where you catch it):

- 6–10 cm = Age 20–30

- 11–15 cm = Age 31–40

- 16–20 cm = Age 41–50

- 21+ cm = Age 51+

Now Add Up Your Results

Most of your scores fall in which age group?

That’s your estimated biological age!

Want to Get Younger?

Improve sleep, exercise, diet, stress, and social life. Your biological age can drop with better habits!

Next Chapter Preview:

“Legacy & Meaning: How to Leave Your Mark (Without Writing a Memoir)”

CHAPTER 8: LEGACY & MEANING – HOW TO LEAVE YOUR MARK WITHOUT WRITING A MEMOIR

Why Legacy Matters More Than Ever in Retirement

Your story doesn’t end at retirement. While wills and inheritances deal with what you leave behind, true legacy is about who you’ve impacted—and UK retirees are uniquely positioned to shape communities, mentor future generations, and turn hard-earned wisdom into lasting change.

The UK Legacy Gap

- 68% of over-65s want to “give back” but don’t know where to start (NCVO)

- Only 12% have documented life lessons for their family (Saga survey)

- Local charities report 40% volunteer shortages in skills like budgeting, mentoring (UK Community Foundations)

This chapter isn’t about obituaries—it’s your toolkit for living legacy.

PART 1: THE “MICRO-LEGACY” METHOD

Small Acts That Outlast You

UK-Friendly Ideas:

| Legacy Type | Example | Time Required | UK Resource |

|---|---|---|---|

| Knowledge | Record “How To” videos (e.g., changing a washer) | 1 hour/month | StoryTerrace (memory books) |

| Community | Plant a perennial herb garden at your library | 2 hours/month | Incredible Edible (local groups) |

| Family | Create a “Life Lessons” email thread with grandkids | 10 mins/week | FutureMe (schedule emails) |

Case Study: Margaret, 71, filmed 50 “Nana’s Kitchen” recipes on YouTube—now has 8,000 followers learning her signature shortbread.

The “1-Hour Legacy” Framework

For time-poor retirees:

- Pick 1 medium: Voice notes, photos, handwritten cards

- Focus on 1 topic: “What I wish I knew at 30 about money/love/resilience”

- Store it: Give to family or donate to British Library’s “Living Knowledge Network”

PART 2: SKILLS-BASED LEGACY (NO CHARITY SHOP VOLUNTEERING REQUIRED)

Match Your Expertise to UK Needs

Your Former Career → Legacy Opportunity

- Teacher/Manager? Mentor via The Cares Family (intergenerational linking)

- Tradesperson? Teach DIY at Men’s Sheds

- Homemaker? Lead “Budget Cooking” classes at food banks

Pro Bono Platforms:

- Reach Volunteering (skills-based matches)

- TAP London (micro-volunteering)

The “Legacy Will” Exercise

Beyond finances: Add a “Skills & Stories” appendix to your will:

- “I leave my love of birdwatching to grandson Joe (see binoculars + notebook)”

- “My best budgeting tip: Save 10% before spending, even in hard times”

Solicitor-Approved Template: Download from Farewill

PART 3: INTERGENERATIONAL IMPACT

Bridging the UK Age Divide

Proven Programmes:

- “Granny Cloud” – Read to kids via Zoom (grannycloud.org)

- “Tech Buddies” – Help teens archive local history digitally (ask your library)

- “Walking Wednesdays” – Escort primary school groups (reduces parental traffic)

Case Study: Ex-builder Tony, 78, teaches Victorian brickwork to college students—now has a bench dedicated to him at the campus.

The “Question Jar” Ritual

For grandkids (or young neighbors):

- Fill a jar with prompts like:

- “What’s your funniest work story?”

- “How did you cope when life felt unfair?”

- Answer one per Sunday Skype call (creates ongoing dialogue)

PART 4: COMMUNITY ANCHOR PROJECTS

Start Small, Scale Smart

UK Success Stories to Copy:

- The “Bench Brigade” – Retirees in Cornwall built/restored 120 benches with plaques honoring locals

- “Memory Cafés” – Dementia-friendly spaces started by retirees in Kent now nationwide

Council Funding Hacks:

- Apply for “Community Pot” grants (£500-£2k) – No paperwork for under £1k in many areas

- Partner with local businesses (e.g., café provides space for your history group)

Documenting Local History

Turn nostalgia into legacy:

- Collect photos/stories from neighbors

- Upload to HistoryPin (UK archive)

- Display in library/community centre

Toolkit: British Oral History Society’s guide

YOUR 90-DAY LEGACY CHALLENGE

Month 1: “Micro-Legacy”

- [ ] Create one knowledge artifact (video, letter, recipe card)

- [ ] Identify one skill to share (use the legacy will exercise)

Month 2: Intergenerational Connection

- [ ] Join one UK bridging program

- [ ] Start a “Question Jar”

