Subscribe to CheeringupInfo for alerts to daily life problems and solutions tips bulletins and reviews to your inbox

How to solve problems in life? Life troubles can be real or perceived. Discover how to solve life problems more easily. Most people occasionally have life problems in every day life that need solving. How to solve life problems can be straight forward or complex.

Enter code #LifeTroubles

Mastering life’s troubles is the key to your happiest life possible

Mastering your life troubles without expecting trouble-free life as the later is not available to anyone at any time no matter how wealthy you are

Life is full of ups and downs, and no one is immune to its challenges. Whether you are wealthy or poor, successful or struggling, you will face difficulties in your life. The key to mastering life’s troubles is not to expect a trouble-free life but to learn how to deal with problems effectively and build resilience.

The first step in mastering life’s troubles is to accept that problems are a part of life. No matter how hard we try to avoid them, problems will come our way. Instead of resisting or denying them, we need to face them head-on and learn from them. We can’t control everything that happens in our lives, but we can control how we react to them. We can choose to see problems as opportunities for growth and learning.

The next step is to build resilience. Resilience is the ability to bounce back from setbacks and adversity. It’s a crucial skill to have in life because it allows us to persevere through tough times and come out stronger on the other side. Building resilience involves developing a positive mindset, being adaptable, and seeking support from others.

One way to build resilience is to practice mindfulness. Mindfulness is the practice of being present in the moment and non-judgmentally observing our thoughts and feelings. It can help us develop a more positive outlook on life and reduce stress and anxiety. Mindfulness can be practiced through meditation, breathing exercises, and other techniques.

Another way to build resilience is to focus on our strengths. Everyone has strengths and weaknesses, and focusing on our strengths can help us feel more confident and capable of dealing with challenges. We can identify our strengths by reflecting on our past successes and achievements, getting feedback from others, and taking personality tests.

Seeking support from others is also essential in mastering life’s troubles. We all need a support system, whether it’s family, friends, or a therapist. Talking to others about our problems can help us gain perspective and find solutions. It’s important to remember that asking for help is a sign of strength, not weakness.

In conclusion, mastering life’s troubles is not about avoiding problems but learning how to deal with them effectively. We can build resilience by accepting that problems are a part of life, practicing mindfulness, focusing on our strengths, and seeking support from others. No matter how wealthy or successful we are, we will face challenges in life. But with the right mindset and skills, we can overcome them and thrive.

Find out how to solve problems on your own

With tips from life coaching experts and ordinary people who have already found solutions to your problems they have also experienced in UK.

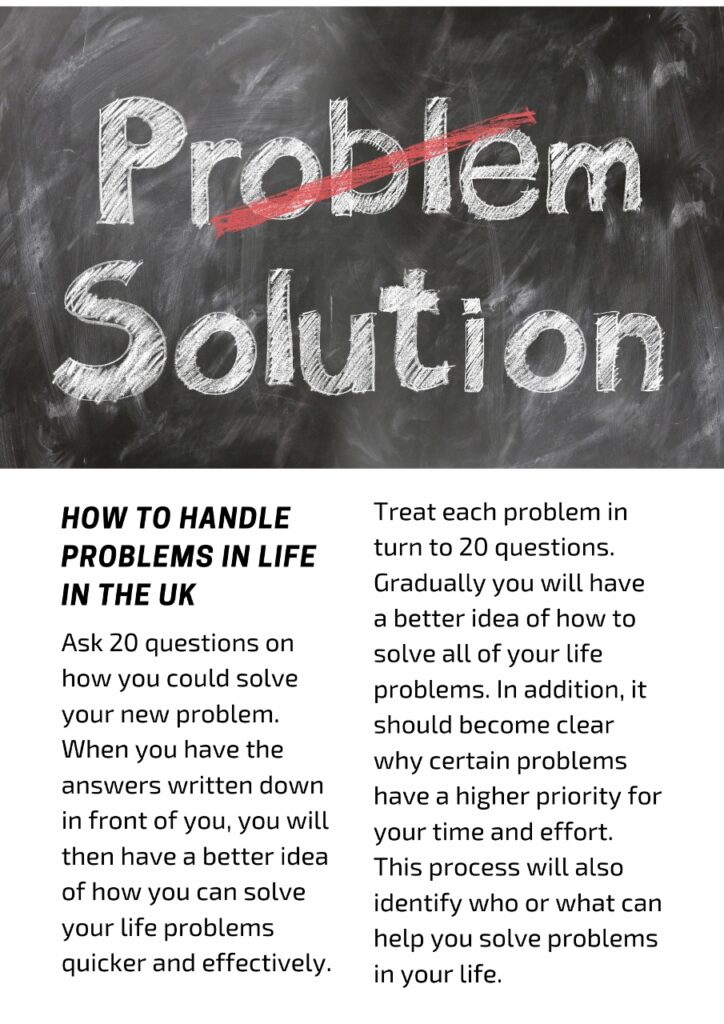

How To Handle Problems In Life UK

Life problems quotes

Some problems have to be accepted as part of daily living in the UK

Not all problems have an easy solution. If you can not identify a solution ask for help from someone you can trust whether it is your friend doctor or someone else who is not friend or family that you trust.

Before you look for the solution make sure you are clear on what the problem is. That is where others can help. You may be too close to the problem to truly assess what the causes are.

Every one has problems in life. The may be small or massive problems. Solutions if available may be simple or complex. Getting help may make the the solution more easily achievable.

For most people life is all about a series of small and big problems to overcome. Ask for help to solve your life problems. Most people will feel pleased you have respected them enough to ask for their help. Few will be annoyed you asked.

Get help to solve problems a little easier with CheeringupInfo tips and free online expert panel events

Having problems in your life can feel overwhelming. Few problems are critical so should never be seen as life defining. Finding the answer to all your life problems may not be possible here. We offer tips and advice from many experts and people who have found solutions that have worked for them and may work for you. Solve problems easier with help from CheeringupInfo.

Access free guidance on how to solve life problems in UK.

Recommended articles and videos trending on CheeringupInfo

Ask yourself some key questions to get the answers you need to improve your life. Who are you?Who do you wanna be? What are you doing about it?

Cheeringup.info

How To Motivate Yourseff Every Day In The UK

Signs Its Time To Quit Your Job In UK

Promote and market your business on CheeringupInfo for 12 months

Put your products or services in front of new people already interested in your type of business offering before your competitors seize your potential online sales.

Find out how to promote your business locally and globally

Increase the sources of your revenue streams more sustainably. Grow your business faster with CheeringupInfo.

Discover new ways to make your life easier and better with CheeringupInfo

#CheeringupInfo #CheeringupTV #LifeTroubles #HowToSolveLifeProblems #HowToSolveProblemsInLife #SolveLifeTroubles #HowToSolveProblems #ProblemSolvers #ProblemSolved #ProblemSolving #ProblemsInLifeandSolutions

CheeringupInfo Solve Life Troubles