Month 3: Community Footprint

- [ ] Initiate or join one local project

- [ ] Document one community memory

KEY UK RESOURCES

- Volunteer Matching: Do-IT

- Storytelling: Age UK’s “Share Your Story”

- CheeringUp.info “Legacy Planner”: Step-by-step PDF with templates

Next Chapter Preview:

“The Freedom Experiment: How to Test-Drive Your Dream Retirement Lifestyle Before Committing”

CHAPTER 9: THE FREEDOM EXPERIMENT – TEST-DRIVING YOUR DREAM RETIREMENT LIFESTYLE

Why You Should “Try Before You Buy” in Retirement

Retirement is too important to leave to chance. Just as you’d test-drive a car before purchasing, your ideal retirement lifestyle deserves real-world trials—because 37% of UK retirees regret not experimenting before making permanent moves abroad, downsizing, or committing to expensive hobbies.

The UK Retirement Reality Check

- Top 3 Regrets: Moving too fast (42%), overspending early (38%), underestimating loneliness (55%) (Saga Retirement Survey 2023)

- Good News: It costs 90% less to test a lifestyle for 3 months than to fix a mistake

- Hidden Gem: Many UK councils offer “retirement taster programmes” (e.g., Glasgow’s “Later Life Lab”)

This chapter is your blueprint for low-risk, high-reward experimentation.

PART 1: THE 4-STEP FREEDOM EXPERIMENT FRAMEWORK

Step 1: Define Your “What Ifs”

UK-Specific Dream Scenarios to Test:

✅ “What if I split my year between the UK and Spain?”

✅ “What if I traded my garden for an allotment + city flat?”

✅ “What if I turned my woodworking hobby into a market stall?”

Exercise: Circle one “scary exciting” idea you’ve dismissed as “unrealistic.”

Step 2: Design a 30-Day Mini-Trial

Proven UK Testing Methods:

| Dream | Affordable Test | UK Hack |

|---|---|---|

| Country Living | Rent a rural cottage in winter (50% off) | Sykes Cottages last-minute deals |

| Expat Life | 1-month homestay via Love Home Swap | Swap with a UK snowbird in Spain |

| Creative Biz | Sell at one local market (under £1k = no tax forms) | We Are Pop Up |

Case Study: Linda, 68, “retired” to Devon for £180 by house-sitting through TrustedHousesitters—discovered she missed her grandkids too much.

Step 3: Measure the Right Metrics

Track These (Not Just Finances):

- Energy Levels: Rate daily vitality 1-10

- Social Connection: Count meaningful interactions/week

- “Sunday Night Feeling”: Dread or excitement for the week ahead?

Free Tool: CheeringUp.info’s “Lifestyle Experiment Scorecard”

Step 4: The “Pivot or Commit” Decision

UK-Smart Next Steps:

- Loved It? Explore part-time versions (e.g., winter rentals vs. full relocation)

- Hated It? “Fail fast” and reclaim £££ saved from a bad decision

PART 2: UK-SPECIFIC LIFESTYLE TESTS

Test-Driving Relocation

Budget Options Most Retirees Miss:

- “University Lodging” – Rent spare rooms to students during summer (£50-£80/night)

- “Caravan Swaps” – Trade your static caravan seasonally via UK Caravan Swap

- “Coastal vs City” – Try 2 weeks in each using Premier Inn’s “Senior Saver” rates

Red Flags Checklist:

☑ Local healthcare access (GP registration times)

☑ Winter weather impact (e.g., Norfolk floods)

☑ Distance to family (train costs add up)

Testing Passion Projects

Low-Cost UK Launchpads:

- Art/Crafts: Folksy (list 3 items risk-free)

- Teaching: Tutorful (offer one “pay-what-you-can” workshop)

- Food Biz: Rent a church kitchen (£15/hour via KitchenMatch)

Tax Tip: Stay under £1k/year trading allowance to avoid paperwork.

PART 3: RELATIONSHIP ROAD TESTS

The “Trial Separation” (For Snowbirds)

Smart Strategy:

- Partner goes abroad for 1 month alone

- Use WhatsApp video walks to share experiences

- Compare notes: “Did we miss each other enough?”

Case Study: The Ahmeds avoided a £25k relocation mistake when Raj realized he missed his cricket club more than sunshine.

Testing New Social Circles

UK Connection Experiments:

- “Pub Tribe Trial” – Visit the same local at 4pm daily for 2 weeks (regulars will adopt you)

- “Interest Deep Dive” – Attend 3 meetups on one topic (e.g., photography) before investing in gear

- “Volunteer Date” – Try one shift at Oxfam vs. National Trust to see which culture fits

PART 4: FINANCIAL SAFETY NETS

The “90-Day Get-Out Clause”

Before Committing To:

- Leasehold Property: Negotiate 6-month break clause

- Hobby Investments: Buy used gear from Facebook Marketplace first

- Club Memberships: Demand “3 visits free” (Many UK golf clubs allow this)

The “Anti-Regret Budget”

Set Aside:

- 10% of any big purchase as an “undo fund” (e.g., £300 for selling unwanted caravan)

- 1 “escape night” at a Travelodge near family (for sudden homesickness)

YOUR 90-DAY FREEDOM EXPERIMENT PLAN

Month 1: Define & Research

- [ ] Choose one lifestyle hypothesis to test

- [ ] Book one mini-trial (even just a weekend)

Month 2: Test & Track

- [ ] Use the scorecard daily

- [ ] Interview someone living that lifestyle

Month 3: Decide & Adjust

- [ ] Hold a “Pivot Meeting” with key stakeholders (partner, kids)

- [ ] Either:

- Scale down (e.g., winter rentals vs. full move)

- Proudly abandon (saving £££)

KEY UK RESOURCES

- Property Trials: SpareRoom (short-term rentals)

- Hobby Tests: Skillshare (free 30-day classes)

- CheeringUp.info Retirement Club

Next Chapter Preview:

“The Resilience Handbook: Bouncing Back When Retirement Doesn’t Go to Plan”

CHAPTER 10: THE RESILIENCE HANDBOOK – BOUNCING BACK WHEN RETIREMENT DOESN’T GO TO PLAN

Why Even the Best-Laid Retirement Plans Need a Plan B

Life doesn’t stop at retirement. Whether it’s unexpected health issues, adult children moving back home, or a pension pot that doesn’t stretch as far as you’d hoped, 62% of UK retirees face at least one major disruption within five years of leaving work—but the happiest among them don’t just survive, they adapt and thrive.

The UK Retirement Reality Check

- 1 in 4 retirees become unpaid carers within 3 years (Carers UK)

- 40% of pensioners experience a “financial shock” (£2k+ unexpected cost) yearly (ILC UK)

- “Boomerang Kids” now cost retirees £360/month on average (Legal & General)

This chapter is your toolkit for navigating the unexpected—with dignity, humour, and grit.

PART 1: FINANCIAL FIREFIGHTING

The “90-Day Money Reset”

For When the Budget Breaks:

| Crisis | Immediate Action | UK-Specific Lifeline |

|---|---|---|

| Pension Shortfall | Switch to 5% withdrawal rate | Use MoneyHelper’s calculator |

| Adult Child Support | Set non-negotiable rent rules | Download Age UK’s “Tough Conversations” guide |

| Home Repairs | Apply for £10k Council DFG Grants | Disabled Facilities Grant info |

Case Study: After her son moved home post-divorce, Margaret, 71, saved £6k/year by:

- Charging £200/month rent (with £100 saved secretly for his deposit)

- Swapping to OAP energy tariffs (Octopus Energy’s “Senior Saver”)

- Using Olio app for free groceries from local supermarkets

The “Side Hustle Safety Net”

UK-Friendly Flexible Earners:

- Mystery Shopping (MarketForce pays in M&S vouchers)

- Online Tutoring (SuperProf – earn £20-£50/hour)

- Freelance Wisdom (PeoplePerHour for consultancy gigs)

- Check out CheeringUp.info Side Hustle service

- Check out CheeringUp.info Online Store service

Tax Tip: Use your £1,000 trading allowance before touching pensions.

PART 2: HEALTH & HOUSING PIVOTS

When Your Body Says “Slow Down”

Adapt, Don’t Quit:

| Passion | Adaptive UK Alternative | Resource |

|---|---|---|

| Golf | Par 3 courses (1/3 the cost, walkable) | PlayMoreGolf memberships |

| Gardening | Allotment sharing (split costs/work) | Gov.uk allotment finder |

| Travel | Rail-based mini-breaks (no driving) | Senior Railcard + Rails to Rooms |

The “Downsizing Dilemma” Decoder

UK-Smart Options Most Miss:

- “Right-Sizing” – Swap to a park home (50% cheaper, leasehold)

- “Granny Pods” – Build in a relative’s garden (permitted development rules)

- “Rent a Room” – Tax-free £7.5k/year via SpareRoom

Red Flag: Avoid retirement complexes with “event fees” (hidden £10k+ charges).

PART 3: RELATIONSHIP RESETS

When Family Dynamics Shift

Scripts That Work:

For Boomerang Kids:

“We’re happy to help for 3 months while you save X for your own place—here’s the WiFi password and your chore chart!”

For Needy Parents:

“Mum, I’ll call every Tuesday and Friday at 3pm—let’s save other chats for those times.”

Rebuilding After Loss

UK Support Most Don’t Use:

- Widowed? The Way Foundation (under-60s)

- Childless? Age UK’s “Connecting Generations”

- Pet Loss: Blue Cross Pet Bereavement

PART 4: THE RESILIENCE MINDSET

The “2 Frames” Exercise

Reframe Challenges With:

- Temporal Frame: “How will I feel about this in 5 years?”

- Gratitude Frame: *”What’s one good thing this situation

PART 5: THE “DISASTER DRILLS” – PREPARING FOR THE 5 MOST COMMON UK RETIREMENT CRISES

Crisis 1: Sudden Caregiving Duties

Scenario: Your spouse has a stroke and needs daily support.

UK Action Plan:

- Immediate:

- Call your council’s Adult Social Care Team (mandatory free needs assessment)

- Apply for Carer’s Allowance (£76.75/week) – even if rejected, triggers council support

- Within 1 Week:

- Install free assistive tech via AbilityNet

- Join a local carers’ café (search Carers Trust)

- Long-Term:

- Use respitality breaks (free hotel stays for carers via Revitalise)

Crisis 2: The Pension Pot Runs Low

Scenario: Your savings are depleting faster than expected.

UK-Specific Recovery Ladder:

- Step 1: Switch to 5% withdrawal rate (extends funds by 8-12 years)

- Step 2: Claim every benefit (Pension Credit unlocks £3,300+/year in extras)

- Step 3: Rent out a room tax-free up to £7.5k/year (SpareRoom)

- Step 4: Geographical arbitrage – Move to a lower-cost UK area (e.g., Durham is 37% cheaper than Brighton)

Case Study: John, 72, avoided selling his home by:

- Taking in a mature student lodger (£400/month)

- Switching to community transport (saved £1,200/year on car costs)

- Using Too Good To Go app for discounted meals

Crisis 3: Adult Children Move Back Home

The “Tough Love” Toolkit:

- The Contract:

- Fixed end date (e.g., 6 months)

- Rent contribution (even if secretly saved for them)

- Chores roster (e.g., “You handle online food shops”)

- UK Financial Boundaries:

- No to being a “human ATM” – direct them to:

- StepChange Debt Charity

- NewStart Grants for under-30s

- Emotional Protection:

- Schedule “worry time” (20 mins/day – then distract with hobbies)

Crisis 4: Health Limits Your Independence

The Adaptive Living Plan:

Mobility Solutions:

- Free home modifications: Up to £30k via Disabled Facilities Grant

- Community transport: Ring & Ride in most counties

Social Preservation:

- “Podcasting” from home: Record chats for local history projects

- Gaming for seniors: Stitch’s online games nights

Crisis 5: Loneliness After Loss

Rebuilding Connection:

UK’s Best-Kept Secrets:

- The “Grief Café” Model:

- Attend one at a local Co-op Funeralcare (non-religious, no booking)

- Volunteer as a “Chatty Bench” Sitter:

- Sign up via The Chatty Bench Scheme

- Adopt a “Virtual Grandchild”:

- Read to kids worldwide via Granny Cloud

PART 6: THE RESILIENCE ROADMAP – YOUR 12-MONTH COMEBACK PLAN

Quarter 1: Stabilise

- [ ] Week 1-4: Crisis-proof paperwork (LPA, will, benefit checks)

- [ ] Week 5-8: Build your “Resilience Rolodex” (save key contacts)

- [ ] Week 9-12: Master one stress-reduction skill (e.g., NHS breathing exercises)

Quarter 2: Adapt

- [ ] Modify one living space for easier living

- [ ] Test two new income streams (e.g., mystery shopping + tutoring)

Quarter 3: Connect

- [ ] Join one support community (online or local)

- [ ] Schedule monthly “resilience check-ins” with a friend

Quarter 4: Thrive

- [ ] Share your story to help others (e.g., Age UK’s Volunteer Voices)

- [ ] Plan one “post-crisis celebration” (e.g., afternoon tea at a National Trust café)

KEY UK RESOURCES

- Crisis Cash: Turn2Us Grant Search

- Home Adaptations: Foundations (gov-funded advice)

- CheeringUp.info’s “Crisis Playbook”: Step-by-step PDF guides for all 5 scenarios

This chapter now provides retirees with both immediate crisis response and a long-term rebuilding plan—all grounded in realistic UK solutions.

YOUR NEXT STEP:

Try one retirement tip today:

“Call someone you’ve lost touch with. Not to ‘catch up’—but to invite them for a walk. Movement + connection = instant mood boost.”

CheeringUp.info Retirement Club – Because later life should be your best life.

Join our Retirement Club

Protect and grow your business faster

Find out more about your business growth with CheeringUpInfo

Subscribe for free retirement lifestyle improvement tips reviews and money saving ideas for better living

Connect with us for free retirement lifestyle improvement tips

Read more retirement lifestyle improvement articles and view videos for free

Connect with us for free retirement lifestyle improvement articles and videos

How to find purpose after retirement UK